Breaking News:

NIMBY: The Battle for Britain’s Clean Energy Future

The UK government faces growing…

Stock Market’s Short-Term Focus Threatens Energy Transition Goals

The problem that most companies…

WTI Stops Slide As API Figures Show Major Gasoline Draw

The American Petroleum Institute (API) reported a draw this week for crude oil of 448,000 barrels, while analysts predicted a smaller draw of 117,000 barrels.

The draw comes as the Department of Energy released 3.4 million barrels from the Strategic Petroleum Reserves in week ending August 12, to 461.2 million barrels.

U.S. crude inventories have shed some 61 million barrels since the start of 2021, with a 1.7 million barrel gain since the start of 2020, according to API data.

In the week prior, the API reported a surprise build in crude oil inventories of 2.156 million barrels after analysts had predicted a draw of 400,000 barrels.

WTI was trading down on Tuesday on disappointing economic data out of China and the improving prospects of reaching a nuclear deal with Iran. WTI was trading down 3.67% on the day at 12:44 p.m. ET in the runup to the release at $86.13 per barrel—more than $3 per barrel down on the week. Brent crude was trading down 3.13% on the day at $92.12—a roughly $4 drop on the week.

U.S. crude oil production data for the week ending August 5 rose 100,000 bpd to 12.2 million bpd, according to the latest weekly EIA data.

The API also reported a draw in gasoline inventories this week of 4.480 million barrels for the week ending Aug 12, compared to the previous week's 627,000-barrel draw.

Distillate stocks saw a draw of 759,000 barrels for the week, compared to last week's 1.376-million-barrel increase.

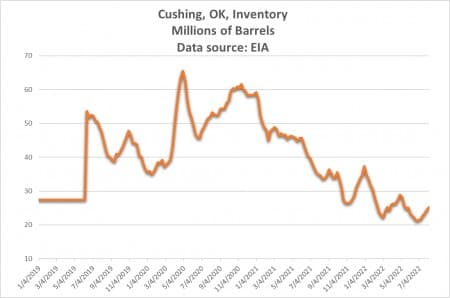

Cushing inventories rose by 250,000 barrels this week. Last week, the API saw a build of 910,000 barrels. Official EIA Cushing inventories for week ending August 5 was 25.189 million barrels, up from 24.466 million barrels in the prior week.

At 4:35 pm, ET, WTI was trading down at $86.83 (-2.89%), with Brent trading down at $92.45 (-2.79%).

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Falling Prices And High Costs Eat Away At Steelmaker Margins

- Nuclear And Hydropower Falter As Droughts Grip Europe

- Gas-To-Oil Switch May Not Be A Huge Catalyst For EU Crude Demand

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B