This week, gold and silver went their separate ways, with gold rising and silver falling, with today's Gaza headlines pushing gold notably higher...

With spot gold topping $2,000 for the first time since May...

And, as Bloomberg's Nour Al Ali points out, this recent acceleration could propel the precious metal to a fresh record high.

Gold has rallied almost 10% this month despite surging US yields and a resilient dollar, primarily driven by its appeal as a safe-haven asset amid geopolitical tension in the Middle East.

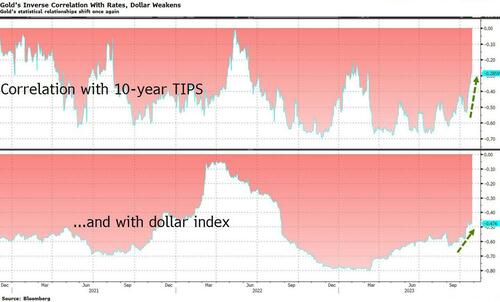

Its historical inverse correlation with real yields and the dollar, usually reliable and strong, has recently waned, based on the difference between the assets measured daily on a 40-day period.

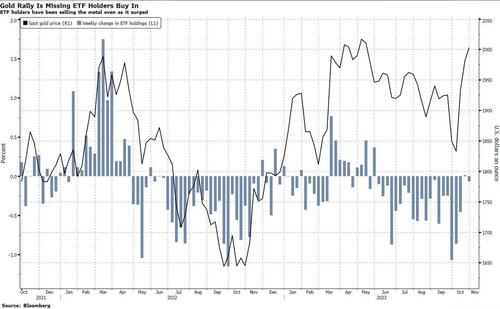

Its impressive comeback has seen the precious metal top $2,000 per ounce threshold, bouncing back from an October low of ~$1,810. Speculators, prompted by geopolitical tensions and buying pressure from funds shifting from short to net long positions, have fueled this resurgence. Yet, total holdings in bullion-backed ETFs have continued to decline as asset managers remain focused on US economic strength, rising bond yields, and the cost of holding non-interest-bearing precious metals.

Their loss.

As the market's attention now turns to Middle East developments, gold’s current price action, within a steep ascending channel, indicates both its rally’s strength and the need for consolidation, as noted by Saxo Bank’s Ole Hansen, who concludes, "a close above $2,000 can push gold beyond the prior record highs it saw around $2,050 in May this year, and March 2022."

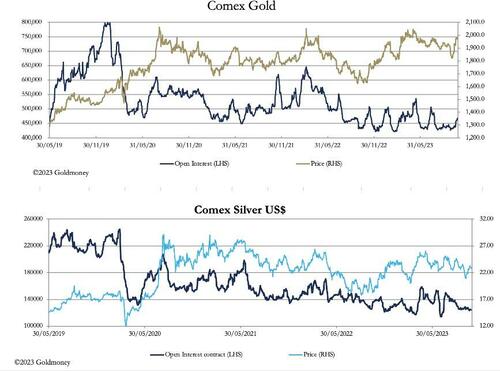

Indeed, as GoldMoney's Alasdair Macleod explains below, all the action is in gold, with Comex Open Interest continuing to rise as our next chart shows, while that of silver is still subdued.

This month, the relationship has driven the gold/silver ratio higher, currently at 87. But it is not as if the hedge funds have been aggressive buyers of gold contracts. While in these markets the Commitment of Traders figures for 17 October are stale (update for 24 October due tonight), they revealed that the Managed Money category was only net long 15,103 contracts.

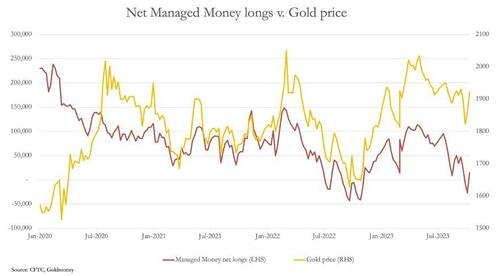

he next chart shows the position relative to the gold price.

