It appears that bullish sentiment has finally broken out in oil markets, helped along by geopolitical uncertainty and an increasingly optimistic demand outlook.

Friday, March 15th 2024

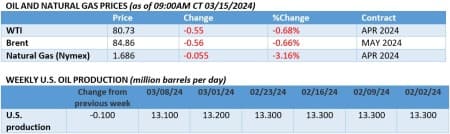

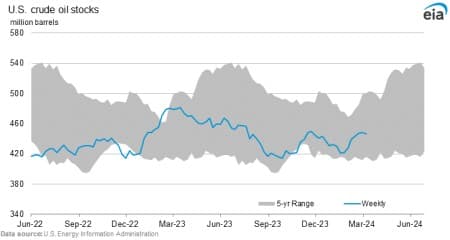

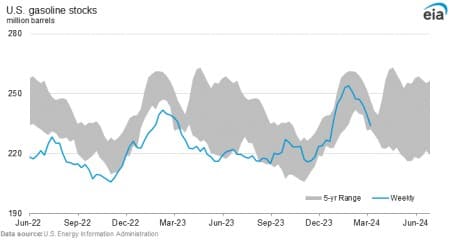

Brent futures have broken through the $85 per barrel for the first time since November, indicating that the gradually improving sentiment, further buoyed by Ukrainian drone strikes on Russian refineries this week and declining US inventories, is here to stay.

White House Signals Discontent with US Steel Takeover. The Biden administration is rumored to have expressed concerns over Nippon Steel’s $14.9 billion takeover of iconic steelmaker US Steel (NYSE:X), citing national security concerns and a lack of trade union consultation.

Drone Strikes Lead to Higher Russian Oil Exports. After this week saw several large-scale drone attacks on Russian refineries in Nizhny Novgorod, Ryazan, and Novoshakhtinsk, Russia’s Energy Ministry said the country’s crude exports will rise, in defiance of OPEC+ commitments.

Glencore Mulls Moving Main Listing to Australia. Activist investor Tribeca Investment Partners has called on mining giant Glencore (LON:GLEN) to move its primary listing from London to Sydney and abort plans to spin off its lucrative coal business to boost its share price.

Mauritius Emerges as Key Bunkering Hub for Rerouted Tankers. After global traders Mercuria and Trafigura suspended refueling operations in South Africa over a tax dispute with local authorities, Mauritius has become the main refueling station for all tankers avoiding the Red Sea and going around the Cape of Good Hope.

US M&A Frenzy Still Far from Over. US investment firm Kimmeridge Energy Management made an improved $2.1 billion offer for Eagle Ford-focused oil and gas producer SilverBow Resources (NYSE:SBOW), proposing to create a combined company and pledging to provide the necessary financing.

China’s Leading Smelters Agree on Production Cuts. China’s leading copper smelters Jiangxi Copper, Tongling, Jinchuan Group, and China Copper are reported to have concluded a rare agreement to cut production as spot fees to process copper concentrate fell to their lowest in a decade.

Nord Stream Sues Insurers for $440 Million. Pipeline operator Nord Stream AG is seeking $440 million from its insurers Lloyd’s Insurance and Arch Insurance in a lawsuit filed at London’s High Court, weeks after both Sweden and Germany found traces of explosives relating to the incident.

The UK’s Ambitious Green Agenda Gets Gas Reality Check. The government of the United Kingdom is proposing to build new gas-fuelled power plants, with the Energy Ministry suggesting 5 GW of generation capacity would be needed to avoid blackouts amidst a renewables pivot.

Cutting Fuel Prices, India Prepares for Elections. India’s state fuel retailers are cutting the price of gasoline and diesel this week to 94.72 and 87.62 rupees per liter respectively, the first change in two years, ahead of the 2024 Indian general election in April-May.

US Commissions First Major Offshore Wind Farm. The first utility-scale offshore wind farm in the United States, the 132 MW South Fork Wind project operated by Orsted (CPH:ORSTED) and Eversource (NYSE:ES) some 35 miles from Long Island, NY, has been launched this week.

China Discovers Another Huge Oil Field. China’s offshore-focused state oil firm CNOOC reported the discovery of Kaiping South in deepwater South China Sea, with the find believed to contain more than 100 million tonnes of oil equivalent in recoverable volumes.

Venezuelan Gas Attracts Key Oil Major. Concurrently to Shell’s 3.2 TCf Dragon field, UK oil major BP (NYSE:BP) is in talks with Venezuela’s PDVSA to develop the Manakin-Cocuina gas field straddling the border of Venezuela and Trinidad and Tobago, to be fed into Atlantic LNG.

IEA Continues to Upgrade 2024 Demand Outlook. The International Energy Agency raised its view on 2024 oil demand growth for the fourth time since November, expecting it to rise 1.3 million b/d, up 110,000 b/d compared to its forecast from last month.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- This Could Be A Gamechanger For Natural Gas In Europe

- Vattenfall Ditches Project to Produce Hydrogen From Offshore Wind

- Saudi Aramco Hikes 2023 Dividend To $98 Billion Despite Lower Profit

This is what is happening now in the global oil market with increasing signs of tightening market underpinned by solid fundamentals and robust demand and supported by a roaring Chinese economy thirsty for oil and OPEC+'s positive projection of demand growth of 2.2 million barrels a day (mbd) in 2024.

That is why oil prices are now on a steep upward trajectory with Brent crude on the way to hitting $90-$100 a barrel soon.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert