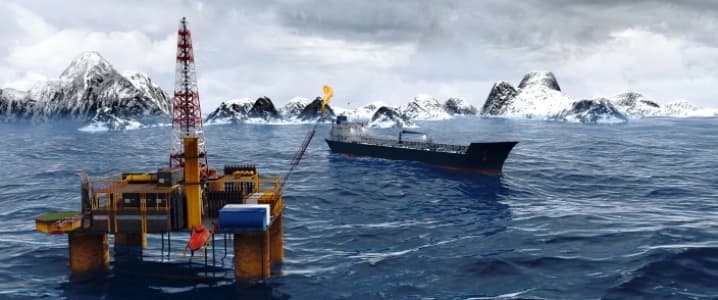

Arctic oil drilling may be controversial and expensive—and is generally not a top priority in the energy industry—but Italy’s energy major Eni begs to differ. The company last week received approval for its drilling plans in the Beaufort Sea from the Bureau of Ocean Energy Management and plans to start drilling at the end of this year.

Eni still needs to obtain other approvals on the state and federal level before drilling begins, but media covering the news note that once the BOEM gives a company the green light, other approvals come easily.

Eni’s leases for the Arctic waters off the Alaskan coast date back a decade, but the Obama administrations did not look kindly on Arctic oil and gas exploration. This changed with Trump’s coming into power in January with a top priority of expanding the U.S. energy industry. A review of Eni’s leases started in March, and according to media, approval has been quick. Yet some challenges remain.

Environmentalists have slammed the approval, arguing that it was granted too quickly, leaving too little time for comments from the public, especially regarding the environmental review that is required by federal law. Opposition is bound to grow as Eni moves closer to the start of drilling operations before its leases expire at the end of 2017. The Center for Biological Diversity, for one, plans to fight the drilling approval.

Separately, Alaska lawmakers this weekend approved a change in the state oil production tax that will cancel cash disbursements to energy companies active in the state for new discoveries they make. The bill still needs to be signed by the governor, but there isn’t much doubt that this will happen, since Governor Bill Walker supported many of the changes it proposes. Related: Ecuador Abandons The OPEC Deal: Who’s Next?

This move has had the industry worried that motivation for new discoveries will wane, especially given that the environment in the Arctic is much harsher than elsewhere and exploration is already costlier. On the other hand, the Arctic waters around Alaska are estimated to contain a wealth of oil and gas, still untapped, and the approval of Eni’s exploration plans for the area might prompt other energy companies to reconsider their Arctic plans.

Arctic exploration seems to be high on Eni’s agenda. The Italian company is the operator of the Goliat field in the Norwegian section of the Barents Sea, which started production last year and is slated to pump 100,000 bpd. Earlier this year, Eni signed a cooperation agreement with Russia’s Rosneft that will focus on exploration in the Russian part of the Barents Sea.

The foray into the Arctic, however, has not been cloudless. The Goliat field went into operation after a costly two-year delay, and since its launch, several incidents such as power outages and gas leaks have taken away from the potential advantages of the project.

Environmental opposition to Arctic drilling is already strong because of the sensitivity of Arctic ecosystems and the specific challenges present in dealing with an oil spill there. This opposition is only likely to intensify further after Washington’s opening up of parts of the Arctic shelf for oil and gas drilling. With the high cost of drilling in the Arctic and possible obstacles that various opponents can put in its way, the profitability is in question. Still, Eni seems to be ready to stick to its priorities even though it’s doing much better than some of its peers in the reserves replacement department: as of end-2016, its reserves replacement ratio was a healthy 139 percent.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- One Way Or Another – Venezuela Will Send Oil Prices Up

- Oil Up As Saudis Consider Deeper Output Cuts

- Hedge Funds Bleed As Oil Price Recovery Fails To Materialize