The threat of falling oil supply from both Iran and Venezuela looms large amid geopolitical tension, economic fears and sanctions. All the while, both are scrambling to maintain flows to key destinations. Below we take a peek at some such routes, and how flows could change.

The chart below shows Iranian crude exports (no condensates) bound for Europe. It highlights how flows have changed since sanctions were lifted - and also underscores where we could see changes coming next.

UN sanctions through 2015 meant Europe didn't receive any deliveries at all in the three years prior, but once sanctions were lifted in early 2016, deliveries to the region rose to nearly 20 percent of total Iranian crude exports, rising further to nearly 25 percent both this year and last.

Southern Europe has accounted for the lion's share of flows into Europe, with the leading European recipients being Italy, France, Spain and Greece.

While there have been rumblings out of Europe that they will keep both strong Iranian relations and oil flows intact, we are already seeing signs of backpedaling in response to U.S. sanctions: Total is unwinding operations of the South Pars project in Iran unless they get a special waiver, while the recompletion of a well in the North Sea has been halted because a subsidiary of the Iranian Oil Company holds a 50 percent interest.

(Click to enlarge)

While flows were throttled to Europe during prior sanctions, China and India were making hay while the sun shined. The two accounted for about 60 percent of flows for the three years through 2015, before seeing flows drop off once Iran was granted the ability to send crude elsewhere.

Flows to the two nations dropped below 50 percent of total exports last year, before clambering back above that threshold so far in 2018. If we do see a pullback in flows to Europe - which is likely to some extent - China and India are set to be the leading beneficiaries.

(Click to enlarge)

China and India are also key destinations for Venezuelan crude, along with the U.S. (as ClipperData analyst Kanan Mehra discusses here in one of our 'Weeklies in a Minute' features). Related: Increasing WTI-Brent Spread Points At Higher Crude Prices

As total exports of Venezuelan crude have dropped, we have seen the U.S. share of exports marginalized, but rising to China instead (hark, servicing debts). The U.S. is still the leading destination, but both China and India each account for a quarter of all exports: the three together cover close to 90 percent of all export barrels.

(Click to enlarge)

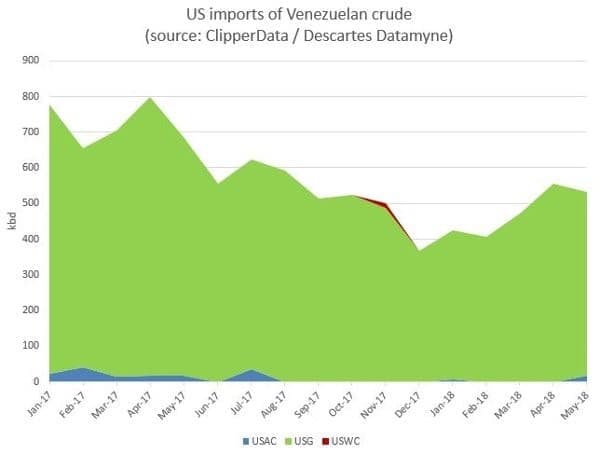

We have discussed previously the drop in Venezuelan flows to the U.S., but we have seen flows picking up in recent months as lower refinery utilization, higher levels of blending and an increasing scramble for cash has encouraged a higher number of barrels to arrive on U.S. shores. (We are seeing a strong number of vessels arriving in the US Gulf just this week).

Some refiners such as Phillips 66 have stopped taking deliveries of Venezuelan crude due to quality issues (hark, no deliveries since December 2017), while others, such as Valero, are said to be ramping up receipts.

While April receipts at Valero's Gulf Coast refineries were the highest since March 2016, deliveries in May to the four - Corpus Christi, Port Arthur, St. Charles and Texas City - have eased lower again:

(Click to enlarge)

Despite the recent rebound, U.S. imports of Venezuela crude have dropped over 20 percent to average under 500,000 bpd this year, having been above 600,000 bpd in 2017, and above 750,000 bpd in 2016.

(Click to enlarge)

By Matt Smith

More Top Reads From Oilprice.com:

- Dubai To Become Global Leader In Solar Energy

- Iran Tensions Send Oil Spiking Again

- EVs Could Erase 7 Million Bpd In Demand