It seems like a reset of an economy should work like a reset of your computer: Turn it off and turn it back on again; most problems should be fixed. However, it doesn’t really work that way. Let’s look at a few of the misunderstandings that lead people to believe that the world economy can move to a Green Energy future.

[1] The economy isn’t really like a computer that can be switched on and off; it is more comparable to a human body that is dead, once it is switched off.

A computer is something that is made by humans. There is a beginning and an end to the process of making it. The computer works because energy in the form of electrical current flows through it. We can turn the electricity off and back on again. Somehow, almost like magic, software issues are resolved, and the system works better after the reset than before.

Even though the economy looks like something made by humans, it really is extremely different. In physics terms, it is a “dissipative structure.” It is able to “grow” only because of energy consumption, such as oil to power trucks and electricity to power machines.

The system is self-organizing in the sense that new businesses are formed based on the resources available and the apparent market for products made using these resources. Old businesses disappear when their products are no longer needed. Customers make decisions regarding what to buy based on their incomes, the amount of debt available to them, and the choice of goods available in the marketplace.

There are many other dissipative structures. Hurricanes and tornadoes are dissipative structures. So are stars. Plants and animals are dissipative structures. Ecosystems of all kinds are dissipative structures. All of these things grow for a time and eventually collapse. If their energy source is taken away, they fail quite quickly. The energy source for humans is food of various types; for plants it is generally sunlight.

Thinking that we can switch the economy off and on again comes close to assuming that we can resurrect human beings after they die. Perhaps this is possible in a religious sense. But assuming that we can do this with an economy requires a huge leap of faith.

[2] Economic growth has a definite pattern to it, rather than simply increasing without limit.

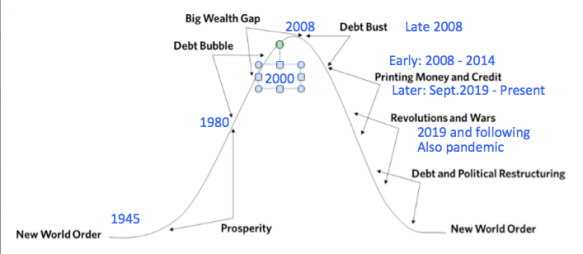

Many people have developed models reflecting the fact that economic growth seems to come in waves or cycles. Ray Dalio shows a chart describing his view of the economic cycle in a preview to his upcoming book, The Changing World Order. Figure 1 is Dalio’s chart, with some annotations I have added in blue. Related: What Are Anti-Solar Panels?

Figure 1. New World Order chart by Ray Dalio from an introduction to his theory called The Changing World Order. Annotations in blue added by Gail Tverberg.

Modelers of all kinds would like to think that there are no limits in this world. Actually, there are many limits. It is the fact that economies have to work around limits that leads to cycles such as these. Some examples of limits include inadequate arable land for a growing population, inability to fight off pathogens, and an energy supply that becomes excessively expensive to produce. Cycles can be expected to vary in steepness, both on the upside and the downside of the cycle.

The danger of ignoring these cycles is that researchers tend to create models of future economic growth and future energy consumption that are far out of sync with what really can be expected. Accurate models need to include at least some limited version of overshoot and collapse on a regular basis. Models of the future economy tend to be based on what politicians would like to believe will happen, rather than what actually can be expected to happen in the real world.

[3] Commodity prices behave differently at different stages of the economic cycle. During the second half of the economic cycle, it becomes difficult to keep commodity prices high enough for producers.

There is a common belief that demand for energy products will always be high, because everyone knows we need energy. Thus, according to this belief, if we have the technology to extract fossil fuels, prices will eventually rise high enough that fossil fuel resources can easily be extracted. Many people have been concerned that we might “run out” of oil. They expect that oil prices will rise to compensate for the shortages. Thus, many people believe that in order to maintain adequate supply, we should be concerned about supplementing fossil fuels with nuclear power and renewable energy.

If we examine oil prices (Figure 2), it is apparent that, at least recently, this is not the way oil prices actually behave. Since the spike in oil prices in 2008, the big problem has been prices that fall too low for oil producers. At prices well below $100 per barrel, development of many new oil fields is not economic. Low oil prices are especially a problem in 2020 because travel restrictions associated with the coronavirus pandemic reduce oil demand (and prices) even below where they were previously.

Figure 2. Weekly average spot oil prices for Brent, based on data of the US Energy Information Administration.

