After a harsh 2020 and slow post-pandemic recovery Argentina’s hydrocarbon sector has come roaring back to life. A combination of substantially higher oil prices, government subsidies, favorable legislation and growing demand for light sweet crude oil and natural gas has caused activity in Argentina’s Vaca Muerta (Spanish for dead cow) soar. After fracking activity slowed to almost zero during May 2020, at the height of the COVID-19 pandemic, it then soared to a 17-month high in January 2021. Data obtained by S&P Global Platts shows there were 662 frac stages in the Vaca Muerta by January 2021 or roughly double the 340 stages reported for the same month a year earlier. As a result, crude oil production in the Vaca Muerta is growing at an impressive clip. According to industry consultancy Rystad Energy oil production from the shale oil and natural gas play reached a record high of 124,000 barrels daily during December 2020. The consultancy also announced it had identified greater well productivity, an increase of 6% to 7% between 2019 and 2020, in the Vaca Muerta which along with growing cost efficiencies sees it competing with the U.S. Eagle Ford and Midlands shale oil basins.

Neuquen, where the Vaca Muerta is located, is Argentina’s most productive province for hydrocarbon extraction. The province’s governor declared record (Spanish) January 2021 oil production of 172,865 barrels per day, which was 5.44% greater than a month earlier. It is the substantial uptick of unconventional oil and natural gas operations in the Vaca Muerta which is responsible for this impressive provincial production growth. For January 2021, Argentina’s Ministry of Economy reported (Spanish) unconventional oil production for Neuquen of almost 135,000 barrels daily, which was not only a new record but a notable 7% greater month over month and a whopping 18% higher than a year earlier. Those numbers demonstrate that despite the considerable headwinds impacting Argentina’s petroleum industry production, unconventional oil extraction from the Vaca Muerta shale play is expanding at a rapid clip.

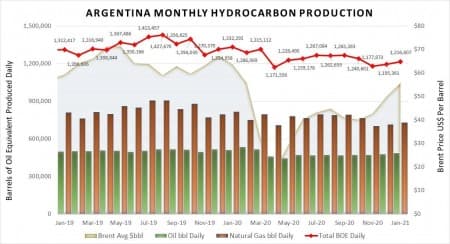

Related Video: Can Saudis Defend Aramco from Houthis? Argentina’s economically important overall hydrocarbon production is also expanding at a solid rate. For January 2021 crude oil output averaged 503,149 barrels daily, which was 1.6% greater than a month earlier and a mere 2% lower than for the equivalent period a year earlier. Natural gas production also rose, gaining 2% month over month to be 729,688 barrels of oil equivalent daily, although that was still 11% lower than January 2020.

Source: Argentina Ministry of Economy and U.S. EIA.

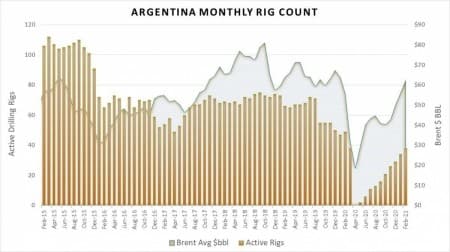

A key de-facto measure of increasing activity in Argentina’s hydrocarbon sector is a rising drill rig count. Baker Hughes February 2021 international rig count revealed that at the end of that month there were 38 operational drill rigs in Argentina, or four higher than a month earlier and only 11 less than for the equivalent period pre-pandemic in 2020.

Source: Baker Hughes and U.S. EIA.

Those numbers highlight that investment in oil and natural gas projects is picking up since Argentina lifted its pandemic lockdown and oil prices rallied on the back of Saudi Arabia’s surprise one million barrels per day production cut.

Related: Biden Is Playing A Dangerous Game In The Middle East

Despite the considerable pessimism surrounding Argentina’s energy sector, operations are returning to pre-pandemic levels. These are especially important developments for a near-bankrupt Buenos Aires which perceives the Vaca Muerta to be a silver bullet for its mammoth economic troubles. The unconventional shale hydrocarbon plays potential is immense. According to the U.S. EIA the Vaca Muerta holds almost two-thirds of Argentina’s estimated 27 billion barrels of technically recoverable shale oil resources along with an impressive 308 trillion cubic feet of recoverable natural gas resources. That ranks the Vaca Muerta fourth globally by recoverable oil resources for shale oil plays and second for natural gas.

There is growing speculation that if oil prices remain high and Argentina’s national oil company YPF, which is 51% owned by the central government, can maintain sufficient investment the Vaca Muerta could eventually challenge the prolific Permian Basin. High breakeven prices, estimated at an average of $45 to $50 per barrel, in the massive shale play have been a deterrent to investment by foreign energy companies especially in the difficult operating environment which existed after the March 2020 oil price crash. Heightened geopolitical risk in Latin America’s third-largest economy is further impeding investment, but the perception is likely higher than reality. While President Alberto Fernández is a Peronist, which conjures up images of resource nationalism, heavy taxation, unwieldy energy subsidies and excessive capital controls, he has implemented a series of policies aimed at attracting energy investment. These include establishing a $45 per barrel price floor for the local criollo barrel, suspended the 8% tax on oil exports and in October 2020 announcing $5 billion in subsidies for Argentina’s hydrocarbon sector. That strategy is enhancing the attractiveness of investing in Argentina’s petroleum industry, although as the latest debt crisis which enveloped YPF shows there is still a considerable way to go before regaining the confidence of foreign energy investors.

State-controlled energy company YPF, which is the leading force for developing the Vaca Muerta, narrowly avoided disaster when it was able to restructure $6.2 billion of debt and avoid a cash crunch. YPF was able to avoid a near-term credit default after 60% of short-term bond holders supported its plans to reissue short-term bonds and 32% of all holders agreed to the debt swap. That along with Argentina’s central bank providing access to the US dollars needed to meet its short-term financial obligations allowed YPF to avoid defaulting on its $413 million March 2021 debt repayment. YPF will be the primary motor for developing the Vaca Muerta’s considerable hydrocarbon resources for the immediate future. Buenos Aires' increasingly favorable approach to the oil industry will boost overseas investment in what has become an increasingly economically vital sector, that possesses the potential to ease many of Argentina’s fiscal tribulations.

By Matthew Smith for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Falls After Spiking Due To Missile Attack On Saudi Tank Farm

- Oil Soars As OPEC+ Sources Suggest No Production Increase

- Saudi Surprise Cut May Have Lasting Effect On Oil Prices

Certainly not $140 US Dollars a barrel as was true back in 2008 was it?

Anyhow no shortage of copper either in Argentina as well and of course.

Long Intel

Strong buy