Anxious and unsure as to when exactly will the COVID-induced recession come to an end, both current and future oil-producing nations have been having quite the hard time to define the ideal path forward in terms of their licensing policy. The easiest solution would be to freeze all planned operations until things get calmer and thus more predictable, although cancelling plans altogether is also an option to consider. Rare are those nations which have turned to improve upstream conditions for investors, especially among those already producing yet Norway’s parliament has recently done just that by voting for a set of fiscal changes to its upstream terms and conditions.

Given that most of Norway’s offshore production takes place in the harsh environment of the North and Barents Seas, its breakeven levels necessitated a more agile reaction from the government’s part to aid the Scandinavian country’s oil industry. Both the ruling Conservative Party and the opposition Labour Party supported the incentivization of short-to-mid term upstream projects so as to avoid an FID pitfall in 2020-2021. The end result is an immediate deduction of capex investment from the 56% special petroleum tax and an uplift of the SPT from 20.8% to 24% - heretofore the uplift duration was spread across 4 years, whilst the capex deduction was rendered immediate instead of the previously stipulated 6 years.

Meagre exploration activity in offshore Norway has been one of the prime reasons that compelled Oslo to mitigate the adverse coronavirus-induced developments. Usually oil companies drill an average of 15 development wells per month and this year has seen the lowest levels in 6 years – the 20% year-on-year drop would have been even more painful were it not for the remarkably active May drilling programme (21 wells spudded). Exploration drilling suffered an even more tangible blow – the Norwegian Petroleum Directorate assumed 2020 would see some 50 exploratory wells, however with the current rate of postponements that number seems to be closer to 40 now. Against such a background, the Norwegian government’s decision to stimulate upstream investment seems more than timely. Related: Can OPEC+ Still Justify Its Deep Output Cuts?

Companies reacted almost immediately to the fiscal amendments – the NOAKA fields (North of Alvheim, Krafla and Askja) fields saw their commissioning by Equinor and Aker BP, Lundin resuscitated its Solveig II and Rolvsens projects that were stalled in March, whilst Equinor is generally expected to move ahead with its 440 MMbbl Wisting discovery in the Barents Sea, the largest Norwegian find of the 2010s. The Norwegian government has also vowed to support offshore developments that would decrease the country’s carbon footprint, meaning that all projects which aimed to connect oil and gas-producing fields to the national power grid and thus decrease CO2 emissions would most probably be kept alive (e.g. Equinor connecting its Sleipner field to the grid at the Utsira High area).

Overall sentiment on this year’s exploration activity, however, has barely changed after the fiscal amendments so Norway is still running the risk of a reduced resource base in the long term. If one is to look at the size of discoveries in recent years, one must inevitably notice the decrease in average reserves – the average discovery size in 2019 stood at 31 MMbbls, whilst the average rate in the 2010s hovered in the 40-50 MMbbls interval. Moreover, exploration in the Barents Sea, long believed to be the next oil frontier for Norway has suffered more than drilling in the North and Norwegian Seas as much-anticipated wells like Stangnesting and Schenzhou were postponed into 2021.

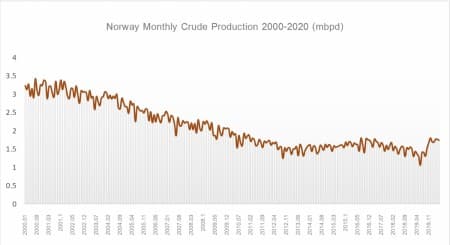

Graph 1. Norway’s Crude Production in 2000-2020 (million barrels per day).

Source: Norway’s Petroleum Directorate.

Norway needs a reliable resource base in order to ready itself for a post-Sverdrup horizon. The 2.7 Bbbls field has started producing in October 2019 and has already reached the first-phase production plateau at 450-460kbpd monthly loadings in July and August, equivalent to 25% of Norway’s aggregate crude output. The Scandinavian nation’s dependence on Sverdrup volumes will increase with time as the field is expected to attain its second-phase plateau of 690kbpd, i.e. 35-40% of national production levels depending on the circumstances. Even in the upcoming years most of projects that would be carried out concurrently to Johan Sverdrup reaching its peak pale in comparison somewhat – Equinor’s Martin Linge (assumed commissioning in 2021) is 250-300 MMbbls in reserves, Var Energi’s Balder (2022) has some 140 MMbbls.

A laudable development in Norway’s oil segment is the relative lack of force majeures that have crippled optimal utilization of assets in the previous couple of years. Yet this has been counteracted by Norway’s participation in the COVID-induced OPEC+ production cuts, vowing to curb 250kbpd in June and 134kbpd for H2 2020. With demand slowly normalizing, especially with Chinese buyers buying up Sverdrup cargoes, Norway might be finally able to start its three-year Sverdrup-led production increase. What happens after the post-2023 horizon is still somewhat vague, however the fiscal changes are a tangible sign that Norway does not want to briskly quit its hydrocarbon bounty, rendering it greener and less polluting might be an elegant way to bridge the gap between the present and the future.

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- The Race To Complete The World’s Most Controversial Pipeline

- Can OPEC+ Still Justify Its Deep Output Cuts?

- Oil And Gas Drilling Set For A Multi-Decade Low In 2020