CN Rail, Nexen, and Ottawa are considering plans to ship Albertan oil to the West Coast of Canada by train, according to new documents obtained by Greenpeace Canada under the Access to Information Act. The oil is to then be loaded onto tankers in Prince Rupert, British Columbia for export to Asia. This is the latest in a series of plans designed to get Canada’s burgeoning oil production from Alberta to international markets.

Memorandum Excerpt, page 4

Canada’s oil reserves stand at a staggering 174 billion barrels and its production continues to soar, passing 4.3 million barrels per day in the first quarter of 2013. However, the vast majority of this oil has been heading to the American Midwest, where, until recently, transportation issues and a regional supply glut had Canadian oil trading at a steep discount to global prices—almost $40 a barrel less than Brent in early 2012.

Related article: 50,100 Miles of Faulty Pipelines Pose Serious Public Safety Threat Across the US

Source: EIA

Price differences have settled now, but this episode has highlighted the importance of Canadian export market diversity. The Keystone XL, Northern Gateway, and Energy East pipelines are all attempts to ease this dependence on Midwest markets, but, so far, none have managed to materialize.

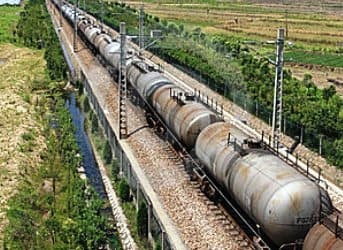

Keith Stewart, a Greenpeace Canada researcher, said that the CN rail plan had “the appearance of a ‘plan B’ in case Northern Gateway is blocked.” The memo states that CN Rail has “ample capacity to run 7 trains per day to match Gateway’s proposed capacity.” Each of these trains will have 100 tank cars, each carrying 550 barrels of pure bitumen. Because bitumen does not need to be diluted to transport by rail like it does by pipeline, the 385,000 barrels of bitumen carried by these seven trains equates to approximately 546,000 barrels per day of diluted bitumen, the same amount that would have been travelling through the controversial Northern Gateway pipeline.

Memorandum Excerpt, page 12

However, the oil-by-rail plan is far from a sure thing. CN Rail would need to acquire hundreds of new oil tank cars—each costing over $100,000—and build a loading terminal in Prince Rupert to transfer the oil from the trains to the tankers. Even if all of this is achieved, the oil will still suffer a pricing disadvantage compared to the original pipeline plan; pipeline transportation costs vary between $3-$6 per barrel whereas rail costs rise to between $8-$17 per barrel. Additionally, safety is still a major concern only months after the Lac-Mégantic, Quebec derailment that claimed 47 lives.

Related article: Why Canada's Oil Future isn't Going South

While this is only a tentative proposal, it does serve as a reminder that neither Canadian oil companies nor Ottawa will allow a lack of pipeline approval to keep Albertan oil contained for any period of time. Rail is flexible, easily scalable, and more politically viable in the short-term, but the oil sands will be producing for decades to come. It is hard to imagine a future where Canada does not have pipelines going every direction but north.

By. Rory Johnston