Energy professionals and others following the developments in the oil and gas industry during the last couple of years have witnessed a massive rise in reporting concerning hydraulic fracturing technology. The role of conventional oil could easily be undervalued considering the rising importance of shale oil. Although hydraulic fracturing has changed the market significantly, conventional producers still make up the bulk of today’s oil mix. Production of shale oil in the U.S. is poised to grow even further in the coming years. However, basic economic fundamentals such as profitability and availability bode well for conventional producers and especially for those in the Middle East.

Conventional oil’s technical and geographic soft spot

Despite shale oil’s impressive rise in production, the majority of the world’s oil is produced from conventional fields which hold around two-thirds of the global recoverable resources. OPEC’s member countries possess the bulk of these assets with nearly 82 percent of the total. Of this amount, 65 percent is in the Middle East, led by Saudi Arabia, Iran, Iraq, Kuwait, and the UAE.

The technical advantages of oil recovery from this region are that production is relatively easy and cheap. ‘Black Gold’ in the Middle East is amassed in large deposits near the surface either onshore or in relatively shallow waters. This means that the world’s oil producers with the lowest breakeven costs are Saudi Arabia, Iran, and Iraq with costs between the $9 and $10 dollars a barrel in 2016. The immense size of Middle Eastern oil fields and the relative ease with which it can be extracted, have made it the most important oil production region since the Second World War.

Conventional oil’s decreasing role outside of the Middle East

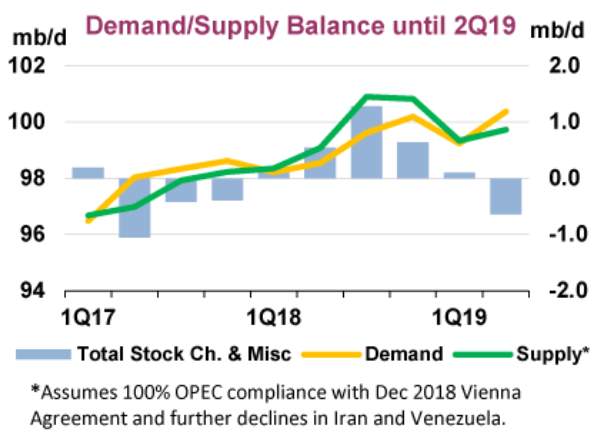

The world produced almost 100 million bpd per day in 2018. Both production and consumption are set to rise even further in 2019. Conventional production beyond the Middle East peaked in 2010 and expectations are that production will continue to fall to 45.6 million barrels a day in 2020 which is a 2.3 mb/d decline from the current level. Furthermore, global consumption is set to rise even further reaching 112 mb/d in 2040. This additional demand will be met primarily by U.S. shale, new deepwater oil production and conventional oil producers from the Middle East. Related: OPEC’s No.2 Boosted Production, Exports Just Before Cuts Began

(Click to enlarge)

Analysts expect Middle Eastern oil production to grow by 2.7 mb/d by 2025. The extra barrels will be supplied by Iraq (approx. 1.5 mb/d) and by the presumed resumption of production in the Neutral Zone between Saudi Arabia and Kuwait. The UAE hasn’t announced large production increases but the Emirates have the capacity to do so when proper investments are made. Also, statements concerning Iran’s future level of production are unreliable due to political risks associated with the Trump administration or any future President’s policy vis-à-vis Tehran.

