The battery boom shows no signs of slowing down, as demand for lithium-based electric batteries continues to grow worldwide. With forecasts indicating a significant rise in the world’s electric car fleet, suppliers look to new sources of lithium, the mineral essential to battery construction.

Yet accessing and securing new lithium sources may prove difficult as demand grows and supplies become harder to come by; that could presage a major bump in world lithium prices.

As Bloomberg reported, world lithium suppliers were caught off guard by the marked increase in lithium demand that accompanied the boom in electric car manufacturing. Projects such as Tesla’s Gigafactory in Nevada, which hopes to produce 500,000 car batteries per year, indicate that the demand on lithium mines will only increase, encouraging mining companies to expand operations. Yet much of the demand will likely come from China, where fifty-five percent of global lithium-battery production is based, compared to ten percent in the United States.

Companies based in Australia, one of the world’s major sources of the mineral, are pushing for more production and greater upstream-downstream cooperation, to ensure the finished product meets industry needs. As investment in downstream lithium-based manufacturing grows, investors in Australia are rushing to secure more supply.

Most Australian output is shipped to China, where much of the world’s battery production is based. Chinese companies are currently planning factories with the capacity to generate 120 GW-hours a year by 2021, three times the output of Tesla’s factory in Nevada, according to Bloomberg. China is itself a major lithium producer, fourth behind Argentina, with an output of 2 thousand metric tons. Related: Libya’s Biggest Oil Field Shut Down As Tensions Rise

Companies are teaming up to integrate mining with downstream operations, to ensure the product needed for lithium batteries is produced in adequate quantities. One Australian miner, Argosy Minerals, secured a deal with Chinese battery manufacturers in August 2017, securing a long-term outlet for its product. Other Australian companies are pursuing similar deals.

The asset-boom in Australia’s $90 billion mining industry is cementing that country’s status as the world’s premier lithium producer, despite the fact that Chile and Argentina possess sixty-seven percent of world lithium reserves. Australian companies have four mines in production and three more operations advancing. The Greenbushes project operated by Talison Lithium, a subsidiary owned by the Tianqi Group and Albermarle, is the world’s largest hard-rock lithium mine and is being expanded with fresh capital from Chinese and Australian investors.

Currently Australia produces 14.3 thousand metric tons of lithium, out of a total world output of 36 thousand metric tons. Chile comes in second at 12 thousand, Argentina third at 5.7 thousand.

The Australian land grab is being compared to the oil and gas rush in the Middle East in the twentieth century, though on a much smaller scale. According to one mining executive, it could mark the largest increase in lithium production in history, “and we are still undershooting demand.” Another believes Australia’s lithium output is tied to the “biggest change in energy management since the Industrial Revolution.” Global interest in renewable energy means higher demand for batteries, which will be essential to allowing renewables to compete with fossil fuels in terms of reliability and consistency.

Lithium mining can be technically difficult, costly and unpredictable. One new venture in northern Argentina managed by Orocobre Ltd. has struggled to get off the ground, with production falling more than twenty percent below expectations, according to a recent Bloomberg report.

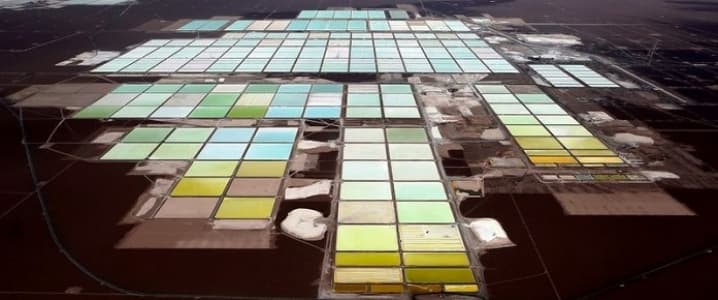

While lithium-mining in South America’s salt flats can be easier, and cheaper, than traditional mining, the technical processes involved and the unpredictable nature of evaporation-based mining tech can lead to lower-than-expected output.

If current production fails to rise or planned mines fail to produce as expected, the electric car boom could stall. Volkswagen has estimated that the industry needs forty “giga-factories” to meet future demand, and a huge shortage could occur by 2025 if more mines and factories don’t come on line. Related: Forget Oil Prices, Oil Majors Are A Buy

Bloomberg expects EVs to outpace traditional car sales within the next few years, and many major auto-makers have announced plans to expand their EV production or shift to EVs exclusively in the years to come. Yet skeptics continue to argue that electric car demand has been over-hyped, that sales of electric cars have yet to threaten traditional vehicles while the advent of new “affordable” EVs like the Tesla Model 3 has led to some backlash.

The CEO of Pilbara Minerals, an Australian lithium producer, has vowed to turn lithium skeptics into believers. In the lithium mining sector, expectations of higher demand in the future is fueling tremendous interest in increasing production now, regardless of doubts surrounding the future of electric vehicles.

By Gregory Brew for Oilprice.com

More Top Reads From Oilprice.com:

- Is This The First In A Slew Of Megadeals In Oil?

- As Compliance Slips, OPEC Decides To 'Reconsider' Output Deal

- The Caribbean Is Poised To Become The Next Major Oil Region

I have my eye on Lithium Americas to be a major player. And also looking Neometals. Those two are rising companies.