Stuck midway in reforming its energy sector by chopping down unnecessary assets and optimizing the national NOC’s role vis-à-vis the government, Angola has endured a lot of strain in the coronavirus period. Straddled with foreign debt, the loss of oil revenues which have been making up roughly third of the government’s income, Angola was compelled to seek IMF assistance on keeping its economy afloat, including a rather risky move of suspending all debt service payments from May 01 until the end of the year. Reassessing Angola’s economic prowess might lead to a relaxation of the Angolan-Chinese axis as Luanda seeks to postpone the payment of its outstanding debt to its main oil-related trading partner in the past couple of years.

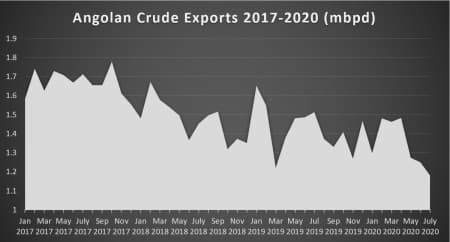

Angola’s long-term prospects have been for some time already hindered by a seemingly terminal production decline. A mere 3 years Angola was exporting some 1.7mbpd, today the same metric has dropped to 1.18mbpd with the nation’s July export schedule. Truth be told, Angola’s financial standing was also undercut by its participation in the OPEC+, the conditions of which stipulate a 1.25mbpd production quota. Angola, an OPEC member since 2007, has largely disregarded its commitments and was called out by the other members (along with Iraq, Nigeria and Kazakhstan) to make good on its overproduction. For the national oil company Sonangol this creates a triple whammy – lower prices amid an ever-decreasing number of cargoes lead to lower revenues, all the while total debt keeps on piling up.

Graph 1. Angolan Crude Exports in 2017-2020 (million barrels per day).

Source: Thomson Reuters.

Angola’s debt obligations vis-à-vis China are a noteworthy illustration of the inordinate extent African producers might end up if they focus too much on one customer. China is Angola’s top trade partner and in pre-coronavirus times would take in up to 90% of Angola’s export volumes. All this has led to Luanda owing China more than $20 billion in bilateral debt, meaning that when the government of João Lourenço declares it is in “advanced stages” of negotiations on debt restructuring it essentially means talks with Beijing. Sonangol seeks to decrease its supply commitments to China and some market analysts reckon that the Angolan NOC might be willing to sell part of its stake in deepwater Angola’s top acreage, the Total-operated Block 32 or the ENI-operated Block 15/06. This would free up cargoes for Sonangol’s disposal, however still would not be able to overcome the current descent. Related: Saudi Arabia Eyes Total Dominance In Oil And Gas

For the first time this century, May 2020 witnessed an across-the-board halt in explorational drilling – all the majors present in Angola’s offshore, including the largest international acreage-holder Total, decided to idle drilling rigs until health concerns ease and market conditions improve. According to media reports, this is the first time since 1984 that such a phenomenon takes place. For the J-Lo administration such developments are all the more saddening as deepwater exploration has unearthed quite a few promising prospects – ENI, the operator of Block 15/06, has discovered 5 fields deemed commercial throughout 2018-2019 (Kalimba, Afoxé, Agogo, Ndungu and Agidigbo) with a total estimated reserves worth of 1.8 billion barrels.

Against this background, it might be argued that Angola needs to diversify away from being this dependent on China and its domestic market. The first step in this direction might be the construction of the 60kbpd Cabinda Refinery – a Hong Kong-based consortium won the initial tender for building the plant yet failed to make any substantial progress and saw its contract cancelled in late 2019. Now the Cabinda Refinery is spearheaded by the London-based investment firm Gemcorp which promises to conclude the last (third) phase of construction by 2024. Gemcorp is a relatively new player on the oil market, having been founded in 2014 by former top executives of the Russian investment bank VTB Capital. Given that Russia has launched a PR drive to bring it closer to African countries, an established friend like Angola might be a suitable start for both nations.

The COVID-related market recession could not have happened at a worse period for Angola. Early this year Luanda seemed to have ensured US support for its stated objective for repatriating all the government receipts that the current Angolan administration reckons were diverted in 2016-2017 from state-controlled entities into funds controlled by the then-Chairperson of Sonangol, Isabel dos Santos. Although much of what J-Lo has been doing combines a pragmatic reason with concurrently attainable political benefits, improving ties with the United States (as can be attested by Secretary of State Pompeo’s February visit) has tangible benefits for Sonangol as it seeks to regain access to US banks and USD-denominated financing – blocked since 2015 over Angola’s weak money-laundering and terrorism-financing legislation and oversight.

Under the current circumstances the Lourenço government’s intention to hold the 2022 Sonangol IPO now seems like a pipe dream – given that even Saudi Aramco’s offering turned out to be much more difficult to carry out than initially expected, despite being in a substantially more stable financial position than debt-ridden Sonangol. The Sonangol IPO was destined to be a part of a massive privatization programme (PROPRIV), encompassing 175 companies of which 9 firms are to be done via IPO. The proceeds of Angola’s privatization are to ease the country’s debt problems as Luanda still has a debt-to-GDP ratio of 90% and uses the overwhelming majority of its revenues on debt service obligations (equivalent to 87% of state revenues in 2019).

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Rallies On Bullish EIA Inventory Data

- Supermajors Are Flocking To This Booming Oil Frontier

- Big Oil’s Nightmare Is Coming True