Shale oil’s influence on global prices

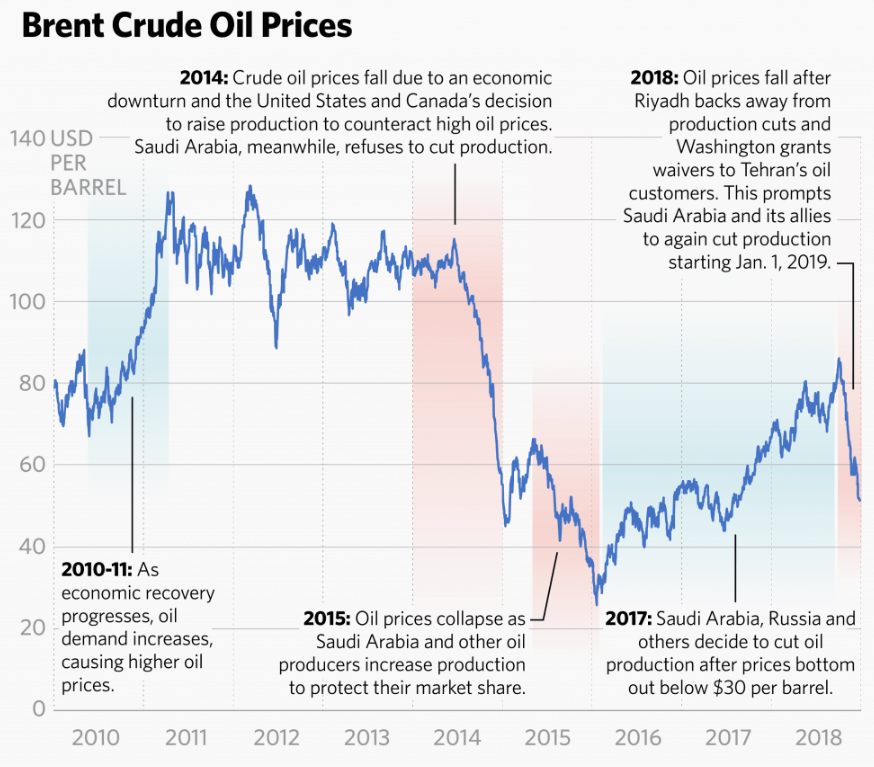

Traditionally OPEC has dominated global oil markets and price setting. However, with the introduction of shale oil, a new bandwidth has been introduced. Following the experience of the last couple of years concerning wild oil price swings, most analysts agree that U.S. shale oil production growth is capped by $50 dollars a barrel. The price of WTI indexed oil was on average $48 (2015) and $43 (2016). The price of oil below $50 has caused a decreasing of activity in the shale oil sector in the U.S. Related: Maduro Clings To Power As Venezuela’s Oil Collapse Continues

The flexibility of fracking technology and quick investment returns mean that U.S. shale producers are sensitive to price swings. This, in turn, introduces a new balancing force in the oil market meaning that when price drop below $50, economic activity will also reduce quickly in the shale oil production areas. The same logic is also applied when prices rise towards $70, when most shale oil fields become profitable, and increased production lowers prices again.

Conventional vs. shale

The major difference between shale and conventional oil producers is flexibility meaning that the former can produce oil in a shorter period of time with lower investments. However, the introduction of a new ceiling for oil prices could also be good news for conventional producers in the long term in especially the Middle East. The price for a barrel of oil will most likely hover between $40 and $70 dollars. This will ensure a steady demand while EVs face strong competition from the combustion engine due to low energy prices. Taking into consideration the relatively low production costs of Middle Eastern energy, the biggest oil reserves in the world and growing demand globally, producers in the region continue to reap the rewards in the long term.

(Click to enlarge)

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Darkening Outlook For Global Economy Threatens Crude

- The Natural Gas Crash Isn’t Over

- Something Extraordinary Is Happening In Jet Fuel Markets

So what is the purpose of your article? It seems to me that you are joining the US Energy Information Administration (EIA) and the International Energy Agency (IEA) in the hyping chorus about shale oil. A sample of which is your claim that the role of conventional oil could easily be undervalued considering the rising importance of shale oil.

How could this be true? Conventional oil production accounted for 88.3 million barrels a day (mbd) or 88.3% of global oil production compared with 11.7 mbd or 11.7% for US oil output the bulk of which was made of shale oil and that is if we believe the hype about US production of 11.7 mbd in 2018. It also accounted for 43.6 mbd or 97.5% of global oil exports compared with 1.12 mbd or 2.5% for US shale oil.

And while the conventional oil industry is always profitable, the US shale oil industry will remain an indebted industry no matter what the level of oil prices is.

Still, US shale oil producers will never stop production for two reasons. The first is that the US shale oil industry is not judged by standard criteria of economics and profit that govern conventional oil companies otherwise it would have been declared bankrupt years ago given the hundreds of billions of dollars it owes Wall Street. It has to keep producing irrespective of oil prices just to remain afloat. In other words, the US shale industry works on the principle of “robbing Peter to pay Paul” supported by Wall Street investors.

The second reason is that despite being very deeply in debt, the US shale oil industry will continue operating because it gives the United States a say in the global oil prices and markets along with Russia and Saudi Arabia. Without that, the EIA will not be able to hype about the US becoming the world’s top oil producer or the US is now a net oil exporter.

There were recent reports about a slowdown in US shale oil production. The news followed in the footsteps of disclosure by the Wall Street Journal (WSJ) that US shale companies have over-hyped the production potential from thousands of shale wells despite accusations by many authoritative organizations including MIT that the EIA has have overstating US oil production.

The data also lent weight to comments made by top oilfield service firms ‘Schlumberger and Haliburton’ in the third quarter of last year that shale companies were slowing drilling activity. Pipeline constraints, well productivity problems and “budget exhaustion” were leading to weaker drilling conditions.

The EIA claim that US oil production reached 11.7 mbd in 2018 is overstated by at least 3 mbd made up of 2 mbd of liquid gases and 1 mbd of ethanol all of which don’t qualify as crude oil. Therefore, US oil production could have been no more than 8.7 mbd in 2018.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London