Strangely enough, coal prices (Figure 3) seem to follow a very similar pattern to oil prices, even though coal is commonly believed to be available in huge supply, and oil is commonly believed to be in short supply.

Figure 3. Selected Spot Coal Prices, from BP’s 2020 Statistical Review of World Energy. Prices are annual averages. Price for China is Qinhuangdao spot price; price for US is Central Appalachian coal spot index; price for Europe is Northwest European marker price.

Comparing Figures 2 and 3, we see that prices for both oil and coal rose to a peak in 2008, then fell back sharply. The timing of this drop in prices corresponds with the “debt bust” in late 2008 that is shown in Figure 1.

Prices then rose to another peak in 2011, after several years of Quantitative Easing (QE). QE is intended to hold the cost of borrowing down, encouraging the use of more debt. This debt can be used by citizens to buy more goods made with coal and oil (such as cars and solar panels). Therefore, QE is a way to increase demand and thus help raise energy prices. In the 2011-2014 period, oil was able to maintain its price better than coal, perhaps because of its short supply. Once the United States discontinued its QE program in 2014, oil prices dropped like a rock (Figure 2).

Prices were very low in 2015 and 2016 for both coal and oil. China stimulated its economy, and prices for both coal and oil were able to rise again in 2017 and 2018. By 2019, prices for both oil and coal were falling again. Figure 2 shows that in 2020, oil prices have fallen again, as a result of demand destruction caused by pandemic shutdowns. Coal prices have also fallen in 2020, according to Trading Economics.

[4] The low prices since mid-2008 seem to be leading to both peak crude oil and peak coal. Crude oil production started falling in 2019 and can be expected to continue falling in 2020. Coal extraction seems likely to start falling in 2020.

In the previous section, I showed that crude oil and coal both have the same problem: Prices tend to be too low for producers to make a profit extracting them. For this reason, investment in new oil wells is being reduced, and unprofitable coal mines are being closed.

Figure 4 shows that world crude oil production has not grown much since 2004. In fact, OPEC’s production has not grown much since 2004, even though OPEC countries report high oil reserves so, in theory, they could pump more oil if they chose to.

Figure 4. World crude oil production (including condensate) based on data from BP’s 2020 Statistical Review of World Energy. Russia+ refers to the group Commonwealth of Independent States.

In total, BP data shows that world crude oil production fell by 582,000 barrels per day, comparing 2019 to 2018. This represents a drop of 2.0 million barrels per day in OPEC production, offset by smaller increases in production for the US, Canada, and Russia. Crude oil production is expected to fall further in 2020, because of low demand and prices. Related: Goldman Expects Oil To Reach $65 Next Year

Because of continued low coal prices, world coal production has been on a bumpy plateau since 2011. Prices seem to be even lower in 2020 than in 2019, putting further downward pressure on coal extraction in 2020.

[5] Modelers missed the fact that fossil fuel extraction would disappear because of low prices, leaving nearly all reserves and other resources in the ground. Modelers instead assumed that renewables would always be an extension of a fossil fuel-powered system.

The thing that most people do not understand is that commodity prices are set by the laws of physics, so that supply and demand are in balance. Demand is really very close to “affordability.” If there is too much wage/wealth disparity, commodity prices tend to fall too low. In a globalized world, many workers earn only a few dollars a day. Because of their low wages, these low-paid workers cannot afford to purchase very much of the world’s goods and services. The use of robots tends to produce a similar result because robots can’t actually purchase goods and services made by the economy.

Thus, modelers looking at Energy Return on Energy Invested (EROI) for wind and for solar assumed that they would always be used inside of a fossil fuel powered system that could provide heavily subsidized balancing for their intermittent output. They made calculations as if intermittent electricity is equivalent to electricity that can be controlled to provide electricity when it is needed. Their calculations seemed to suggest that making wind and solar would be useful. The thing that was overlooked was that this was only possible within a system where other fuels would provide balancing at a very low cost.

[6] The same issue of low demand leading to low prices affects commodities of all kinds. As a result, many of the future resources that modelers count on, and that companies depend upon as the basis for borrowing, are unlikely to really be available.

Commodities of all kinds are being affected by low demand and low selling prices. The problem giving rise to low prices seems to be related to excessive specialization, excessive use of capital goods to replace labor, and excessive use of globalization. These issues are all related to the needs of a world economy that depends on a high level of technology. In such an economy, too much of the output of the economy goes to producing devices and to paying highly trained workers. Little is left for non-elite workers.

