Looking for potentially rewarding oil and gas stocks during the ongoing energy crisis can very much feel like dumpster diving. The energy sector has been deeply out of favor over the past few years, with the Covid-19 pandemic only serving to make an already bad situation worse.

With the sector's favorite benchmark S&P 500 Energy Sector SPDR (XLE) down 40% in the year-to-date, playing the long-game by buying beaten-down companies with excellent potential for a rebound might be the best strategy at this point.

Historically, a company's market cap tends to have an inverse or opposite relationship to both risk and return. On average, large-cap oil and gas with market capitalizations of US$10 billion and greater tend to grow more slowly, have less potential for returns, but are more stable than their smaller brethren. On the other hand, mid-cap companies (market cap between $2 and $10 billion) and small-cap companies (market cap between $300 million and $2 billion) tend to grow faster and have the potential for higher returns, but they are more volatile and present a higher risk profile.

Related: Two Major Shale Drillers Plan Layoffs

However, this crisis has not spared even behemoths with deep pockets with the XLE's Top 10 stocks all deep in the red in the YTD.

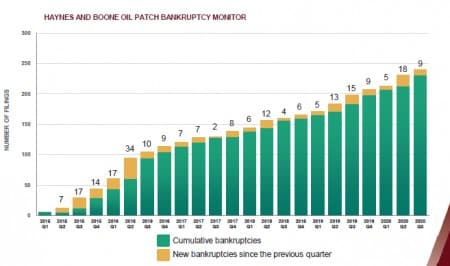

That said, bigger oil and gas companies have still held up better than their smaller peers, with heavily indebted shale and oilfield services companies generally faring the worst. According to the Haynes and Boone Oil Patch Bankruptcy Monitor, 32 U.S. energy companies have filed for bankruptcy protection in the YTD, reflecting aggregate debt of more than $49 billion.

The vast majority of those filings have been by companies operating in the Texas Shale Patch.

Source: Haynes and Boone

Here are top picks for big-cap, mid-cap and small-cap oil and gas companies:

#1 Big-Cap: Chevron Corp.

Market Cap: $159.5B

Chevron Corp. (NYSE:CVX) is the second-largest U.S. energy company behind only ExxonMobil Corp. (NYSE:XOM), which sports a market cap of $173.4B.

Prior to the pandemic, a cross-section of Wall Street was beginning to warm up to Exxon, believing that years of investments were about to start paying off.

Specifically, Bank of America Merrill Lynch had tapped XOM as its top 2020 stock pick, arguing that the stock could surge as production in the Permian Basin and projects in offshore Guyana ramped up.

But alas, that playbook has changed dramatically thanks to Covid-19.

Unlike the case in the past couple of years, investors are no longer rewarding shale companies with aggressive expansion plans. Instead, they are rewarding the shale companies that demonstrate better capital and cost discipline. In fact, this market has been reacting more positively to news about less, not more, oil and gas production: XLE is up 2.5% in Monday trading on news that energy producers have shut in ~1.07M b/d of oil, or nearly 58%, of offshore crude oil production and another 1.2M cf/day, or 45%, of natural gas output from the U.S. Gulf of Mexico due to the twin threat from Hurricane Marco and Tropical Storm Laura.

With a YTD return of -39.8% vs. -28.2% by CVX, XOM stock has fared worse than CVX partly because Exxon's counter-cyclical spending model has left the company cash flow negative for years and put the all-important dividend in danger. Chevron has generally maintained more modest capital investment plans and was quick to lower its 2020 capex when oil prices nosedived. CVX has made further spending cuts as conditions further deteriorated, taking its planned capex from $20 billion to $14 billion.

Exxon delayed its spending cuts but finally lowered its 2020 capex from $33 billion to $23 billion. Unfortunately, that has not stopped the company's debt from ballooning, with XOM's long-term debt surging 30% to $19 billion at the end of the June quarter. Exxon's debt-to-equity ratio of 0.37 is still considerably lower than that by most of its supermajor peers but could present a problem considering the company's juicy dividend--XOM's dividend yield (fwd) of 8.49% is at an all-time high.

Chevron's debt has been expanding, too, but at a more manageable clip of 20% during the period. The company's debt-to-equity ratio of 0.25 is the lowest among the supermajors, while its dividend yield (fwd) of 6.06% appears more sustainable than Exxon's.

With so much uncertainty surrounding the oil and gas sector and fears that the downturn might last for years, the ability of a company to withstand a prolonged bust cycle is an important consideration.

Chevron wins the stress test by a country mile.

Wood Mackenzie, a global energy, renewables, and mining research and consultancy group, has reported that Chevron Corp and Royal Dutch Shell (NYSE: RDS.A) are the most resilient, thanks to their robust deepwater projects and LNG as well as less exposure to high-cost assets. WoodMac has reported that Exxon is the most vulnerable of the majors due to its huge exposure to low-margin assets.

The supermajors are also well-known for their M&A prowess--and Chevron has not disappointed on this front either. CVX recently acquired Israel-based Noble Energy (NASDAQ:NBL) in an all-stock deal valued at $5B. The deal has been well received because it gives the company better exposure to the pivotal Permian Basin-- but at a much lower price. Chevron famously dodged a bullet by forfeiting the Anadarko purchase that has landed Occidental Petroleum (NYSE:OXY) in plenty of trouble.

#2 Mid-Cap: Apache Corp

Market Cap: $5.38B Houston-based Apache Corp.(NYSE:APA) is one of the biggest players in the Permian Basin.

Three weeks ago, APA stock jumped nearly 20% after the company announced that it had made a world-class discovery at the Kwaskwasi-1 well located in the prolific Guyana-Suriname Basin, where it encountered 278 meters (912 feet) of net oil and volatile oil/gas condensate pay.

Related: Laying The Base For A Hydrogen Economy In The U.S.

"We are thrilled with the results from the Kwaskwasi-1 exploration well. This is the best well we've drilled in the basin to date, with the highest net pay in the best quality reservoirs," Apache CEO and President, John J. Christmann, gushed. "While we have a lot more work to do, a discovery of this quality and magnitude merits a pace of evaluation that enables the option of accelerated first production."

Last year, Bank of America Merrill Lynch touted the Suriname prospect as a potential game-changer for Apache:

"Suriname has the potential to reset the investment case," Merrill Lynch's veteran oil-industry analyst Doug Leggate said.

Apache was among the first shale companies to undertake deep spending cuts after oil prices crashed in March. Apache lowered 2020 capex to $1B-$1.2B from its previous guidance of $1.6B-$1.9B. But it did not stop there: The company also cut the dividend by 90% to $0.025/share from $0.25. Apache has revealed that its 2020 capex is tracking towards the lower end of its guidance.

Its capital-light structure appears to be paying off.

During the company's latest earnings call, Apache's management said that the company would be running cash flow positive as long as WTI prices remain above $30/barrel (current WTI is $40.14). Further, the company said it would use any excess cash to pay down its debt.

However, should prices hit $50 or more, Apache said it would undertake very measured capex increases with the first column of that incremental free cash flow returned to investors, maybe through a dividend increase or share buybacks.

#3 Small-Cap: Renewable Energy Group

Market Cap: $1.44B

Iowa-based Renewable Energy Group (NASDAQ:REGI) is a biodiesel production company operating 13 biorefineries and a feedstock processing facility. The company manufactures biodiesel and renewable diesel from biomass feedstocks such as animal fats, distilled corn oil, and even used cooking oils.

REGI stock has been enjoying a remarkable run, up 35.6% YTD and 237.5% over the past 12 months thanks to continuing solid performance even during the pandemic.

At a time when demand for transportation fuels has been drastically reduced by the coronavirus pandemic, diesel fuel demand has generally held up better compared to demand for gasoline and jet fuels. Renewable Energy Group has also been benefiting big time from California's newly reinstated Low-Carbon Fuel Standard (LCFS) credits when it sells biomass-based diesel in the Golden State, even if the fuel is manufactured in Iowa.

During its latest earnings call, REGI reported that it produced 132M gallons of biodiesel and renewable diesel during the quarter, a 4% increase. The company also reported a surprise Q2 profit as well as better-than-forecast revenues of $546M. Gross profit as a percentage of revenue climbed to 5% vs. -5% of revenues a year ago. REGI was also able to sidestep volatile feedstock markets by increasing its use of soybean oil 126%, which gave a nice boost to the bottom line.

Overall, with the largest and most efficient operating footprint in its history, REGI appears well-positioned to increasingly invest in profitable growth and lower its reliance on amorphous tax credits.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Investment Funds Could Miss Out On Multi-Year Bull Run In Oil & Gas Stocks

- German Scientists Find New Way To Extract Lithium

- Saudi Energy Ministry To Help Build $500 Billion Smart City