|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 6 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 13 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 13 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 13 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 13 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

Chinese Mining Operations in Tajikistan Spark Environmental Backlash

Chinese mining and agricultural companies…

EU Leverages Frozen Russian Assets for €1.5 Billion Aid Package to Ukraine

The European Union has transferred…

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

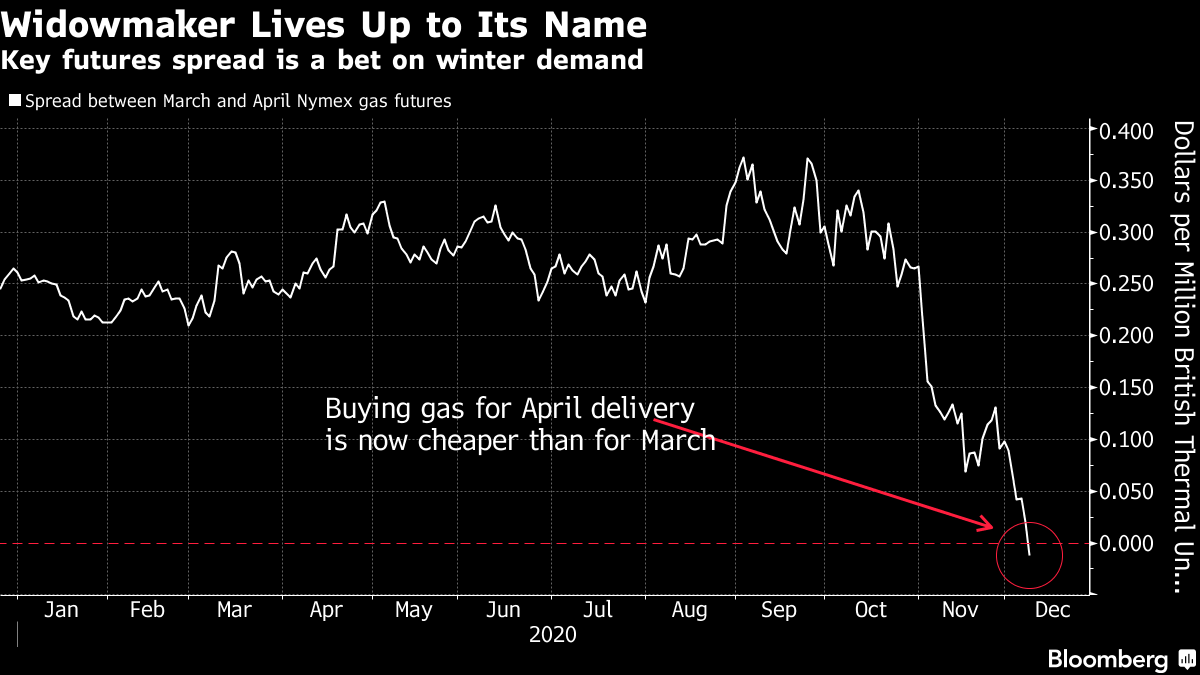

''Widowmaker'' Natural Gas Trade Collapses On Mild Winter Forecast

By ZeroHedge - Dec 09, 2020, 10:30 AM CSTThe spread between March and April natural gas futures collapsed to zero on Tuesday. The spread is critical in gauging how tight supplies will be for the North American winter. In one of the earliest collapses to less than zero, for the first time since 2015, this suggests traders are forecasting a mild winter that will dent energy demand.

Bloomberg calls the collapse in the spread the "widowmaker." It's a signal that traders are giving up on hopes of a frigid U.S. winter.

"It's a significant event," said Gary Cunningham, a director at Stamford, Connecticut-based Tradition Energy. "We may end winter with very strong gas inventories."

Nat gas prices have tumbled since the start of November as persistent mild weather has caused inventories to rise rather than draw down with seasonal trends.

On Monday, we attributed the plunge in nat gas future prices on new weather models suggesting "December could end top 3 warmest all time."

Earlier in the heating season, there was the anticipation of a colder winter, pushing prices up - but with the Lower 48 states now 25% through the winter heating season with mild temperatures expected - demand will be lackluster.

Now, there is some good news - mild weather will greatly help restaurants as many have resorted to outdoor dinning and the use of propane heaters.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Why Is Denmark Ditching Natural Gas?

- Oil Market Hopeful As Vaccinations Begin

- Finding A Way Around The World's Largest Oil Chokepoint

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com

Trading natural gas futures has been a crazy thing to do for over a decade now and zero hedge still remains only bested by Seeking Alpha as "worst investment site on Earth"(as far as online media. CNBC, Fox Business, etc have been even worse).