Crude And Condensate

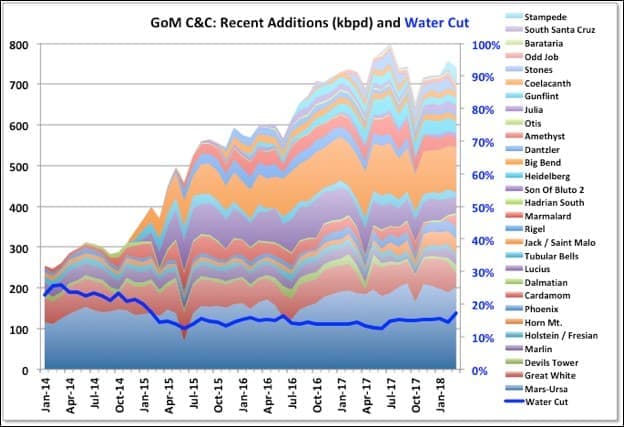

BOEM has March 2018 production at 1696 kbpd, which is down 1 percent month-on-month and 4 percent year-on-year (March 2017 was the peak production month for GoM so far). EIA numbers were very similar, although last month’s were higher and haven’t been revised yet – typically EIA numbers end up almost exactly corresponding to the BOEM reported total qualified lease production, whereas BOEM can be a little higher, maybe including test wells or non-qualified leases.

(Click to enlarge)

The major new project, Stampede, started in January, has no reported production numbers yet. BOEM and EIA estimate non-reported values and then retrospectively adjust their reports when actual numbers are available. I don’t know how they estimate new production, but Stampede could produce around 60 kbpd with current plans, though likely a lot less initially as only one of two leases has been ramping up. I’ve assumed 20 and 40 kbpd for February and March respectively, which still might be high. Even allowing for that, and assuming other late numbers are the same as the previous month, since December EIA and BOEM both have estimates about 30 to 40 kbpd higher than the reported lease and well production numbers (which always match closely) would suggest. Usually the difference is no more than ten. It is unlikely that the other late numbers, of which there are few, and none for all four months, will show such large, sudden and unexplained increases so either I’m missing something (maybe a lease not yet included in the numbers, but also not reported as starting up) or there could be some future downward adjustments.

Rigel and Otis are still off-line following the failure at a subsea manifold last October and are taking out about 22 kbpd plus some gas (Otis is a small gas field). Great White, Stones (for the full month) and Caesar/Tonga all had noticeable downtime in March taking about 90 kbpd off-stream.

(Click to enlarge)

The Kaikias Phase I development for Shell, a tie-back to the Ursa hub, was brought on line one year ahead of schedule in early June. It has an expected peak nameplate of 40 kboed (which may only be around 30 kpbd average oil) and will likely take a bit of time to ramp up to maximum. Equally to accelerate production like this probably meant using a drill rig that was previously scheduled for alternative wells on Mars-Ursa, so there may be faster than previously planned decline on some of the other leases there. Related: Tesla Closing Down Solar Capacity

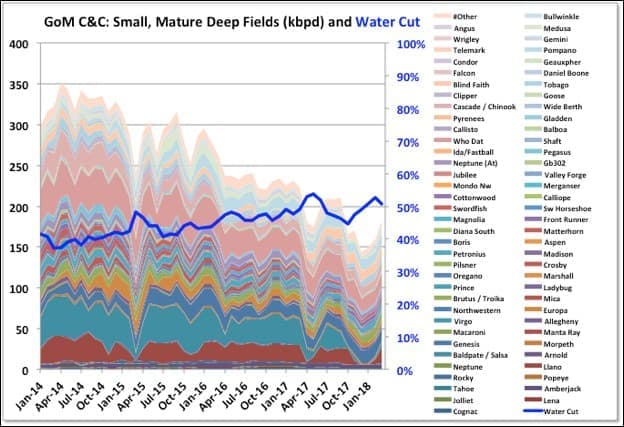

In the second quarter there is likely to be downtime showing for Marlin, Horn Mountain and Holstein as they have planned turnarounds to prepare them for new production and, presumably, to allow normal maintenance; they should then come back online with higher overall flows. Marlin has one new Anadarko well planned, plus two from LLOGs Crown and Anchor field. Holstein has a platform rig and is developing four side-track wells this year and next. Horn Mountain has one more tie-back from Dorado field planned.

(Click to enlarge)

Atlantis has no drilling or work-over activity currently shown and in the past its wells have declined at around 20 percent year-on-year (see below), which may continue until the first Phase III wells come on line in 2020.

(Click to enlarge)

Llano, Cardamom and some of Baldpate/Salsa production came back on line following the partial repair of the Enchilada pipeline, adding around 45 kbpd, but there is some still off line, which I think has to be processed through the Enchilada platform and for which I’ve seen no expected restart news; however Anadarko have said it will be “later this year”, which I’d take to mean a few months yet. All these fields are fast declining so although they give a jump for March they will result in steeper declines for the remainder of the year

(Click to enlarge)

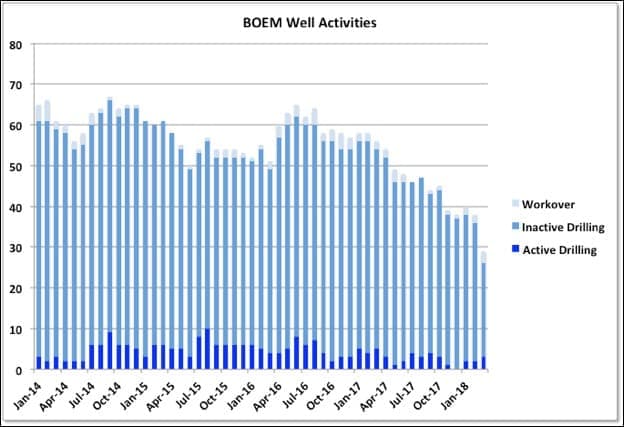

The BSEE deep-water activity report showing wells with drilling, completion, P&A or work-over activity currently shows 40 actions, this is down from around 50 at the beginning of the year and has been fairly steady for the past two months.

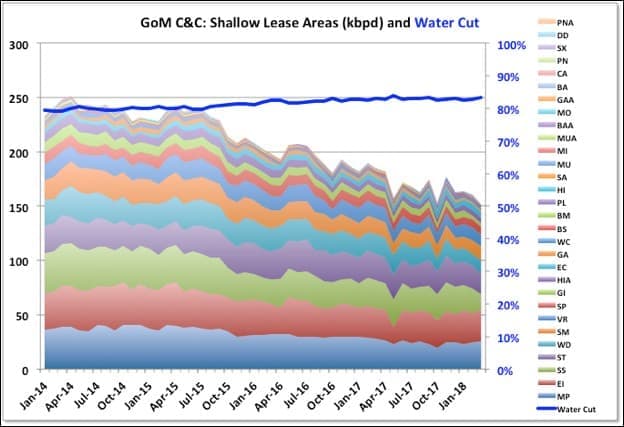

Overall C&C looks to be continuing an overall slow decline started in the second half of last year, and if the unaccounted for 40 odd kbpd is revised out, then it is clearly accelerating. A lot will depend on downtime for turnarounds and hurricanes. So far this year these losses look higher than last (e.g. the early Tropical Storm Alberto took out about 7 kbpd for about a week, and also disrupted P&A activity on Lena and installation work at Appomattox) plus Mars-Ursa looks set for a partial shut down in April and the current Perdido / Great White turn around looks to be quite prolonged. Another major unplanned outage, like Enchilada or Delta House, is also possible. The Kaikias development by Shell has been advanced, but that may be countered by delays to Constellation, Hadrian North and some Delta House tie-backs.

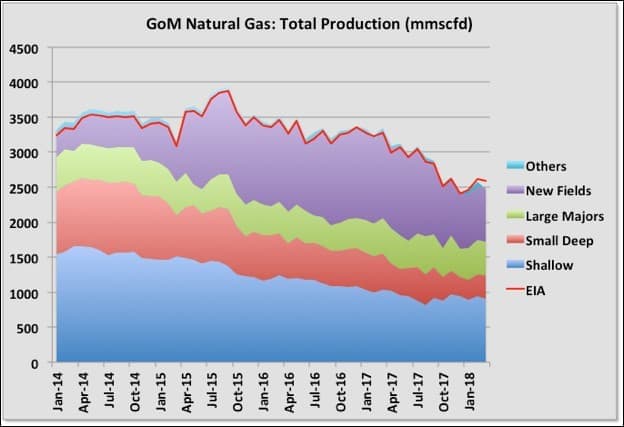

Natural Gas

Natural gas production is in continuous decline. BOEM had March production at 2.59 bcfd, down 1 percent month-on-month but 21 percent year-on-year. The loss of 300 mmcfd from Hadrian South since last year and the losses from Baldpate / Salsa, one of the few other remaining significant gas fields, and Otis, because of the Delta House failure, meant last year showed accelerating decline which is unlikely to recover. Na Kika has a few gas leases, and a new long distance tie-back, Coulomb II, is due soon, but mostly the gas now is associated with the oil and will decline accordingly.

