As mentioned in the last post, the huge break in energy prices between the US and the rest of the world could explain the extreme dollar strength we have seen this year.

Part of the problem I have with that is that the corollary of that trade is energy exporters should see a boost from the improved terms of trade. Australia is one of the biggest LNG exporters in the world, and it has not seen any currency appreciation.

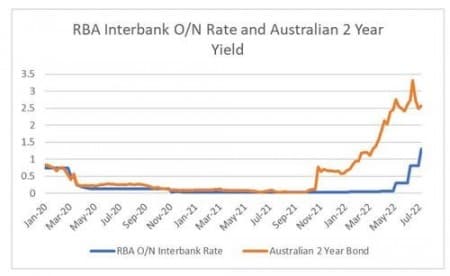

There is another way of looking at currency markets that would better explain this behavior. To generalize, central banks control short-term interest rates, and the market controls long-term rates. When 2-year bond rates diverge radically from central bank rates, it's the market’s way of saying inflation is way stronger than expected, and the central bank needs to do something about it. You can see that the market told the Fed to cut to close to zero when Covid hit and has been telling them to raise rates since late 2021, which they have now followed through on.

Australia got the same signal from the bond market but has been much tardier to raise rates.

Australia has typically had higher interest rates than the US, this tardiness in raising rates is probably explaining a lot of the currency weakness.

So if central banks' tardiness is driving a currency like the Australian dollar, what is it saying about Europe?

We are going to use the German 2 Year Bond yield (so we can ignore risk spreads) and we can see the ECB has usually followed the bond market pretty closely. But so far this year, they seem to be asleep at the wheel.

Switzerland offers a good counterpoint to the ECB - raising rates to match the sell-off in bond yields.

This has led to the Swiss Franc appreciating against the Euro substantially this year.

The irony of the situation is that during the deflationary decades of the 2010s, central bankers spent all their time dreaming up new and innovative ways to try and create inflation. Now that inflation has returned, all they need to do is raise interest rates, and they seem to have forgotten how.

By Zerohedge.com

More Top Reads From Oilprice.com:

- ESG Funds Reel As Investors Pile Into Energy And Defense Stocks

- Boris Johnson Resigns As Energy Crisis Worsens And Scandals Mount

- The EU Has Frozen $13 Billion In Russian Assets