World number one mining company BHP (ASX, NYSE: BHP) (LON:BLT) said 2017 will go down in history as the year when key changes took place in the electric cars market, making them more accessible to customers and so boosting demand for commodities from copper to nickel.

“I think if we look back in a few years we would call 2017 the tipping point of electric vehicles,” Arnoud Balhuizen, head of marketing at BHP, said at a Reuters event held in Singapore.

BHP recently revealed plans to transform itself into the world’s biggest suppliers of nickel sulphate — a key component in lithium-ion batteries that power electric cars.

The company is spending $43 million on a plant in Australia that will generate 100,000 tonnes of sulphate per year and which is expected to begin production by April 2019.

Currently, electric cars add up to roughly 1 million, out of a global fleet of closer to 1.1 billion. But BHP believes that figure could rise to 140 million electric vehicles, or 8 percent of the global fleet, by 2035.

“The reality is a mid-sized electric vehicle still needs subsidies to compete… so a lot will depend on batteries, on policy, on infrastructure,” Balhuizen said. Related: Is It Time For OPEC To Turn The Taps Back On?

Based on the company’s forecasts the looming electric vehicle boom will be evident first in the copper market, with supply struggling to meet increased demand due to hardly any new discoveries in the last two decades.

Producers, Balhuizen noted, may have underestimated the impact on copper demand of what would be a dramatic change, given fully electric vehicles require four times more of the red metal than cars which run on combustion engines.

“The expectation is that the next generation of electric vehicles that will have even more automation will require even more copper,” he said.

Electric cars add up to roughly 1 million, out of a global fleet of closer to 1.1 billion – but BHP forecasts that could rise to 140 million vehicles by 2035.

BHP, already the world's second-biggest listed copper miner, has been taken steps towards increasing it presence in the market as of late. In July, the company said it would spend $2.5 billion to extend the life of its Spence mine in northern Chile by more than 50 years.

That announcement followed the mining giant’s decision last year of raising its annual exploration spending by 29 percent, allocating nearly all its $900 million budget to finding new copper deposits, to add to a strong portfolio that includes assets such as Escondida in Chile, the world’s biggest copper mine, and Olympic Dam in Australia.

For oil, though, the impact of the electric car boom won’t come until later, after 20 years, due to demand growth in developing countries.

The “China effect”

China's efforts to build a new Silk Road are another major factor influencing demand for metals in the near term, according to BHP. The country's ambitious "One Belt, One Road" initiative could result in additional steel demand of 150 million tones, Balhuizen wrote in a blog post published Tuesday.

China's president Xii Jinping unveiled in March 2015 a plan to revive the ancient trade rout and tie China closer to over 68 regions and countries in Central Asia, Southeast Asia and the Middle East. Related: In A Bold Move, Saudis Raise Crude Prices For Asia

The “One Belt, One Road” initiative (BRI) is expected to boost demand for raw materials, particularly copper, iron ore, nickel and steelmaking coal.

BHP looked at 400 core projects that will require $1.3 trillion of spending under Xi's plan, and estimated their steel use. Those projects could lead to an additional 15 million tonnes per year of steel, an additional 3 to 4 per cent demand growth, it said. That will be met by Chinese steel mills as only 10 of the 68 countries covered by the BRI are net steel exporters, BHP said.

"We don't think China's steel [demand] has peaked, this will support some of that," Balhuizen concluded.

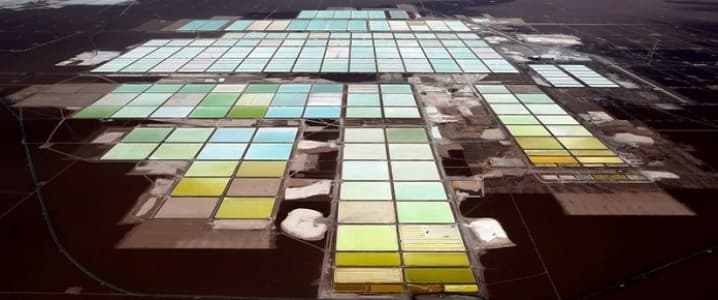

(Click to enlarge)

Source: BHP's blog.

By Mining.com

More Top Reads From Oilprice.com:

- The Driving Forces Behind Today’s Oil Markets

- Ghana Doubles Energy Revenue With Increased Oil Production

- Aramco Optimizes Oil Trading Operations Ahead Of IPO