By Farah Elbahrawy, Bloomberg markets live reporter and strategist

Outperforming mining and energy stocks are set for further gains as a constructive backdrop for commodity prices and demand is set to support earnings.

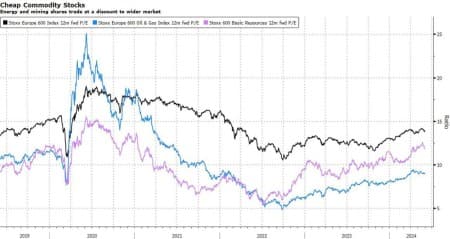

Basic resources and energy shares have outpaced the benchmark over the past three months, despite May’s drop in crude prices. Strategists are turning increasingly positive, with shareholder payouts and a wide discount to the market supporting the case for the sector.

JPMorgan’s Mislav Matejka said miners’ earnings-per-share will be supported by gains in industrial commodity prices by the second half of the year. He also likes the energy sector “which offers strong cash flow generation, attractive dividend yield, and is a geopolitical hedge.”

Profits are set to recover after stalling for two years, with analysts expecting the European energy and materials sectors to gain in 2025, according to data compiled by Bloomberg Intelligence.

Morgan Stanley analysts led by Martijn Rats retain an attractive industry view as the structural outlook for energy companies over the coming years “continues to be in good shape.” They expect oil prices will trend higher this summer as seasonal demand strength creates a deficit in crude balances.

The case for energy stocks is also underpinned by their massive shareholder payouts. Companies like Shell and BP doubled down on making buybacks a priority this earnings season. European companies are expected to return over €600 billion ($652 billion) to shareholders this year, a decade-high, and energy firms are set to be one of the biggest contributors. Investors are also monitoring a wave of mergers and acquisitions in the sector.

Another team of Morgan Stanley analysts including Alain Gabriel is also positive on metals and mining stocks in Europe, saying miners trade at a steep discount to the market relative to history. “A stable demand environment and continued focus on supply stress continues to underpin a solid commodity price environment,” they said.

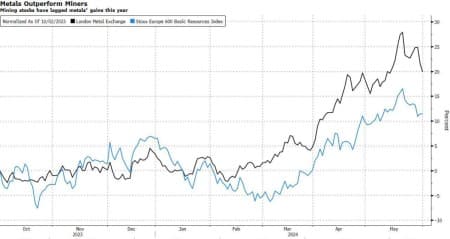

Societe Generale strategists including Manish Kabra said equities rather than metals are now a more attractive way to play the boom in commodity prices. “The current rise in metal prices suggests an inflection in EPS momentum ahead for the mining sector,” he said, adding his team prefers miners to energy stocks.

China’s recovery is another driver investors are closely monitoring, with mixed signals emerging in recent days. Official data showed the country’s factory activity unexpectedly contracted in May, a warning sign from the area of the economy that Beijing is most reliant on to drive growth. A different poll showed manufacturing activity expanded.

One of the key risks for commodity shares “is the lack of momentum in industrial activity in China and the property sector,” Liberum strategist Susana Cruz said. “That, added to a slowdown in the US economy reduces the upside for the sector,” though improving momentum in Europe could support demand in the second half of the year.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Oil Price Plunge Hits BP and Shell Shares

- What Does OPEC’s Strategy Shift Mean for the Oil Market?

- Saudi Aramco’s $12 Billion Share Sale Quickly Sells Out, but Who is Buying?