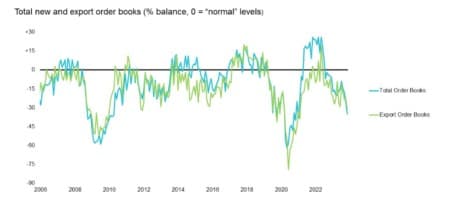

Order books for manufacturing firms fell to their weakest level since early 2021, quashing hopes of a recovery in the sector.

According to the Confederation of British Industry’s (CBI) industrial trends survey, firms reported a sharp deterioration in order books in the three months to November.

A weighted balance of -35 percent reported a downturn in order books, well below the long-run average of -13 percent and the weakest level since January 2021 – at the start of the second Covid lockdown.

Anna Leach, CBI Deputy Chief Economist, said “the further softening in orders this month is a worry, with order books now in their weakest position since the start of 2021 when the economy was locked down amid the pandemic”.

Source: CBI

The figures also showed that more firms reported a fall in output than a rise in the previous three months. The balance of factories reporting a rise in output versus a fall slumped to -17 percent, compared to – 6 percent in the previous rolling quarter.

“Manufacturing output has been under pressure recently given the combination of slowing demand and the run-down of stocks of finished goods,” Leach said.

Manufacturing in almost all major economies has been contracting for many months now. Slow growth in China has dented demand while consumers have increasingly prioritised spending on services rather than goods post-pandemic.

Rising interest rates are also putting cost pressures on businesses, suggesting the downturn may have further to run.

“This latest data will fuel concerns that the economy is slowing swiftly as the highest interest rates for 15 years take their toll on demand,” Leach said.

Ahead of the Autumn Statement, Chancellor Jeremy Hunt announced a £4.5bn investment package to lift the UK’s so-called ‘strategic manufacturing sectors’, including clean energy.

By City AM

More Top Reads From Oilprice.com:

- Global Uranium Shortage Spurs Investment Frenzy

- New Tungsten Oxide Coating Boosts Hydrogen Fuel Cell Life

- New DRC Copper Discoveries Boost Shares of Canadian Miner

As for the EU and US economies, the slowdown of their economies and the declining manufacturing sectors are due to hikes in interest rates to combat inflation, rising energy prices and contributions of hundreds of billions of dollars in military and financial aid to Ukraine.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert