Divestment of stocks in fossil fuel companies may seem like a good idea if the goal is to put financial pressure on conventional energy companies and thereby leave an opening for cleaner alternative fuels in the fight against climate change. The question is whether the strategy works.

Certainly any company, whose core business is making money, is likely to take notice of any activity that affects its revenues. Yet many argue that a drop in investment in an energy company may not be the best way to get its attention, especially at a time when alternative energies are scarce and fossil fuels remain the dominant source of power.

In other words, how many people today can afford to junk their gasoline-powered cars and invest in more expensive electric models?

That’s exactly the point made by London Mayor Boris Johnson, a member of Britain’s Conservative Party who also harbors libertarian, if not liberal, political views. The London Assembly had called on him to divest City Hall’s pension fund from fossil fuels. Related: Can Tesla’s Battery System Actually Live Up To The Hype?

Johnson responded on May 12 that Britain needs to press on with domestic oil exploration and production, including the controversial practice of hydraulic fracturing, or fracking, to keep the kingdom more energy independent and less reliant on gas from Russia and the Middle East. To divest from fossil fuels, he said, would be to face a “sudden cliff edge.”

Johnson isn’t alone in preferring a slower approach to a change in investments. The same day Johnson rejected the London Assembly’s proposal, the court of Scotland’s Edinburgh University decided unanimously that it wouldn’t make a complete and immediate divestment in stocks its owns in fossil fuel companies.

“Our commitment is to engage before divestment,” said the school’s senior vice principal, Professor Charlie Jeffrey, “but the expectation is that we will bring about change by engagement.” In other words, rather than divesting across the board, the university’s investment in each company would be evaluated on its specific merits.

Jeffrey said the school would divest from companies that produce oil sands, such as those in western Canada, or mine for coal, but only if these companies don’t also have stakes in low-carbon energy sources and when alternative forms of power aren’t available.

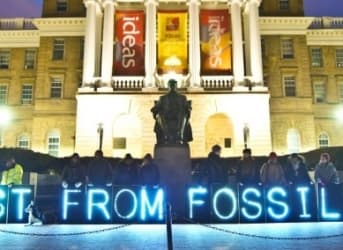

Some representatives of environmental groups expressed disappointment, either through statements in response to Johnson’s refusal to divest, or with Edinburgh University students lying down on the steps of the building where Jeffrey set out the school’s decision. And their reaction may be understandable. Related: Here Is Why Predictions For Lower Oil Prices Are Wrong

After all, the divestment tactics have a proven track record from the second half of the 20th century, when an increasing number of individuals, then companies, then governments divested their stakes in South African companies to bring economic pressure on Pretoria to end its apartheid policy. And it worked.

But some economists note that the climate change challenge that the world faces today isn’t the same as apartheid. For one thing, unless a 21st century world wants to revert to the candles of the 19th century, it will need some sort of modern alternative to oil, gas and coal.

More important is the understanding that investment is “proportional ownership” of a company, Timothy Devinney, the University Leadership Chair & Professor at University of Leeds, writes on The Conversation, an Australian website featuring academic articles.

“Legally, any individual holding a specific ownership share can bring issues to the company and has proportional rights to vote on all motions put to the ownership either by the board or shareholders,” Devinney writes. Related: California’s Climate Goals: Realistic Or Just Wishful Thinking?

He says this relationship makes corporations accountable to shareholders, who “determine the composition of the board, and the value of their investment will be influenced directly by what the board and senior management do.

“Those behind divestment campaigns have lost sight of the fact that investment can imply control,” Devinney writes. “Significant ownership shares, or coalitions of ownership shares, can be turned into activist voting blocks and also ensure that specific ownership interests get seats on the board.”

In other words, the argument goes, working from within often gets desired results.

By Andy Tully of Oilprice.com

More Top Reads From Oilprice.com:

- Who Is The Biggest Player In Energy?

- Alberta Election Result Changes Little For Oil Industry

- Could This New Business Model Save Fracking?