After a decades-long legacy of dismissing the potentially meteoric rise of electric cars, oil and gas companies are finally changing their tune. In fact, in some sectors Big Oil is doing a complete 180, taking over the “new fuels” industry by buying up electric car charging startups at a breakneck pace. Their timing couldn’t be better.

The electric vehicles industry is set to explode. More than 350 new electric vehicle models are on track to debut by 2025, according to a report published by New York-based management consulting firm McKinsey & Company, putting electric vehicles in an ideal position for potential mass-market adoption. It is estimated that global demand for traditional gasoline will hit its peak in just a couple of years, in 2021 approximately, in large part thanks to the growth of electronic vehicles along with fuel efficiency advancements.

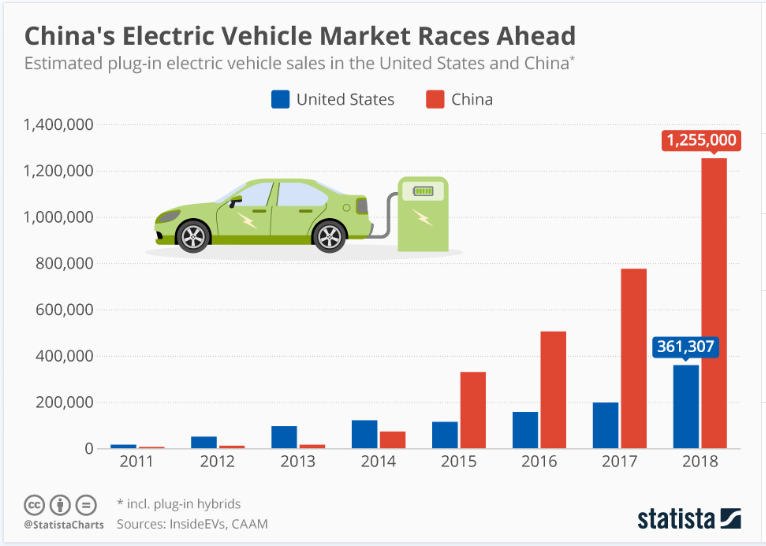

So far, China is leading the charge toward EV by a huge margin. China already has a significant lead in electric vehicle sales, with EVs representing over 4 percent of the 28.1 million automobiles sold in the country last year, as compared to 3 percent in Europe and 2 percent in the United States. But this number is likely going to skyrocket very soon, with the Chinese government pushing hard to reach an ambitious goal of 10 percent electric vehicles for conventional passenger cars this year, with a target of 12 percent by 2020.

What makes China the global leader in electric vehicles, however, isn’t just its buying power but its domination of the lithium ion battery industry. China currently produces about two thirds of the global supply of lithium ion batteries, the battery type most commonly used in electric vehicles. What’s more, these batteries alone make up a whopping 40 percent of the entire vehicle’s value. China is so far ahead of the rest of the world in terms of lithium ion battery production, it would be nearly impossible for the U.S. or Europe to catch up. In fact, at present, the entire European continent is estimated to hold just 1 percent of the market. Related: Platts Survey: OPEC Production Drops To Lowest Since March 2015

The United States is also rapidly increasing its own charging infrastructure investment and is on track to top $18 billion per year by 2030. That being said, by that time China is expected to have triple the amount of energy demand. This dynamic has not gone unnoticed by Big Oil. The fossil fuel industry is investing hand over fist and often acquiring electrical infrastructure outright. While the volume of investment itself isn’t massive yet, it stands out because of how fast Big Oil’s investment in the EV sector is growing. Across the globe public charging infrastructure for electric vehicles is booming, but the investment has been coming from a wide variety of sources. In Europe, nearly 80 percent of the public charging infrastructure is operated by utilities and oil companies, whereas in the United States 62 percent of public charging infrastructure is operated by strictly EV companies. Meanwhile in China, the equipment manufacturers themselves dominate the market.

Indeed, European fossil fuel companies are leading the most aggressive charge toward EV investing. The most recent example is Royal Dutch Shell’s acquisition of a Los Angeles-based EV software and charging network startup called Greenlots. The supermajor intends to use the company’s technology, a platform that boasts a unique combination of battery charging optimization software grid balancing services, as the building block of its North American electric vehicle industry. This is just one purchase in what is about $1 billion worth of investment that Shell is dishing out per year on similar deals.

Meanwhile, fossil fuel giants in the United States are just beginning to dip their toes into the EV market. Chevron and ExxonMobil have just begun to acquire charging infrastructure in the last year. Utilities such as Pacific Gas and Electric, Southern California Edison, San Diego Gas & Electric, and New Jersey’s PSE&G, have also partnered with oil and auto companies to offer hefty EV rebates. It’s a solid start, but the U.S. fossil fuel industry will have to push a lot harder if they hope to compete with China and Europe in a post peak-gasoline landscape.

By Haley Zaremba for Oilprice.com

More Top Reads From Oilprice.com:

- Venezuelan Oil Exports Plunge On ‘Harsher’ Sanctions

- Big Oil Defies 40% Price Plunge, Posts Best Results In Years

- Oil Prices Drop After Touching 2019 High