The widening gap between the price and net longs is bullish. It means the gold price has held up well despite hedge funds not buying. With Open Interest having increased by under 30,000 contracts since the COT figures, hedge funds are unlikely to be more than 35,000—40,000 contracts net long today against a neutral position of over 100,000 contracts. In other words, after a rise of $175 in this month alone, gold still looks oversold.

The slight caveat is that in the next few days, there is the month end contract expiry, when the Swaps and market makers could make a concerted effort to get prices down so that as many call options as possible expire worthless.

There are two reasons for this change in behaviour: geopolitics, and a growing awareness of the dire state of the US Government’s finances.

The Israeli-Hamas situation is the most urgent. Yesterday, American jets attacked Hamas-related positions in Syria. At the same time, President Putin has invited senior Hamas and Iranian leaders to Moscow for talks, probably to America’s annoyance.

With the western alliance unequivocally backing Israel and Russia with an eye on her Muslim interests, the conflict in Gaza is threatening to widen.

For dealers in gold, it appears that we are early in a deteriorating situation.

The fear must be that the western alliance pushes the boundaries as far as it can to protect the Israelis.

The bigger picture is to not give any more ground to the Asian hegemons over influence in the Middle East. The Saudis are key in this, no longer kowtowing to the US, working with Russia and Iran to control oil prices.

This is the new reality. If the US has a pop at Iran, Iran will probably retaliate by closing Hormuz and driving oil prices considerably higher. And unlike in the past, led by the Saudis the Arab world will probably unite behind Iran.

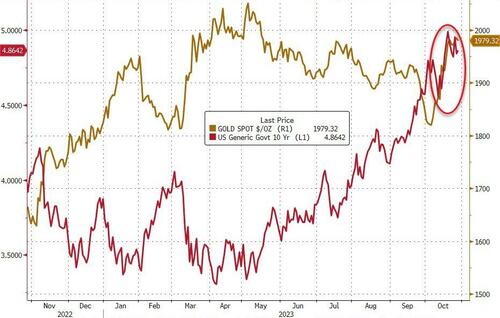

One last word on America’s deteriorating finances: gold is now rising along with US Treasury yields...

...indicating that the dollar is becoming destabilised by Bidenomics, and a debt trap is being sprung on US Government finances.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Guyana's Oil Boom Challenges OPEC+ Dominance

- Most Canadians Oppose Federal Plan To Write Down Trans Mountain Debt

- Big Oil’s Mega Acquisitions Raise Questions About Peak Oil Demand

But gold is of only symbolic value in times of global economic problems or even escalating global tension. Because of its scarcity, it is incapable of solving any economic problems. Therefore, its value to the global economy is very limited if not dubious.

Traditionally the dollar index and gold are interconnected. After all 60% of Central Banks’ reserves are held in dollar. However, in recent times, gold and the US dollar have been heading in separate ways.

Until recently rising interest rates by the US Federal Bank and other Central banks influenced gold prices but no more.

The decline in Central banks’ influence over gold prices could be due to two major factors: One is scarcity of gold and the second is an increasing lack of confidence in the US dollar.

The amount of gold in the world is very limited. About 244,000 metric tons of gold have been discovered to date (187,000 metric tons historically produced plus current underground reserves of 57,000 metric tons). Moreover, current annual production is estimated at 3,750 tons

Because of its relative scarcity and the robust demand for it, gold prices are exceeding whatever hikes in interest rates the US Federal bank and other Central banks undertake.

Another major factor is an increasing lack of confidence in the dollar. The dollar is facing a growing risk of a debt crisis, increasing global drive for de-dollarization, declining share in the global oil trade and also declining value.

Those who are talking about reviving the International Gold Standard (IGS) are wasting their time. There isn’t enough gold to go around.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert