The Vaca Muerta Shale Basin in Argentina is the only unconventional play outside of North America where activity has already made the transition from exploration to full-scale development. The potential prize is huge – geographically, the Vaca Muerta Shale is three times the size of the highly prolific Permian Basin in the US, and it could turn out to be the “next Permian” if the right conditions are established. But much remains to be done before that happens.

Rystad Energy’s Shale Intel group, in collaboration with Luxmath Consulting, has released a comprehensive new report covering all aspects of the Vaca Muerta Shale – including development status, production forecasts, drilling and completion projections, and the outlook for the various service segments in the industry. The report integrates Rystad Energy’s well-level research for Argentina, public disclosures from oil & gas companies and service contractors active in the region, and our conversations with on-the-ground field experts.

(Click to enlarge)

“There are several major bottlenecks that are currently affecting Vaca Muerta – proppant, infrastructure, labor, pressure pumping and the macro economic situation in Argentina. In addition, investments need to be made in water transportation infrastructure as drilling and completions increase within the region,” says Ryan Carbrey, Senior Vice President of Shale Research at Rystad Energy.

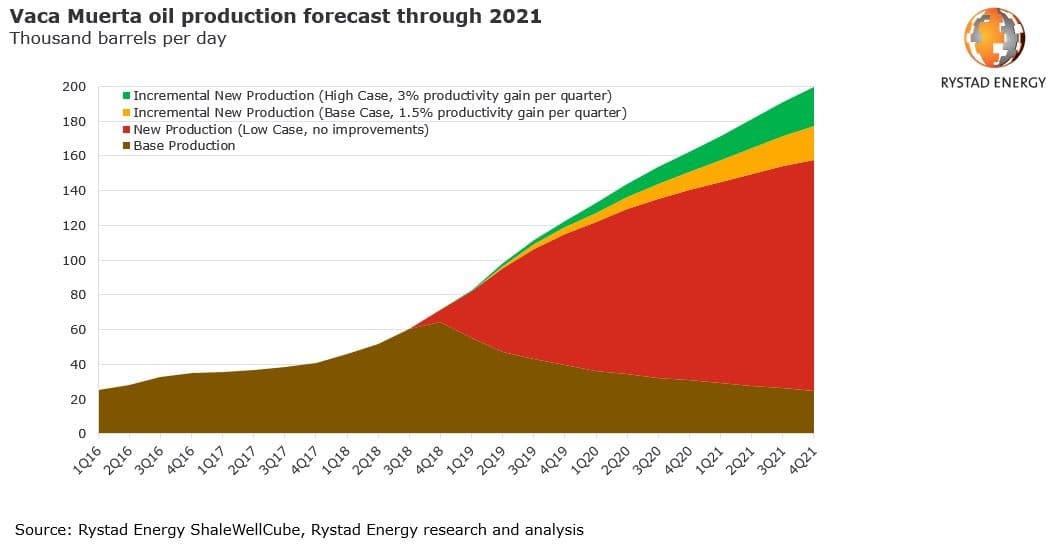

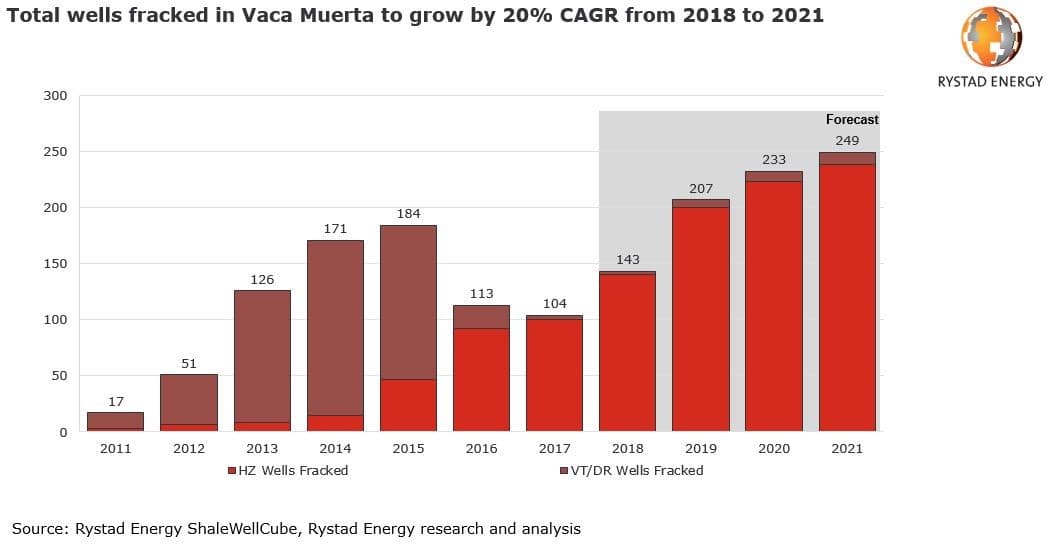

Vaca Muerta should see the tally of fracked wells reach between 140 and 150 this year. Only three of those wells are vertical, while all other wells are high-density horizontal completions. It is expected that fracking activity will grow at a rate of 20% per year from 2019 through 2021, reaching about 250 wells in 2021. According to Rystad Energy research, this heightened activity will generate a significant boost in Vaca Muerta oil production – from about 60,000 bpd in the third quarter of 2018 to between 160,000 and 200,000 bpd in the fourth quarter of 2021. Most of this growth will come from the liquids-rich Loma Campana portion of the play, operated by YPF. Related: Latest Oil Price Slump Was ‘Made In America’

(Click to enlarge)