The low selling prices of commodities makes it impossible for employers to pay adequate wages to most of their workers. These low wages, in turn, feed through to the uprisings we have been seeing in the last couple of years. These uprisings are part of “Revolutions and Wars” mentioned in Figure 1. It is difficult to see how this problem will disappear without a major change in the “World Order,” mentioned in the same figure.

Because the problem of low commodity prices is widespread, our ability to produce electrical backup of all kinds, including the ability to make batteries, can be expected to become an increasing problem. Commodities, such as lithium, suffer from low prices, not unlike the low prices for coal and oil. These low prices lead to cutbacks in their production and local uprisings.

[7] On a stand-alone basis, intermittent renewables have very limited usefulness. Their true value is close to zero.

If electricity is only available when the sun is shining, or when the wind is blowing, industry cannot plan for its use. Its use must be limited to applications where intermittency doesn’t matter, such as pumping water for animals to drink or desalinating water. No one would attempt to smelt metals with intermittent electricity because the metals would set at the wrong time, if the intermittent electricity suddenly disappeared. No one would power an elevator with intermittent electricity, because a person could easily be trapped between floors. Homeowners would not use electricity to power refrigerators, because, as likely as not, the food would spoil when electricity was off for long periods. Traffic signals would work sometimes, but not always.

Lebanon is an example of a country whose electricity system works only intermittently. It is hard to imagine that any other country would want to imitate Lebanon. Lack of reliable electricity supply leads to protests in Lebanon.

[8] The true cost of wind and solar has been hidden from everyone, using subsidies whose total cost is hard to determine.

Each country has its own way of providing subsidies to renewables. Most countries give wind and solar the subsidy of “going first.” They are often given a fixed rate as well. Both of these are subsidies. In the US, other subsidies are buried in the tax system. Recently, there has been talk of using QE to help wind and solar providers lower their cost of borrowing.

Newspapers regularly report that the price of wind and solar is at “grid parity,” but this is not an apples to apples comparison. To be useful, electricity needs to be available when users need it. The cost of storage is far too high to allow us to store electricity for weeks and months at a time.

If we were to use intermittent electricity as a substitute for fossil fuels in general, we would need to use intermittent electricity to heat homes and offices in winter. Sunshine is abundant in the summer, but not in the winter. Without storage, solar panels cannot even be counted on to provide homeowners with heat for cooking dinner after the sun sets in the evening. An incredibly huge amount of storage would be needed to store heat from summer to winter.

China reports that it has $42 billion in unpaid clean energy subsidies, and this amount is getting larger each year. Countries are now becoming poorer and the taxes they are able to collect are lower. Their ability to subsidize a high cost, unreliable electricity system is disappearing.

[9] Wind, solar, and hydroelectric today only comprise a little under 10% of the world’s energy supply.

We are deluding ourselves if we think we can get along on such a tiny total energy supply.

Figure 6. Hydroelectric, wind, and solar electricity as a percentage of world energy supply, based on BP’s 2020 Statistical Review of World Energy.

Few people understand what a small share of the world’s energy supply wind and solar provide today. The amounts shown in Figure 6 assume that the denominator is total energy (including oil, for example), not just electricity. In 2019, hydroelectric accounted for 6.4% of world energy supply. Wind accounted for 2.2%, and solar accounted for 1.1%. The three together amounted to 9.7% of the world’s energy supply.

None of these three energy types is suited to producing food. Oil is currently used for tilling fields, making herbicides and pesticides, and transporting refrigerated crops to market.

[10] Few people understand how important energy supply is for giving humans control over other species and pathogens.

Control over other species and pathogens has been a multistage effort. In recent years, this effort has involved antibiotics, antivirals and vaccines. Pasteurization became an important technique in the 1800s.

Humans’ control over other species started over 100,000 years ago, when humans learned to burn biomass for many uses, including cooking foods, scaring away predators, and burning down entire forests to improve their food supply. In my 2018 post, Supplemental energy puts humans in charge, I wrote about one proof of the importance of humans’ control of fire. In the lower layers of a cave in South Africa, big cats were in charge: There were no carbon deposits from fire and gnawed human bones were scattered around the cave. In the upper layers of the same cave, humans were clearly in charge. There were carbon deposits from fires, and bones of big cats that had been gnawed by humans were scattered around the cave.

