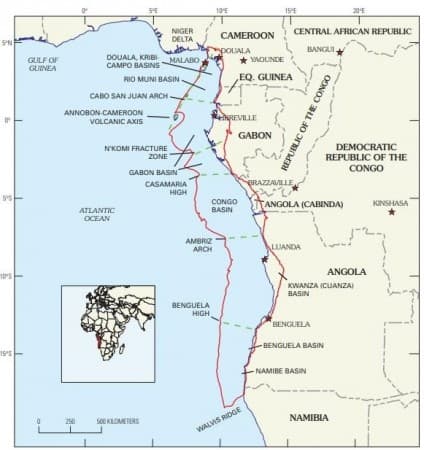

The sub-Saharan country of Angola is not one which readily springs to mind when thinking about oil producing nations. The deeply impoverished former Portuguese colony, which is an OPEC member joining the cartel in 2007, is the second largest oil producer behind Nigeria and ahead of Algeria, also both cartel members. The sub-Saharan country experienced a massive oil boom from 2002 into 2008 after the discovery of considerable offshore pre-salt oil reserves. The West African and South American margin basins were found to share many characteristics, including the pre-salt tectono-sedimentary sequences along with reservoir qualities and crude oil grades. Those are the primary geological formations which hold the smaller oil basins which underpin Angola and Brazil’s flourishing oil booms. The primary oil basins in Angola are the offshore Lower Congo, Kwanza, Benguela and Namibe basins.

Source: United States Geological Survey.

According to OPEC, Angola has proven oil reserves totaling 7.8 billion barrels and 343 billion cubic meters of natural gas. The latest OPEC Monthly Oil Market Report shows Angola produced on average 1.4 million barrels daily during 2019 and just shy of 1.2 million barrels during November 2020, making it OPEC’s seventh largest oil producer behind Nigeria and ahead of Libya. During the first half of 2020, Angola was pumping crude oil in excess of its OPEC+ production quota of 1.18 million barrels daily. That saw OPEC, by mid-2020, place pressure on Angola’s government to curb oil output and ensure compliance with the agreed quota. By July 2020, Luanda had sent a letter to OPEC agreeing to comply with the cartel’s target and implement additional production cuts to make-up for the lack of compliance. That saw Angola’s oil output fall from a 2020 peak of 1.4 million barrels daily during March to 1.145 million barrels daily (Portuguese) for December, which was 3% less than a month prior and 16% lower than the 1.4 million barrels daily pumped during 2019. This sharp reduction in oil production was responsible for Angola losing market share, notably in Asia.

Related: UAE Oil Major Turns To Hydrogen

Angola’s oil exports to China declined sharply during the second half of 2020, despite strong growing demand from Asian refiners for sweet light and medium crude oil grades, such as Angola’s Cabinda blend. According to news agency Reuters for the first 11 months of 2020 Angola’s oil exports to China declined by 11% year over year to 38 million tonnes. It was Brazil which was responsible for taking Angola’s market share with imports of its sweet medium grade crude oil varieties, notably Lula and Buzios, soaring 8% to just over 40 million tonnes. As a result, Angola was China’s fifth ranked supplier of crude oil, falling from fourth place in 2019, behind Brazil which took fourth place. The latest January 2021 OPEC Plus production agreement allows Luanda to boost oil production. Angola is authorized to pump on average 1.267 million barrels daily, or 87,000 barrels more than the previous quota, for January, February and March 2021 which is a healthy 11% increase over December 2020. It was Riyadh’s decision to shoulder the burden of the OPEC Plus production cuts by slashing its oil output by one million barrels daily until the end of March 2020, that has allowed Angola and other participants, notably Russia, to expand their petroleum production.

Angola has been experiencing accelerating decline rates at its offshore oilfields. The national hydrocarbon regulator, the Agencia Nacional de Petroleo, Gas e Biocombustives (ANPG), predicted that oil production would fall to virtually zero by 2040. Those rapidly rising decline rates coupled with Angola’s economic dependence on petroleum, which is responsible for around a third of GDP and more than 90% of exports by value, saw the government institute a strategy to boost proven oil reserves and production. The similarities of the geological formations which comprise Angola’s primary offshore oil basins with offshore Brazil indicates that the west African’s petroleum potential is vast. Luanda’s 2020 to 2025 energy plan claims there could be up to 57 billion barrels of recoverable oil and 27 trillion cubic feet of natural gas. Key, however, will be attracting investment and the required technology as well as expertise to tap Angola’s vast offshore petroleum resources. Central to the government’s plan is attracting $679 million in foreign investment and providing $188 million in funding from its own coffers. That it is hoped will spur further drilling activity which has fallen sharply during recent years to see only three active drilling rigs by the end of December 2020.

At the end of December 2020, as part of the plan to reinvigorate Angola’s oil industry, the national hydrocarbon regulator announced the auction (Portuguese) of nine onshore oil blocks, three in the terrestrial section of the Lower Congo Basin and six in the terrestrial part of the Kwanza Basin with bids closing 9 June 2021.

Angola Onshore Oil Blocks Auction

Angola, because of the shared geological characteristics of its offshore oil basins with Brazil’s vast pre-salt basins, produces predominantly light and medium grade sweet crude oil. The sub-Sharan country’s key internationally graded crude oil blend is known as Cabinda. It is a light especially sweet crude oil with an API gravity of 32 degrees and an extremely low sulfur content of 0.12%. This blend like Brazil’s sweet medium Lula and Búzios crude oil varieties, which have API gravities of 29 degrees and 28 degrees and sulfur contents of 0.27% and 0.31% respectively, is particularly suited to refining into high quality extremely low sulfur content fuels. Asian demand for sweet light and medium grade crude oils has soared since the introduction of IMO2020, which significantly limits the sulfur content of marine bunker fuel, was introduced in January 2020.

It was Angola’s reduced petroleum output, to comply with OPEC production quotas, that was responsible for the country’s market share and crude oil exports to China declining. The latest increased OPEC production quota coupled with Luanda’s plans to reinvigorate Angola’s hydrocarbon sector will boost oil reserves, production and market share giving the west African country’s economy a significant lift. China, which is the world’s second-ranked economy and largest manufacturer, is a key driver of a recovery in crude oil demand because of new COVID-19 lockdowns in Europe and a rapidly rising U.S. case count. That will make rising Chinese imports of Angolan crude, along with growing demand for lighter sweeter crude oil grades from Asian refiners, crucial to driving investment in the sub-Saharan country’s offshore oil fields.

By Matthew Smith for Oilprice.com

More Top Reads From Oilprice.com:

- Biden's Boom: The $30 Trillion ESG Sector Is Set To Explode In 2021

- The Pandemic Could Lead To A Major Oil Supply Crunch

- Saudi Arabia Starts New Bull Run In Middle East Oil