“YPF tested its first 10,000-foot lateral well in Loma Campana in 2018. Initial oil production results look very promising and fully competitive with typical two-mile design wells in core areas of key US liquid basins like Bakken and central Eagle Ford. We haven’t yet seen performance levels to match the Permian-Delaware Basin, but further optimization of well designs will surely lead to additional improvements in Vaca Muerta,” says Artem Abramov, Head of Shale Research at Rystad Energy.

Several gas-rich areas in the play already compete with the best US shale gas reservoirs. YPF’s performance in the El Orejano area, TecPetrol’s in Fortin De Piedra, and both BP’s and Total’s results in Aguada Pichana all exhibit gas well productivity on par with the core areas of the Utica, Haynesville and Marcellus shale basins in the US.

There are six active service companies currently providing pressure pumping services in Vaca Muerta, collectively supplying about 665,000 horsepower for hydraulic fracturing operations. Thus far, however, most of these service providers have struggled to achieve acceptable margins in Argentina. Improving the return on investment for key service providers will be a vital issue to be addressed by operators in order to achieve their goal of attracting new investments into the region.

Proppant demand is increasing rapidly in Vaca Muerta and Rystad Energy expects to see growth rates of about 34% per year in 2019-2021, reaching 2 million tons of proppant in 2021.

(Click to enlarge)

“Frac sand demand will increase faster than the well count as operators migrate towards longer laterals and increased proppant intensity. On the supply side, proppant is in fact the biggest immediate bottleneck in Vaca Muerta as trucking distances are upwards of 1,000 km at times. We expect some brownfield mine expansions along with investments into in-basin mines. This will bring total sand supply from 870,000 tons in 2018 to 2.5 million tons in 2021,” says Thomas Jacob, Lead Proppant Market Analyst at Rystad Energy.

More Top Reads From Oilprice.com:

- Natural Gas Markets Remain Ultra Tight

- Oil Prices Crash, But Oil Majors Aren’t Panicking

- Abu Dhabi’s Remarkable Energy Diversification

For now , just boost the mpg of gdi engines by heating the gasoline to 200 celcius before injecting it directly into the cylinder at 15 degrees before top dead center. This can do easily over 90 mpg instead of the 50 mpg that my 2014 Hyundai accent do.