We are dealing with COVID-19 now. Today’s hospitals are only possible thanks to a modern mix of energy supply. Drugs are very often made using oil. Personal protective equipment is made in factories around the world and shipped to where it is used, generally using oil for transport.

Conclusion

We do indeed appear to be headed for a Great Reset. There is little chance that Green Energy can play more than a small role, however. Leaders are often confused because of the erroneous modeling that has been done. Given that the world’s oil and coal supply seem to be declining in the near term, the chance that fossil fuel production will ever rise as high as assumptions made in the IPCC reports seems very slim.

It is true that some Green Energy devices may continue to operate for a time. But, as the world economy continues to head downhill, it will be increasingly difficult to make new renewable devices and to repair existing systems. Wholesale electricity prices can be expected to stay very low, leading to the need for continued subsidies for wind and solar.

Figure 1 indicates that we can expect more revolutions and wars at this stage in the cycle. At least part of this unrest will be related to low commodity prices and low wages. Globalization will tend to disappear. Keeping transmission lines repaired will become an increasing problem, as will many other tasks associated with keeping energy supplies available.

By Gail Tverberg via Ourfiniteworld.com

More Top Read From Oilprice.com:

- What Explains The Sudden Drop In Oil Prices?

- Canadian Oil Prices Rise On Pipeline Shutdown

- Low Oil Prices Force Aramco To Delay LNG, Petchem Ambitions

I do not buy it. I see coal mines closing and coal power plants blown up to make space for more useful structures as we see in the video of Brayton Point that used to generate 10% of New England's electricity with coal. https://youtu.be/fbw1lhpduGw?t=24

Oil and fossil gas are on a similar trajectory. Sorry stranded assets is not a good enough excuse to keep uneconomic and disease causing sources of energy longer than needed to replace them. Less fossil fuel means less disease, fewer hospitals, healthier work force. The rest of the business world cannot wait to see them gone. And we have not even mentioned global climate catastrophe. No need to drive the economy into the ground to salvage disease causing energy sources when we have readily available alternatives.

The argument that wind and solar only supply 10% of electricity is pretty much irrelevant, its like saying that Apple only supplies 6% of the PC market. Wind and solar output has doubled in a little over three years and at the utility or consumer level it is cheaper than the alternatives so it will keep growing. 2/3 rds of all generating capacity installed around the world last year was wind and solar. This year combined output of renewables has overtaken coal in the US. Worldwide wind and solar combined will pass nuclear output next year as it already has in Europe, China and India

Further wind tends to be stronger at night and in winter and solar during the day and in summer so the seasonal variability long talked about is in fact very minor. If you look at total weekly renewable output in the US, Germany and Australia, there is very little seasonal variation because summer solar offsets weaker summer winds and stronger winter winds offset reduced solar. Germany is already at 54% renewable electricity and is still a net electricity exporter and it has far less hydro, wind or solar capacity per person than the US, China or India. Now that Volkswagen and other European vehicle manufacturers are joining electrification bandwagon, smart charging of EVs will play a big part in matching electrical demand to supply so it is likely that within 6-8 years Germany with very little hydro will reach 50% of its total energy supply from renewables.

It is true that oil gas and coal will be with us for many years but their share of energy output will not only decline but decline at an increasing rate, just as it is already doing in Germany the UK and the US. In 2012 coal supplied 11 times as much energy as wind and 100 times as much as solar in the UK. Just 8 years later wind supplies 12 times as much energy as coal and solar twice as much. Similarly in Germany in 2013 coal and gas provided 350% more electricity than wind and solar. Year to date wind and solar have provided 20% more power than coal and gas combined

It follows then that there will neither be a post-oil era nor a peak oil demand throughout the 21st century and probably far beyond. Moreover, the notions of an imminent global energy transition from oil and gas to renewables and zero emissions by 2050 are illusions. Oil and gas will continue to be the fulcrum of the global economy and the core business of the global oil industry well into the future. Any mandatory transition from oil and gas to renewables will not achieve the desired effect. Renewables have to compete with other sources of energy for a market share.

And while renewables particularly wind and solar power have made impressive inroads into coal and even natural gas in electricity generation over the recent years, oil will remain the major driver for the global transport system well into the future while gas will continue to be the pivot for the global energy transition for years to come.

Therefore, the post-COVID reset won’t be fuelled by renewables. It can only be fuelled by oil and gas with renewables playing a supporting role in electricity generation.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London