A basic review of the chart for oil futures (CL) suggests that crude is about to take off. Whether the next move from here is up or down, providing a critical level holds in one case or is broken in another, it will send a strong technical buy signal.

It is not, however, confirmed as a buy signal until one of two things happens. Either we move on up through the high of the first plateau, which in this case is the $54.55 achieved on December 4th, or there is a second failed try at the roughly $50 base of the two “shoulders”. Either one would indicate a move higher, so while there is no real signal yet, it is very likely that there will be one soon.

As any trader will tell you though, technical analysis has its limits. Previous price action and chart patterns can be useful in the short term, but any signal they send is only valid as long as fundamental conditions stay essentially the same. That means that no matter how strong a signal the chart is sending, a review of prevailing conditions in the market is advisable before taking a position that is designed to be run for any length of time. So, with a good chance of a buy signal in the next few days, now is a good time to assess the fundamentals of crude to see if you should listen to what the chart…

A basic review of the chart for oil futures (CL) suggests that crude is about to take off. Whether the next move from here is up or down, providing a critical level holds in one case or is broken in another, it will send a strong technical buy signal.

(Click to enlarge)

The pattern concerned is basically a flat period followed by a dip, a recovery to the same level and then another sideways move. It is known as a teacup and is similar to an inverse head and shoulders formation, but without the pronounced shoulders formed by two dips during the periods of sideways action. Still, the theory is the same as to why it presages a run up. It indicates a failed move down that should discourage any aggressive selling from here.

It is not, however, confirmed as a buy signal until one of two things happens. Either we move on up through the high of the first plateau, which in this case is the $54.55 achieved on December 4th, or there is a second failed try at the roughly $50 base of the two “shoulders”. Either one would indicate a move higher, so while there is no real signal yet, it is very likely that there will be one soon.

As any trader will tell you though, technical analysis has its limits. Previous price action and chart patterns can be useful in the short term, but any signal they send is only valid as long as fundamental conditions stay essentially the same. That means that no matter how strong a signal the chart is sending, a review of prevailing conditions in the market is advisable before taking a position that is designed to be run for any length of time. So, with a good chance of a buy signal in the next few days, now is a good time to assess the fundamentals of crude to see if you should listen to what the chart is saying.

On the supply side, there is a strong bull case to be made. WTI rose and remained elevated during 2018 as the effects of the production cuts by OPEC and some other key producers were felt. The extended period above $60, however, encouraged increased production in the U.S. as more shale fields became profitable. Eventually that took its toll and the price adjusted.

At the end of last year, as oil dropped precipitously in the face of those increases and concerns about global growth, the OPEC group renewed their enthusiasm for and extended the cuts. That drop will have also affected the profitability of the wells opened when WTI was in the $70s so, while it takes time for it to filter through into the price, some reduction, or at least a levelling off, in U.S. output is likely. The supply side pressures on crude therefore look to be dissipating.

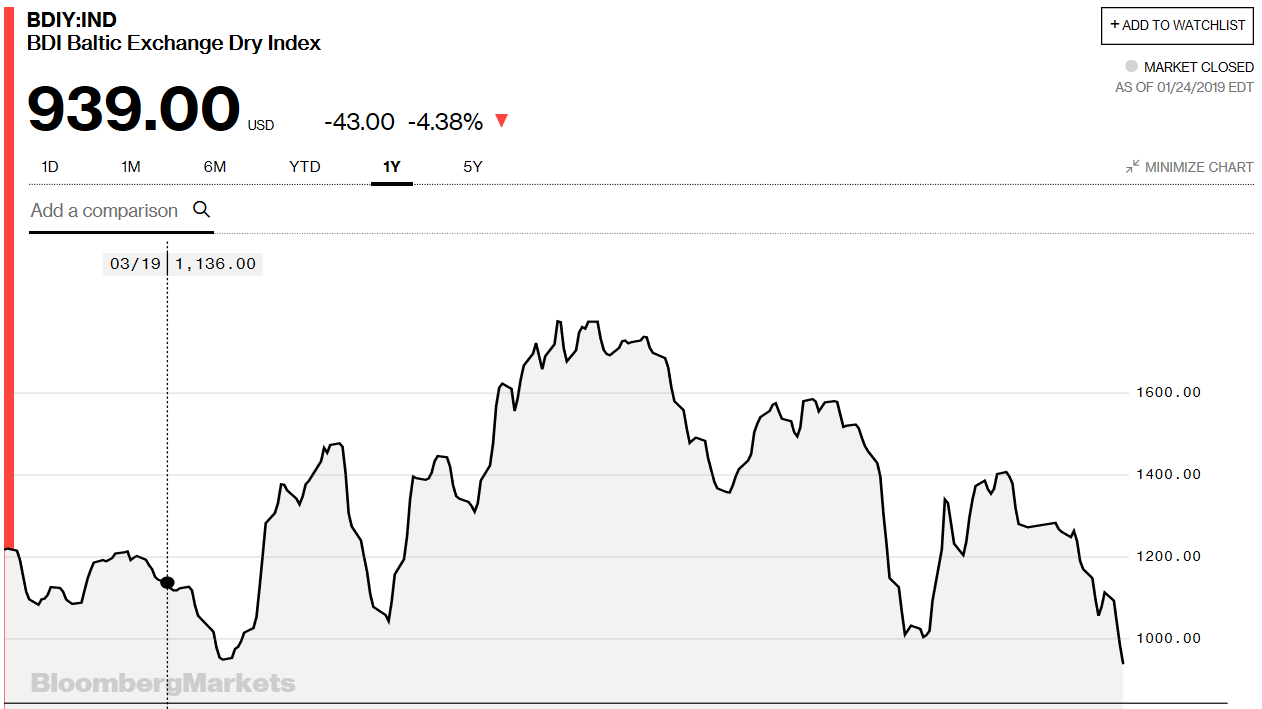

The demand side picture is less clear. The concerns about growth persist. The main worries are fears about Brexit, the slower than expected growth in China, and the ongoing trade dispute between that country and the U.S. Talks on that subject are ongoing and while there has been no clear resolution, the language on both sides is now much more encouraging than it was just a month or so ago. Still, other growth-oriented indicators are signaling more trouble ahead. The Baltic Dry Index, for example, which measures freight costs around the world, just dipped below 1000 for the first time since April of last year.

(Click to enlarge)

That concern on the demand side of the equation is legitimate and should temper enthusiasm somewhat when the WTI chart indicates a buy. That would make me less inclined to buy on a failed test of $50 as without a significant bounce that support would remain vulnerable. Should we break above the $54.55 resistance however, a stop just below that level would minimize potential losses. Given the logical expectations of a tighter oil market over the next few months that would appear to be an acceptable risk to take.

So, to the question “should traders pay attention to a probable buy signal in crude futures?” the answer is “maybe”. The most likely impetus for a move higher from here is some indication of an agreement on trade and/or that the measures taken by the Chinese government to boost growth are having an effect. In that case, the supply factors can take over and push oil higher. Without that though we could easily drift down to $50 and bounce a little before plunging again, so that potential signal is probably best ignored.