(Click to enlarge)

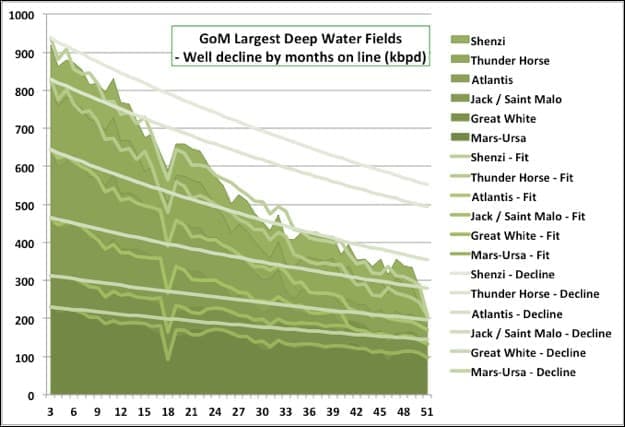

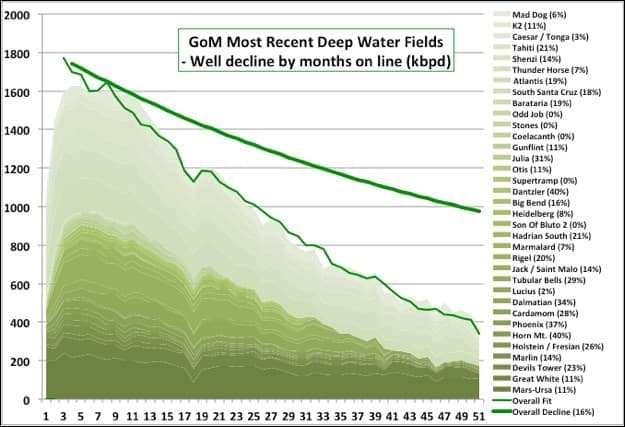

Deep Water Well Decline Rates

I had a go at finding the decline rates of the wells in the more recent deep-water fields. In the charts below for each field all the wells are lined up so month one is their first production or January 2014, whichever is later, and a decline curve is fitted, from the third operating month to avoid the ramp-up period, assuming all wells in a field follow the same exponential decline and according to how many wells were producing for each month.

Related: OPEC Edges Closer To Production Agreement

Most of the fits came out reasonably well. Six of the largest fields are shown in detail below. The overall (stacked) decline curves indicate the expected decline rate for all the wells remaining online, they are not predictions of future production.

(Click to enlarge)

The fields where the fit was poor were either new projects that are still on plateau, have had fairly patchy start-ups, or have produced a lot of water (or all three) and include Lucius, Stones and Odd Job; or ones where there has been some sort of well rework, e.g. K2, which had gas lift added, and Mad Dog, which had various new measures including water injection added on some blocks. I didn’t include Na Kika as it is a collection of several different fields, some of them gas, and has a pretty uneven production history. The individual decline rates for each field are shown in parentheses after the name and run from 0 percent for fields on early plateau, up to 40 percent and with a pretty good spread between.

(Click to enlarge)

The decline rate for the fields analyzed is likely to increase because of new projects coming off plateau, water breakthrough or acceleration (e.g. at Great White, Mad Dog, Lucius and Mars-Ursa might be the most likely) and a normal development feature that the best wells are drilled first; but overall that would likely be balanced by new projects reaching plateau. The overall average decline rate came out as 16 percent, which is maybe not surprising given that depletion rate for the whole GoM based on BOEM 2P numbers for 2016 (the latest available data) was also 16 percent. With depletion and decline close it would imply there isn’t much being added to reserves on operating fields, or any that has been was quickly put on-line.

