Breaking News:

Oil Prices Climb as Bullish Catalysts Build

Oil prices are set to…

Sinopec Challenges India's Energy Influence with New Sri Lanka Refinery

The refinery project in Sri…

Musk Expresses Uncertainty About Cybertruck's Production And Profitability

TSLA shares were holding up, higher from the close, until CEO Elon Musk showed some uncertainty about the cybertruck's launch (which had been picked up optimistically from the press release).

“It's an amazing product but I do want to emphasize that there will be enormous challenges in reaching volume production with the Cybertruck and then in making the Cybertruck cash flow positive,” Musk said during Tesla’s earnings call on Wednesday.

“While I think this is potentially our best product ever — I think it is our best product ever — it is going to require immense work to reach high-volume production and be cash flow positive at a price that people can afford.”

This sent TSLA shares back to the lows of the day, down around 9% on the day (around 4% lower than the cash close)...

Musk claims demand for the Cybertruck is “off the charts” with more than 1 million potential buyers putting down $100 to reserve one.

* * *

Tesla disappointed investors with its Q3 earnings report, missing on top-line, bottom-line, and margins as the company's focus on reducing cost (and price) per vehicle impacted the numbers:

- Tesla 3Q Adj EPS 66c, Est. 74c

- Tesla 3Q Rev. $23.4B (Up 9% Y/Y), Est. $24.06B

- Tesla 3Q Gross Margin 17.9%, Est. 18%

Though arguably, maintaining margins amid this massive price war is noteworthy (though it was down from 25.1% a year ago).

“We continue to believe that an industry leader needs to be a cost leader,” the company said.

“During a high interest rate environment, we believe focusing on investments in R&D and capital expenditures for future growth, while maintaining positive free cash flow, is the right approach.”

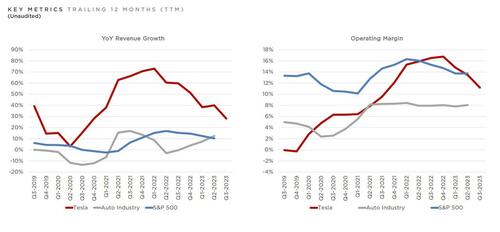

As the RHS chart below shows, Tesla still has considerable edge over the industry with regard to margins.

Revenue was impacted by the following items:

+ growth in vehicle deliveries

+ growth in other parts of the business

- reduced average selling price (ASP) YoY (excluding FX impact)

- negative FX impact of $0.4B

Free cash flow disappointed at $848 million, well below the estimate of $2.59 billion.

And Tesla still sees production 1.8 million vehicles this year (in line with the estimate of 1.82 million).

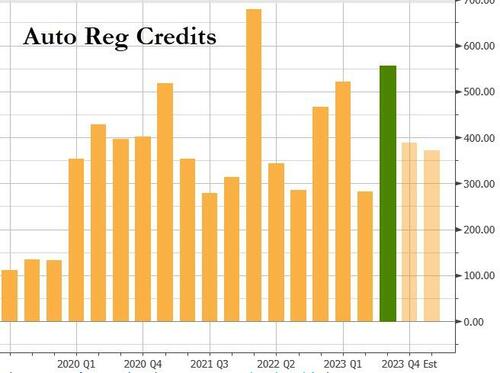

Tesla’s automotive gross margins ex-regulatory credits for the quarter was 16.3% (below expectations of 17.7%) and that was helped by a boost in regulatory credits...

Tesla noted that while deliveries rose YoY, they declined sequentially...

The electric vehicle manufacturer says its sequential decline in volume was caused by planned downtimes for factory upgrades.

BUT, a positive spin was offered as Tesla said they had more than doubled the size of their AI-training computer.

We have more than doubled the size of our AI training computer to accommodate for our growing dataset as well as our Optimus robot project. Our humanoid robot is currently being trained for simple tasks through AI rather than hard-coded software, and its hardware is being further upgraded.

We have commissioned one of the world's largest supercomputers to accelerate the pace of our AI development, with compute capacity more than doubling compared to Q2.

ADVERTISEMENT

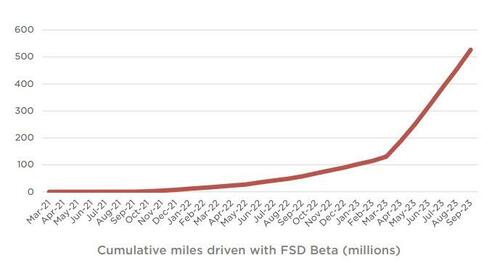

Our large installed base of vehicles continues to generate anonymized video and other data used to develop our FSD Capability features.

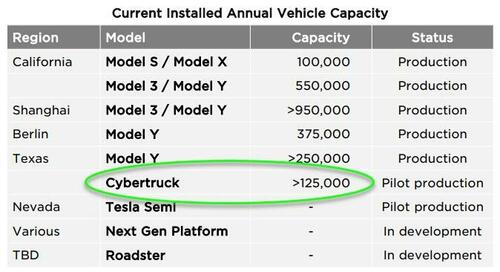

And an additional highlight is that Tesla says that “Cybertruck deliveries begin in November 2023” but without a lot of context as to what kind of volume we are talking about here.

Tesla is now tweeting that:

“Cybertruck production remains on track for later this year, with first deliveries scheduled for November 30th at Giga Texas.”

TSLA shares initially puked on the miss, but bounced back above the close...

Though TSLA was down around 5% on the day amid an ugly market.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Goldman's Grim Forecast: Shipping Industry Faces Prolonged Downturn

- Oil Markets Underestimating The Risk Of A Middle East Blowout

- The Top Energy Stocks Of Q3 2023

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B