Introduction

The collapse of deepwater drilling in the Gulf of Mexico, (GoM) beginning in 2014, with no real recovery yet in sight, has spread a lot of misery around the oilfield. Nowhere is that more evident than in the fortunes of Carbo Ceramics, NYSE: CRR. A former oilfield high flyer, Carbo, whose stock crested in 2014 at $154.30 per share, now trades under $2.00 per share.

Their legacy is that of the provision of high technology of crush-resistant ceramic beads used to prop open fractures created in oil and gas formations by hydraulic fracking. This is referred to in the industry as “stimulation”, and is the process by which oil and gas flow is enabled from tight rock formations. The deepwater jobs in the GoM sometimes used as much as a million pounds of the stuff at a time. As in all booms, the industry players lost sight of the general up and down nature of the oil markets historically, and when the bust hit were stuck with too much inventory, and a bloated manufacturing structure. A situation that described Carbo to a T.

The question now before us is, does Carbo have a long term upside that might make a patient investor some money? Or are they a value trap, slated to slide to zero?

The problem with ceramics in the “low cost” oilfield

The…

Introduction

The collapse of deepwater drilling in the Gulf of Mexico, (GoM) beginning in 2014, with no real recovery yet in sight, has spread a lot of misery around the oilfield. Nowhere is that more evident than in the fortunes of Carbo Ceramics, NYSE: CRR. A former oilfield high flyer, Carbo, whose stock crested in 2014 at $154.30 per share, now trades under $2.00 per share.

Yahoo Financial

Their legacy is that of the provision of high technology of crush-resistant ceramic beads used to prop open fractures created in oil and gas formations by hydraulic fracking. This is referred to in the industry as “stimulation”, and is the process by which oil and gas flow is enabled from tight rock formations. The deepwater jobs in the GoM sometimes used as much as a million pounds of the stuff at a time. As in all booms, the industry players lost sight of the general up and down nature of the oil markets historically, and when the bust hit were stuck with too much inventory, and a bloated manufacturing structure. A situation that described Carbo to a T.

The question now before us is, does Carbo have a long term upside that might make a patient investor some money? Or are they a value trap, slated to slide to zero?

The problem with ceramics in the “low cost” oilfield

The onshore oilfield expansion in the shale plays has sucked most of the “oxygen” out of oil company investment coffers in recent times. The lure of easy access and quick returns has led to oil companies to focus there, as opposed to developing the long-cycle projects that sustained players like Carbo for so many years. A question naturally arises then, why don’t they just transfer their efforts in this area.

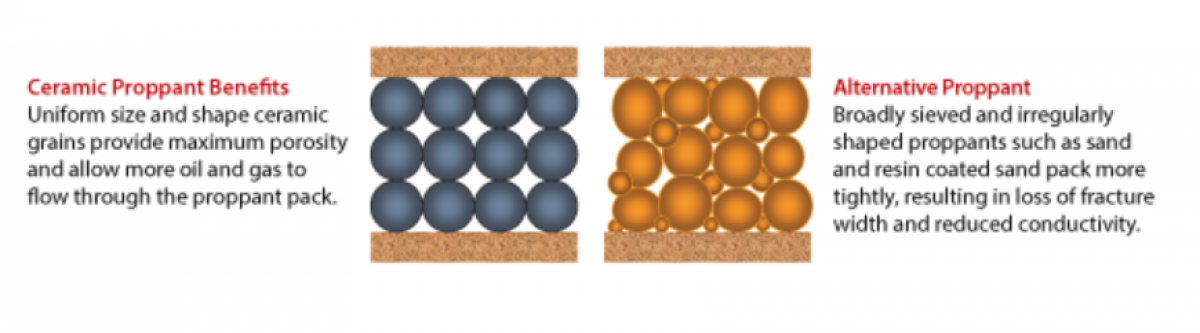

Carbo has a two-fold problem with selling its high-tech Kryptosphere product to the shale-based oilfield. First, the industry has moved into a lower cost environment, where operators ruthlessly find ways to cut well costs. Ceramics are more expensive by a factor of ten to twenty times than alternative proppants, like resieved sand, and operators just can’t justify its use. You can see from the graphic below that it is clearly superior in size and shape to alternatives, but the cost differential is just too high.

Source

The second problem lies in the message the industry is sending about proppant. Put simply, proppant quality, in terms of sphericity and crush resistance, is just not presently much of a factor in selection, as it once was. This is underscored by the shift to Texas Red sand, and away from the purer Northern White material. Fracking sand volumes have increased so massively, as much as 5,000 # per lateral foot. When you consider the nearly 10,000 foot length of some wells, you can see what the impact of cost differentials between the two are to operators making cost decisions.

Source In this picture darker sand from West Texas is shown with Northern White sand next to it.

Carbo has tried to crack this market, and even gotten a job here and there in the shale patch, often with impressive results. It hasn’t made a difference as shipments of Carbo’s signature Kryptosphere proppant have continued to decline quarter after quarter. In 2018 Carbo saw a 32% decrease in ceramics sales from the prior year.

Developing other markets for ceramics and outside products

With its formerly lucrative deepwater market shrunk to near non-existence, Carbo has successfully started developing industrial markets in the grinding and casting industries with its products. There is a federal initiative to move away from silica in grinding and castings that is supportive of this business. Silica (sand) is a known causal agent in silicosis and some forms of lung cancer.

