Breaking News:

A Critical Election Looms for Venezuela

The outcome of the presidential…

3 Solar Stocks To Watch as Earnings Season Starts

First Solar, Nextracker, and Sunrun…

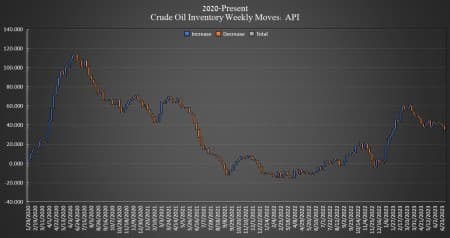

WTI Spikes As Crude Inventories Fall

Crude oil inventories in the United States decreased this week by 4.382 million barrels, the American Petroleum Institute (API) data showed on Wednesday, after falling by 2.408 million barrels in the week prior as the IEA eyes a supply deficit in this half of the year.

Analysts were expecting a smaller 1.8-million-barrel draw in U.S. crude-oil inventories. The total number of barrels of crude oil gained so far this year is nearly 32 million barrels, according to API data, although the net draw in crude inventories since April is more than 15 million barrels.

On Monday, the Department of Energy (DoE) reported that it sold another 1.4 million barrels of crude in the week ending June 30 from the Strategic Petroleum Reserve (SPR), for the 14th consecutive weekly drop in the stockpile to a 40-year low of 347.2 million barrels.

The price of WTI and Brent were both trading up on Wednesday in the run-up to the data release after the market interpreted a new round of OPEC+ messaging as bullish.

By 7:14 p.m. EST, WTI was trading up 0.15%, at $71.90 per barrel—up $4 per barrel since last Tuesday, while Brent crude was trading up 0.52% at $76.65 in after-hours trading.

Gasoline inventories rose by 1.615 million barrels, nearly undoing the 2.85 million barrel dip in the week prior. Distillate inventories rose by 604,000 barrels, on top of the 777,000 barrel build in the week prior.

Crude oil production in the United States stayed at 12.2 million bpd for the week ending June 23, according to EIA data, matching the previous low for this year.

Inventories at Cushing, Oklahoma, rose by 289,000 barrels, after rising 1.45 million barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Big Oil Revives Offshore Exploration

- Trans Mountain Pipeline Unlikely To Ship Canadian Oil To Asia

- Russia’s Oil And Gas Revenues Drop In June

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B