Breaking News:

U.S. Commands Higher Prices for Crude Amid Growing Global Oil Market Influence

Increased domestic offtake capacity and…

Iranian Oil Exports Have Risen Sharply, Facilitated By Malaysia

Whether or not the U.S.…

U.S. Crude, Product Inventories Rise Amid Oil Price Rally

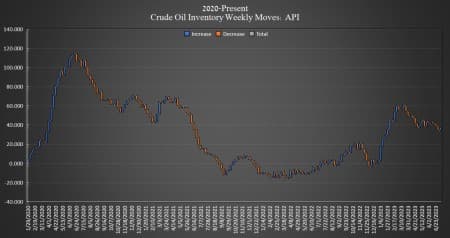

Crude oil inventories in the United States increased this week by 3.026 million barrels, the American Petroleum Institute (API) data showed on Wednesday, after falling by 4.382 million barrels in the week prior.

Analysts were expecting a much smaller build of 200,000 barrels in U.S. crude-oil inventories. The total number of barrels of crude oil gained so far this year is nearly 35 million barrels, according to API data, although the net draw in crude inventories since April is more than 12 million barrels.

On Monday, the Department of Energy (DoE) reported that it sold another 400,000 barrels of crude in the week ending July 7 from the Strategic Petroleum Reserve (SPR), for the 15th consecutive weekly drop in the stockpile to a new 40-year low of 346.8 million barrels.

The price of WTI and Brent were both trading up on Tuesday in the run-up to the data release, with the market finally strapping on the possibility that we are indeed on the cusp of a bullish cycle, with estimations for a supply deficit this half of the year.

By 4:10 p.m. EST, WTI was trading up 2.62%, at $74.90 per barrel—up $3 per barrel since last Tuesday, while Brent crude was trading up 2.29% at $79.47.

Gasoline inventories rose by 1.004 million barrels after rising by 1.615 million barrels in the week prior. Distillate inventories rose by 2.908 million barrels, on top of the 604,000 barrel build in the week prior.

Crude oil production in the United States rose to 12.4 million bpd for the week ending June 30, according to EIA data, up 200,000 bpd from the start of the year.

Inventories at Cushing, Oklahoma, fell by 2.150 barrels, after rising 289,000 barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- UAE Will Not Make Voluntary Oil Production Cuts

- Commerzbank Lowers Brent Oil Price Outlook To $85 At Year

- Norway Makes Biggest Hydrocarbon Discovery In 10 Years

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

At one time I thought it was a coincidence but the practice has been repeated regularly and punctually to lend credence to the view that it is done deliberately to slow down the price rise if not to kill the rally altogether.

This is the United States’ way of manipulating oil prices. And yet, it has the temerity to accuse OPEC+ of manipulating prices.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert

That is news #absolutely