Last week, the Treasury Department revealed that the federal deficit hit $1.1 trillion in the first half of the fiscal year ending in March, $432 billion larger than the same period a year earlier.

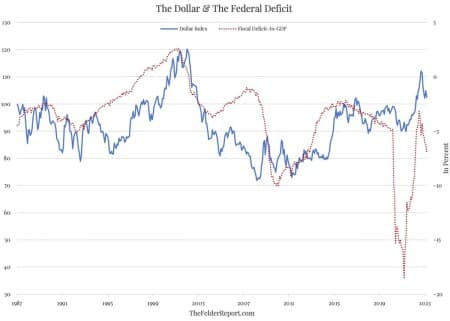

Moreover, most of this expansion came in the month of March, as spending rose 36% year-over-year (not in small part due to rapidly rising interest costs). Longer-term, there is a clear widening trend that began back in 2015 that appears to now have resumed after some pandemic-inspired gyrations. And, if history is any guide, this deteriorating fiscal trend should represent a structurally bearish influence for the dollar in the months and years to come.

Moreover, if history is any guide, the best protection against a deteriorating fiscal situation (mathematically guaranteed by rapidly growing social security and medicare spending) is gold.

The last time the deficit reversed from a narrowing trend and began a major widening trend, back in the early-2000’s, it coincided with a major top in the dollar index which evolved into a major bear market for the greenback (inverted in the chart below) that lasted roughly a decade.

This was one of the primary catalysts for a major bull market in the price of gold which rose from a low of $250 in 2001 to a high of nearly $2,000 a decade later.

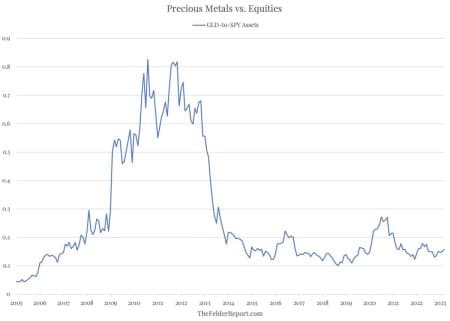

Currently, investors have little to no interest in owning gold (which is a bullish contrarian sign in my book).

As my friend Callum Thomas recently pointed out, assets in gold ETFs like GLD are a tiny fraction of those invested in equity ETFs like SPY.

However, there’s a good chance that the deteriorating fiscal situation will over time light a fire under investor appetites for precious metals relative to financial assets, just as it did two decades ago.

And that’s exactly the sort of thing that could power another major bull market for the precious metal.

Got gold?

By Jesse Felder via TheFelderReport.com via Zerohedge.com

More Top Reads From Oilprice.com:

- ADNOC Aims To Grow Energy Market Share In Europe

- GCC Countries Look To AI To Build A New Kind Of Workforce

- Visualizing The De-dollarization Of The Global Economy

Rather than cut expenditure and eliminate the widening budget deficit, successive US administrations have persisted on deficit financing causing US debts to mushroom to $30.9 trillion in 2022 and growing. Moreover the value of an ounce of gold has risen from $35 for an ounce under the Gold Standard to $2000 today signifying a huge loss of value for the dollar.

Last week, the US Treasury Department revealed that the federal deficit hit $1.1 trillion in the first half of the fiscal year ending in March or $432 bn larger than the same period a year earlier. This deteriorating fiscal trend is causing the dollar to continue to lose value. However, the more the US prints dollars to support deficit financing, the more devalued the dollar becomes. This means that Americans are now buying gold to protect their savings.

The dominance of the dollar in global trade and as a global reserve currency and also the petrodollar in the global oil trade will soon become a relic of the past.

It is inevitable that within the next 1-2 decades the yuan will become the world’s main reserve currency with the petro-yuan replacing the petrodollar as the dominant global oil currency.

Moving oil trade out of the petrodollar into the petro-yuan could take away an estimated $1.62 trillion worth of transactions out of the petrodollar annually based on an average Brent crude oil price of $100.0 a barrel. This could lead to a devaluation of the dollar by a quarter to one third.

Meanwhile, China has been accumulating an unprecedented amounts of gold in support of the petro-yuan. Contrast a petrodollar backed by US treasury bills with a petro-yuan convertible to gold.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert