Breaking News:

NIMBY: The Battle for Britain’s Clean Energy Future

The UK government faces growing…

Kuwait Looks To Nearly Double Production After Major Oil Find

Sheikh Nawaf al-Sabah, CEO of…

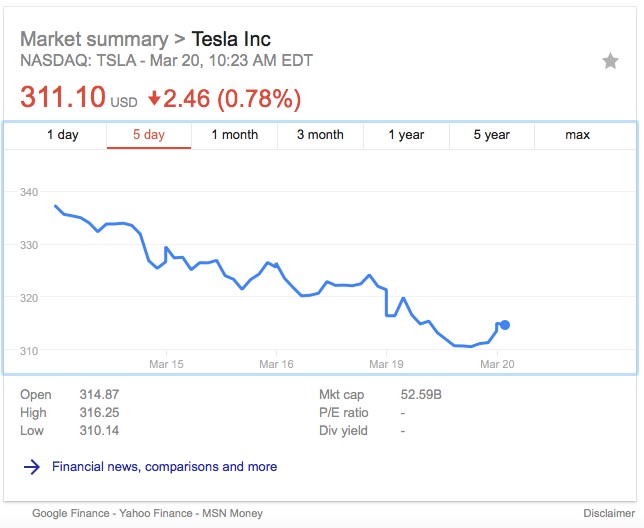

Tesla Tumbles With News Of Model 3 Production Woes

Forgiveness is a precious gift from investors—for as long as it lasts, but with Tesla shares down almost 7 percent over the past week and Goldman Sachs reiterating a sell rating and putting $205 price target on the stock, the days of absolution may be over.

(Click to enlarge)

Now, as Tesla’s Model 3 looks set to miss production targets for the first quarter of this year, analysts say that even the most loyal investors are losing patience.

“We believe the company is tracking below its 2018 Model S/X guidance of approx. 100k units (an implied 25,000 per quarter). Further, while monthly Model 3 deliveries are showing sequential improvement, we estimate that they will fall well short of consensus expectations,” Goldman Sachs’ David Tamberrino wrote in a note to clients.

Tamberrino expects production and deliveries of the Model 3 to continue to ramp up—but at a slower pace than Tesla CEO Elon Musk has previously promised.

According to Bank of America analyst John Murphy, Tesla still has time to get its business on track, but its margin for error is getting thinner by the day.

“Despite being a growing top-line business in need of capital to fund its ambitious growth plans, we think investors may grow tired of supplying Tesla with incremental low-cost capital in perpetuity if investments fail to generate returns soon,” Murphy said.

Still, even with patience running thing, Tamberrino’s $205 six-month price target for Tesla shares seems harsh. After all, this is a 36-percent downside.

And market watchers will also be wise to note that Tamberrino’s record isn’t the best. He’s one of the lowest rated analysts on TipRanks, coming in 4,527th out of 4,783 analysts, with a 48-percent success rate and an average return of -13.5%.

Remember last summer, when he reiterated a sell rating on Tesla stock at $180? It’s not the first time he’s been exceedingly skeptical on Tesla, and lost.

Related: The Truth About Aramco’s $2 Trillion Valuation

But that doesn’t change the fact that Tesla keeps missing its production goals.

Tesla originally said it would ramp up Model 3 production to 5,000 sedans a week in 2017 and then double it per week in 2018. However, it pushed back its 2017 goal to late in the first quarter of 2018 and then again to end of second quarter. The current estimate is 2,500 per week by the end of the first quarter, with 5,000 a week by the end of second quarter.

The Goldman Sachs analyst said Model S and Model X deliveries were also likely to disappoint.

In Q42017, only 1,550 Model 3s were delivered, and with only 220 delivered in the third quarter, that means that since deliveries launched in late July last year, only 1,770 have gone out.

And more trouble is brewing.

Last week, CNBC reported that Tesla has been producing a high ratio of flawed parts further contributing to production delays. Owners noted issues such as glitches in the touch-screen, buzzing sounds, vibration in the steering wheel and misaligned body panels.

Some execs at Tesla, which is led by CEO Elon Musk, said last week that the company is manufacturing a high ratio of flawed auto parts.

Musk, however, is unfazed.

On Sunday, he said his first spaceship to Mars would be ready by mid-2019, conceding, “Although sometimes, my timelines are a little, you know…”.

By Charles Benavidez for Safehaven.com

More Top Reads From Oilprice.com:

- Legal Risks Jeopardize World's Largest IPO

- Natural Gas Is Under Attack

- OPEC Doubles Down On Draining Oil Inventories

Safehaven.com

Safehaven.com is one of the most established finance and news sites in the world, providing insight into the most important sectors in the business and…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

I believe that more disastrous is your short position on TSLA and your failed attempts to bash this stock. Happy to see that people what are betting on failures of others are getting what they've deserved. Karma is a b...