Across a number of lines ranging from industrial floor protectors with its Assetguard line to Metakao which is sold to concrete blenders to add structural strength Carbo has done an outstanding job diversifying its product base away from the oilfield.

They have also ventured into contract manufacturing for outside clients to soak up fallow factory space. Recently they’ve also entered into a joint venture with Melior Innovations, to manufacture and market its PicOnyx, M-Tone form of carbon black to printer ink and coatings business.

So, while the company cannot be accused of letting grass grow under its feet, the persistent decline in the stock price tells us that the investing community just doesn’t care, at least right now.

The forecast through 2020

On the oilfield side, Carbo is expecting an uptick in offshore work in the coming quarters. They have a well programmed for Kryptosphere HD that is scheduled for late in the second quarter, and have projects for the LD form later in the year. Deepwater activity will be down for Carbo year-on-year, but the outlook for 2020 is robust with high double-digit growth given the current projects that are under discussion.

The StrataGen consulting business is expected to increase in the second quarter of 2019 as clients complete more projects than in the first quarter. In addition, with improving domestic activity, software sales should benefit in the second quarter.

In the industrial sector, they see growth in the industrial ceramic markets. Product trials with potential clients around the world are in discussion. METAKAO in recent third-party tests against other metakaolin providers, METAKAO significantly outperformed competing products during the evaluation of compressive strength and water intake.

This is all interesting but the investment case largely rests with the Kryptosphere family of products. Ceramics used in fracking drive so many aspects of their business that no amount of industrial activity that is achievable in the realistic near term, can replace it.

Key Financials

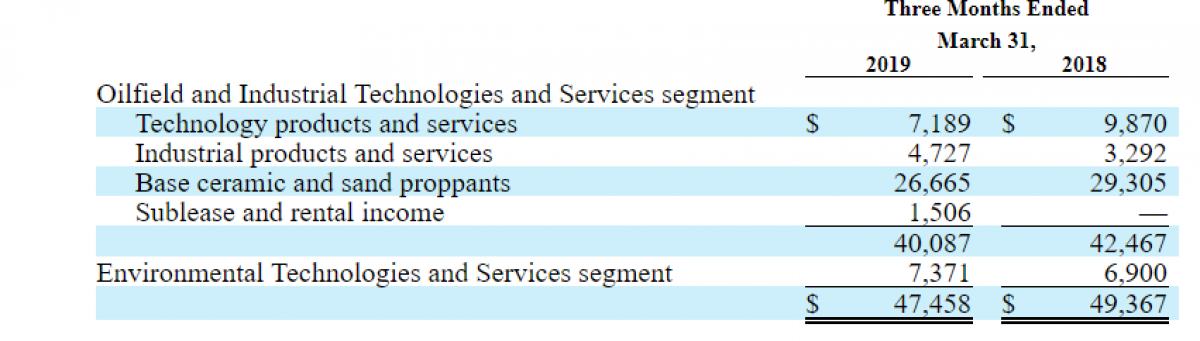

Revenue is down 4.5% sequentially from the same period in 2018, at $47.5 mm. Declines in oilfield revenue were partially offset by increases on the industrial side.

Losses have been cut 10% to $-0.74 per share, a significant portion of which are non-cash, with impairments, inventory write downs, and associated expenses being the culprits

Cash on hand stands at about $81mm, giving them some room to fund operations, although they forecast using about half of this amount to repay loans to the company made by two of its directors. This should still leave ample liquidity to fund operations for several years.

Long term debt stands at $65 mm the bulk of which is due in 2020, but may likely be rolled into a new credit agreement as the lenders have warrants to buy a half a million shares at $14.91 a share. At current prices these lenders who already hold 10% of the common stock are unlikely to exercise these warrants.

Source, Carbo Ceramics, 10-Q

The revenue picture continues a downward slope as declines in the oilfield sector outweigh increases in industrial activity. You can see the bulk of their revenue still comes from a combination of sand (Carbo sells Northern White as well as ceramics), and ceramics. A couple of years ago Carbo stopped breaking out sand and ceramics, so it’s impossible to know the exact ratio of the two. My expectation this is it is skewed largely to sand.

Source Carbo Ceramics, 10-Q

The key takeaway here is that even with its dramatically reduced levels, the oilfield provides 80% of Carbo’s revenue. Carbo is still predominantly an oilfield service supplier.

Your takeaway

The company expressed optimism about the upcoming couple of years both on the oilfield side and with growth in the industrial side amounting to 40% of its business in a couple of years. There is nothing wrong with being optimistic, the industrial growth is impressive. It’s just small potatoes.

I would rate in the investbility in the company as being very marginal until they show some strong improvement in ceramics sales. It should be noted that their future is in the hands of their lenders, who although they have stepped into avert bankruptcy before, might be close to having their patience exhausted.

Carbo has to be viewed as a purely speculative play at current levels akin to stepping up to the roulette table.

By David Messler for Oilprice.com

Disclosure: The writer does not hold and does not intend to obtain a position in this stock within the next 72hrs. The author expresses his own opinions and has no business relationship with any company whose stock is mentioned in this article.

With the supposedly robust shale oil industry booming in the States and the amount of hydraulic fracturing required to keep that industry viable (and therefore a booming market for proppant), how did they manage to go belly up?