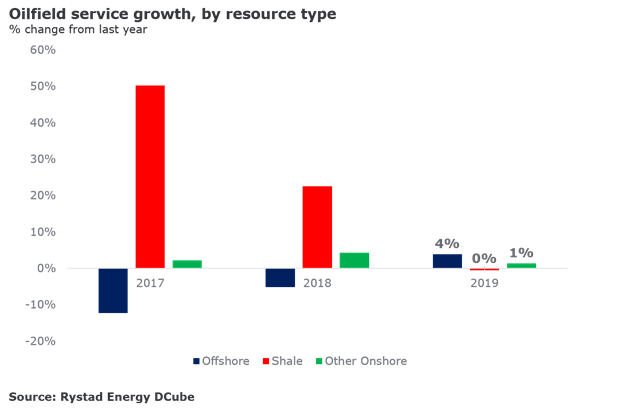

Rystad Energy forecasts offshore spending will outgrow spending on onshore shale activities this year. Service companies exposed to the offshore subsea market and the maintenance, modifications and operations (MMO) sector are set to benefit from this trend reversal.

At current oil price levels, spending on land rigs, fracking and other services for the shale industry is likely to stay essentially flat in 2019. The offshore service market, too, will feel the effects of the recent oil price slide, but this sector is nevertheless projected to grow by a robust 4% this year, according to Rystad Energy forecasts.

“Many would expect offshore spending to be cut as drastically as shale, but offshore budgets were at a 10-year low last year, after four years of intense cost focus, and from that level you don’t need much additional activity or inflation to drive up the market,” Rystad Energy head of oilfield services research Audun Martinsen said.

(Click to enlarge)

Since oil prices fell in the fourth quarter of 2018 and the oil market outlook for 2019 appeared more bearish, shale budgets for next year have been cut drastically to compensate for the anticipated loss of revenues.

“We saw the tendency already last month that the shale service market started to hit the brakes. The number of fracked wells per day dropped from an average of around 50 wells per day to 44 wells per day, and frack service pricing continued to fall in the fourth quarter of 2018. For the full year of 2019 we expect more or less the same number of wells completed, at around 20,000 wells, and we do not anticipate seeing utilization returning to the levels as seen in early 2018,” Martinsen said.

Rystad Energy expects the uptick in offshore spending to be driven by exploration and greenfield projects. In addition, operational expenditure (opex) budgets will likely swell thanks to cost inflation, more fields coming on stream, and a buildup of work that needs to be completed. Related: Fears Of U.S. Shale Demise May Be Overblown

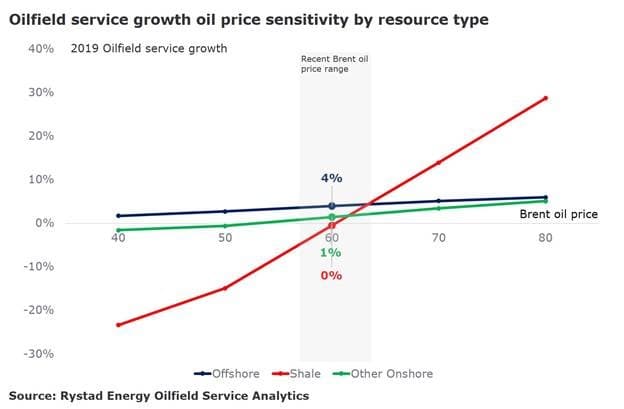

New research from Rystad Energy shows the inflection point for when the short cycle shale business could again grow faster than offshore. According to this research, a price of $64 per barrel of Brent crude would see both shale and offshore grow at around 5%, but in a scenario where Brent climbs to $70 per barrel, the shale industry could achieve an impressive 14% growth.

(Click to enlarge)

“Investors now need to position their bets correctly based on their price strip assumptions. As long as oil prices are below $60 a barrel for Brent it could be interesting to take a second look at service contractors exposed to the offshore sector to see what they have to offer as compared to service companies exposed to shale,” Martinsen added.

By breaking down capex and opex budgets across resource types, and allocating the spending to the associated service segments, Rystad Energy estimates revenue growth based on known backlog, latest contract awards and regional exposure.

“It seems that the names that will be able to deliver the best revenue growth are the service companies exposed to the offshore subsea market and MMO. This is a clear switch from 2018, when it was the shale names that were market share winners in the global service market,” Martinsen concludes.

By Rystad Energy

More Top Reads From Oilprice.com:

- Oil Rises After Choppy Start To The Week

- U.S.-Qatar Energy Partnership Has Russia On Edge

- CME To Start Selling U.S. Export Crude