Applying these decline rates to the 2017 field production rates gives an expected drop this year of 175 kbpd. Shallow fields are likely to decline 30 kbpd and the deep-water fields that I didn’t include about 45 kbpd. So total would be 250 kbpd; assuming 90 percent availability that would require 275 kbpd of additional nameplate capacity added to hold production steady.

2018 and 2018 Developments

The only certain major new fields this year are Stampede, adding up to 60 kbpd, and Kaikias Phase I, which may add about 20 kbpd averaged over the year. Constellation was due but looks to have been pushed into 2019, and Big Foot is due late but may not contribute much to the average, although could boost the 2018 exit rate. There are four smaller field tie-backs for LLOG with one or two wells: Red Zinger, Crown and Anchor, Claibourne and La Femme / Blue Wing Olive. Some of these may be limited by available capacity at the host, and will contribute only in the second half of the year. Recent small field wells tend to start at around 6000 to 8000 bpd and immediately decline, but those fields together could add 50 to 60 kbpd at end of year. Bigger wells are likely to come from in-fill and development drilling at Jack / St. Malo (two wells), Horn Mountain Deep and Marlin for Anadarko (three wells, but very high decline rates if they are like the recent ones), Tonga (I think one last production well), one side track well at Holstein (with three more next year), continued BP drilling at Thunder Horse, and Shell projects at Mars-Ursa, Stones and Great White. BP and Shell wells may add the most, but they are also the ones with the least information.

There should be some offline production returning at Rigel and Baldpate, maybe 40 kbpd, but also fast declining. With the new fields that would leave 120 to 180 kbpd needed this year from the in-fill drilling to keep annual rates about average (the range is dependent on the timing of all the wells coming on); I think that is going to be difficult. Next year decline is likely to accelerate because a lot of the mentioned in-fill wells and tie-backs are the last available for those projects and some of the rigs are being released, plus Kaikias has been accelerated, so will contribute less additions next year than originally planned. Atlantis Phase III has also been moved back to 2020. 2019 has some planned continued development for Thunder Horse, tie-backs for Hadrian North and Buckskin to Lucius and the delayed Constellation tie-back to Constitution, but overall things look thinner than this year, at least until Appomattox (with 175 kboed nameplate) begins ramp-up towards the end of the year.

The drop off in the number of wells showing drilling or work over in the chart below highlights the possible slowdown coming in 2019.

(Click to enlarge)

Better projections will be possible when the BOEM reserve estimates for the end of 2016 are available. These are quite late compared to last year, but in the past, they have come out in July or August, and EIA reserve estimates were also pretty late this year.

EIA Forecasts

The above summary for near term new developments and added production does not agree much at all with EIA predictions, either in outcome or details: U.S. Gulf of Mexico crude oil production to continue at record highs through 2019

Among the fields given it lists significant new oil production as expected from: Amethyst, a small and failed gas project and Phobos, both of which are rescinded leases with no current activity; Otis, an existing gas field; Son of Bluto 2, a small oil field started in early 2016 with no current drilling and indicating slight decline; Rydberg, a recent Shell discovery with reported 100 mmboe resource base, which I think would be a later addition to the Appomattox project; Gotcha, a lease which is part of Great White, started in 2014 and in slow decline; and Bushwood, a single gas well tie-back started in 2014 and now almost exhausted (although there has been some drilling there this year). There is little new oil, or much significant oil at all, in that collection.

It does also list Horn Mountain Deep, Stampede (though listed as two fields, when it is really only one) and Kaikias, which will be bigger contributors, but not enough by far to meet the given growth expectations (and I think the Horn Mountain developments will be showing rapid decline by next year).

It does not mention Big Foot, Appomattox, Buckskin, Hadrian North, Red Zinger, Crown and Anchor, Claibourne or Blue Wing Olive as new fields, or the Thunder Horse developments and other Anadarko in-fill wells. I don’t know how they come up with their assessments, but they seem to be getting more removed from actuality, and not just from being overly optimistic. Similarly, the EIA STEO is just a constant exponential growth that is re-zeroed each month to current production figures with no changes made based on FID decisions, reserve numbers or overall production history.

By Peak Oil Barrel

More Top Reads From Oilprice.com:

- The U.S.-China Trade War Is Great News For OPEC

- OPEC’s Agreement Sends Oil Prices Soaring

- The New OPEC Deal: Paper Barrels Won’t Materialize

Just Saying..