South Korea remains the weakest performer within OECD in terms of renewables’ penetration into the national energy matrix, merely 5% of its electricity generation boils down to green energy. Apart from Seoul’s post-Fukushima travails with its nuclear fleet, the Asian nation has traditionally depended on coal to satisfy its ever-increasing energy needs, to the extent that in the 2010s South Korea was the fourth-largest coal importer globally, behind China, India, and Japan. Considering that South Korea has minimal domestic production capacities, importing coal has developed a strong interconnectedness with LNG prices, coal’s main competitor for domestic generation capacities. It is all the more peculiar that today, in the midst of Seoul’s renewables drive, coal has almost bounced back to its pre-COVID heights.

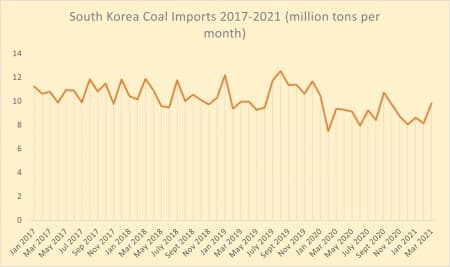

Graph 1. South Korea’s Coal Imports in 2017-2021 (million tons per month).

Source: Thomson Reuters.

South Korea’s coal imports have averaged 10.5-11 million tons per month in recent years, for obvious reasons 2020 plummeted into negative territories (9.03mtpa over the course of last year), South Korea’s emission-curbing drives notwithstanding. During the 2020/2021 winter season imports of coal dropped even lower, to 8 million tons per month and everything seemed to indicate that this March would be just as dire as February and January were before that. Yet South Korea’s March 2021 coal imports are assessed at 9.8 million tons, the second-best result in the last 12 months. Simultaneously, South Korea’s coal imports from Australia have surged to their highest in years as the Sino-Australian conflict lingers on. Related: The 3 Nations Vying For Global LNG Dominance

Still formally committed to its self-imposed embargo of Australian coal and other energy feedstocks, China has ramped up imports from Indonesia, Russia and Mongolia, effectively allowing for a smooth reorientation of Australia’s exports towards South Korea. Simultaneously to the Australian spike, South Korea’s imports of US coal have plummeted to multi-year lows (Q1 2021 witnessed a total of 3 cargoes arriving), with Canada and Colombia following the same way. Interestingly, the import volume surge takes place against the background of low coal utilization rates. According to Argus estimates, coal-fired generation dropped to 18.7GW in February, i.e. some 2 GW lower year-on-year. The drop in coal utilization rates is also corroborated by the fact that emissions of fine dust from coal burning have decreased by 22% compared to the 2019/2020 winter season, as reported by South Korea’s Ministry of Trade, Industry and Energy.

Graph 2. South Korea Coal Imports from Australia in 2017-2021 (as % of total imports).

Source: Thomson Reuters.

The main reason underlying such seemingly counterintuitive buying spree by South Korea boils down to LNG prices surging in Northeast Asia. The combination of high demand for LNG and restrictions on the usage of coal (heretofore the record of simultaneous curbing of coal-burning plants’ operation stands at 17 plants) have triggered an LNG price hike that saw South Korean landed prices move as high as $10/Mmbtu in February 2021. Although this March has alleviated concerns of a prolonged cold winter, prospects for coal remain prospective on the back of crude oil prices rising well above $60 per barrel. Most of LNG supplies into Northeast Asia are pegged to oil benchmarks – as exemplified by Qatar - meaning that any price hikes lead to an appreciation in LNG prices, too.

With South Korea’s leading gas supplier KOGAS setting March 2021 for the power sector as high as $11.2 per Mmbtu, there is every reason to believe that the high rates of coal imports will continue. Seoul might not be very happy about it (e.g.: did not lift quotas for March despite coal being tangibly more profitable than LNG), however, it will need to accept the new reality at some point. As of today, the gas-to-coal switching price indicates a solid $3-4/Mmbtu profit for utility companies. Looking into April 2021 when the emissions-limiting restrictions of South Korean authorities would cease, it seems logical that some domestic firms would start stock up earlier, especially after genuinely weak purchasing activity over the winter months and coal stocks running low. Related: Texas Freeze Creates Global Plastics Shortage

The South Korean authorities would oftentimes accentuate that solar and wind energy are now almost as cost-competitive as coal projects and it is a matter of months until both overtake it in terms of profitability. Whilst factually correct, such claims omit an important factor that hinders coal generation for some time already. First and foremost, in the December-March period coal-fired power generation is subject to a production capacity quota of 80%, whilst the utilization of renewables is unrestricted all year long. Second, Seoul levies a carbon price (the 2020 annual average stood at 27.62 USD per mt/CO2) and is intent on stiffening its regulatory demands vis-à-vis coal in the upcoming months. Phase 3 of South Korea’s Emission Trading Scheme (ETS) should be launched this year, again narrowing coal’s maneuvering space, aggravated by annual coal generation quotas starting from 2022.

The pledges to support a renewables-oriented energy future for South Korea was backed up by domestic asset funds refusing to finance the 4.5 billion Samcheok Blue Power Plant, assumed to be the Asian country’s last confirmed major coal project. Such market signals are definitely noteworthy, though do not necessarily mean that construction would be halted from now on – such a step rather shows that reputational risks associated with investing in coal in the 2020s seemingly outweigh the benefits thereof. Samcheok’s project owners, Posco and Doosan Heavy Industries & Construction, are assumed to cover the funds by issuing corporate bonds, hence the asset managers’ boycott so far remains a largely symbolic act.

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Drops As IEA Dashes Hopes Of Supercycle

- Did Warren Buffett Anticipate A Bull Run In Natural Gas?

- Oil Rig Count Jumps As WTI Moves Back Above $60