Peru’s oil industry has been under considerable pressure for some time. A combination of long-running political turmoil, community dissent and the pandemic are weighing heavily on the outlook for the Andean country’s hydrocarbon sector. Socialist Pedro Castillo’s victory in Peru’s controversial 2021 presidential election, where he defeated contentious hard-right opponent Keiko Fujimori, daughter of jailed former president Alberto Fujimori, sparked considerable fear about the oil industry’s future.

Castillo during his campaign made many statements about resource nationalism, sparking fears that his administration would consider seizing privately owned mining and petroleum assets. That, along with the Marxist leanings of Castillo’s Free Peru party rattled the Andean country’s urban business elite and the resources sector.

Nonetheless as the likelihood of victory grew, Castillo sought to clarify his proposed policies indicating that there was no need to fear the nationalization of mining or oil assets. Prior to officially entering office Castillo stated that his administration will respect private investment and property with the state only seeking a greater share of profits from the exploitation of natural resources. That additional revenue he intends to use to increase investment in those communities in the regions where the oil industry operates to address structural economic inequality in those remote regions, thereby hopefully reducing conflict. It was the lack of funding for basic public goods and social programs in Peru’s Amazon Basin which caused the petroleum industry’s social license to deteriorate, leading to community blockades and violent protests.

By early August 2020 demonstrators had seized a pumping station for PetroPeru’s 100,000 barrel per day capacity northern oil pipeline forcing operations to cease. That along with violent blockades of Block 95 forced the operator, Canadian oil junior PetroTal, to shut-in its Bretaña oilfield.

During early September 2020 PetroTal was able to re-open the field after the national government in Lima reached an agreement with local communities to invest $1.7 billion in public infrastructure over a six-year period. As part of his plan to reduce conflict between communities and the petroleum industry, Castillo announced that private investment in hydrocarbon exploitation must not only be economically profitable but also benefit local communities.

PetroTal has offered to participate in a pilot program (Spanish) that will benefit the communities located near Block 95 by increasing the oil fees payable to the local provinces and municipalities where the oil industry operates. That along with additional investment in public infrastructure Castillo hopes will reduce conflict between local communities and the oil industry. PetroTal’s Block 95 is an ideal test case having suffered 193 incidents relating to community conflict.

Despite those positive developments, Peru’s oil industry, especially in the Amazon, remains in jeopardy because of a weak social license which has the potential to cause further operational disruptions due to community conflict. Ongoing maintenance and reliability issues make the northern pipeline, the primary means of shipping the crude oil produced in Peru’s Amazon to the coast, a key bottleneck which is preventing the Andean country from boosting oil production. Illegal valves, sabotage, poor maintenance and leaks have plagued the pipeline for years, leading to regular outages which have forced drillers in Peru’s Amazon to shutter operations. It is estimated by industry experts that it will take at least $250 million to upgrade and modernize the crucial pipeline.

As a result of those hazards, notably a sustained community blockade, Canadian intermediate oil producer Frontera Energy declared force majeure for Block 192 during March 2020. Prior to operations being shuttered Block 192, which contains 13 producing oilfields, was one of Peru’s most important oil assets pumping around 10,000 barrels per day. PetroPeru intends to recommence operations at Block 192, three decades after the national oil company under the direction of then President Alberto Fujimori sold its upstream oil assets to privately owned energy companies. Reportedly PetroPeru, which holds exploration Block 64, is considering taking over operatorship of Block 8 where Argentina's Pluspetrol shuttered operations in April 2020.

The considerable uncertainty surrounding the outlook for Peru’s petroleum industry makes it extremely difficult for Lima to attract foreign energy investors, making PetroPeru the only realistic option for restarting production at those blocks. The considerable headwinds facing Peru’s oil industry are weighing on production causing growth to remain weak. For July 2021, data from Peru’s Ministry of Energy and Mines shows that the Andean country pumped on average 38,888 barrels of crude oil per day. While that was 12% greater than for the same time during 2020, when oil output fell sharply because of pandemic-induced shut-ins, it is still 11.5% lower than July 2019 when Peru pumped on average 43,917 barrels per day.

Source: Peru Ministry of Energy and Mines.

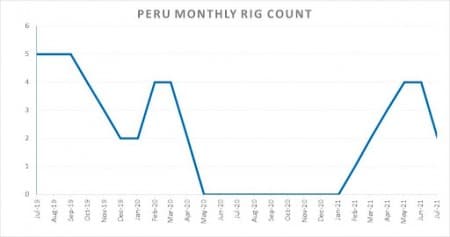

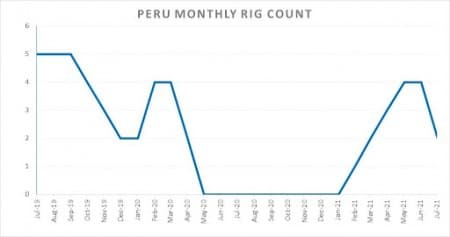

The Baker Hughes monthly rig count is a dependable de-facto measure of oil industry activity. By the end of July there were only two operational drill rigs in Peru compared to four a month earlier, although this was a significant improvement over the same period during 2020 when there were no active rigs.

Source: Baker Hughes.

Nevertheless, at the end of July 2019 there were five active rigs counted by Baker Hughes, which aside from being more than double July 2021 indicates that the tempo of operations in Peru’s petroleum industry has yet to return to pre-pandemic levels.

Regardless of Castillo’s statements indicating that he will respect private property and investment, there are considerable concerns that his administration may embark on more radical policies regarding Peru’s resource sector. That, along with fears of tax hikes and further protests, is acting as a considerable deterrent to investment by foreign energy companies, explaining why the Andean country’s crude oil output and rig count have not returned to pre-pandemic levels. Peru’s petroleum industry has the potential to be a key driver of the country’s post-pandemic economic recovery, particularly after gross domestic product contracted by a worrying 11% during 2020.

By Matthew Smith for Oilprice.com

More Top Reads From Oilprice.com:

- OPEC+ Ignores Biden, Keeps Output Plans Unchanged

- How To Capitalize On Guyana’s Oil Boom

- 3 Distinct Futures For The Oil Industry