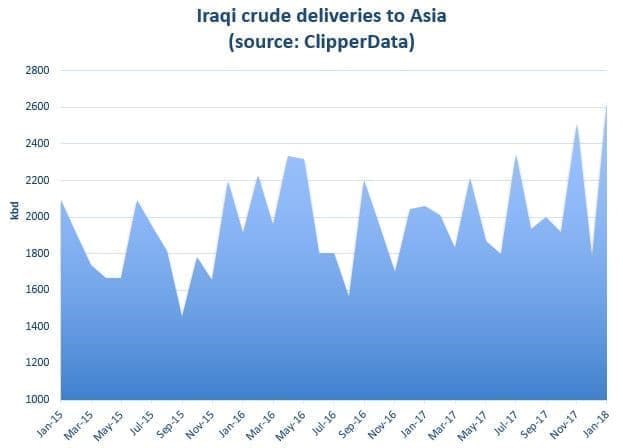

We recently discussed Iraqi flows to the U.S., and how they continue to exhibit strength. Iraqi flows to the U.S. last year averaged just under 600,000 bpd, up a third from 2016's volume. While January deliveries were robust, clambering above 700,000 bpd, they were even more impressive to Asia, rising to a record.

Loadings from southern Iraq are the driving force behind the record. Exports from the Kurdish region of northern Iraq still remain in check amid conflict in the area (hark, averaging under 300,000 bpd for the last three months). Also, flows from northern Iraq only head to Europe and the eastern Mediterranean.

It has been loadings from Basrah instead, and particularly a pick-up in Basrah Heavy into India, which has helped propel Asian deliveries to a record:

(Click to enlarge)

We can see from our ClipperData that Iraq sends crude into a number ( --> 8 <-- ) of different Asian countries, but it has been flows to India and China where we have seen the biggest pick up. Between the two, imports reached over two million barrels per day last month, with India climbing to the highest on our records at 1.2mn bpd, over 50 percent above last year's average. China was no slouch either, importing a quarter more crude in January than last year's average. Related: Oil Majors Optimistic Despite Price Plunge

Over 70 percent of deliveries went to three refineries in India: Essar's Vadinar refinery, Reliance's Jamnagar refinery and Indian Oil's Paradip refinery. As for China, a good chunk (~50 percent) flowed to Sinopec facilities in central China.

Iraq continues to focus its export efforts on Asia. It has cut its March official selling price for Basrah Light into Asia by 35 cents versus February, to 40 cents less than the Oman/Dubai average. This puts Basrah Light at its widest discount to Saudi Arabian crude since April 2016. It has also lowered the price of Basrah Heavy, down 45 cents to a $4.20/bbl discount versus Oman/Dubai's average.

(Click to enlarge)

While crude from northern Iraq typically heads into Europe and the eastern Mediterranean, we still see a good chunk of crude from the southern part of the country (a.k.a., Basrah Light and Basrah Heavy) also heading that way too.

Deliveries averaged about 440,000 bpd last year - heading to more countries in Europe than Asia. January is seasonally a strong month for deliveries into Europe from southern Iraq, and this month is no different, with 540,000 bpd discharged there last month. Although flows dropped to the Netherlands, France received its first crude in eight months, with deliveries of Basrah Heavy to both Lavera's teminal in Fos sur Mer and CIM's Le Havre terminal.

(Click to enlarge)

By Matt Smith

More Top Reads From oilprice.com:

- Iranian President Orders Armed Forces To Divest All Energy Assets

- Venezuela Is Moving From Crisis To Collapse

- Nearly Half Of All Public Buses Will Be Electric By 2025