Breaking News:

How the U.S. Presidential Election Could Influence Precious Metals Prices

Precious metals prices are expected…

What Would the Re-Election of Trump Mean for U.S. Energy?

A potential Trump re-election could…

Surprise Crude Build Disappoints Oil Bulls

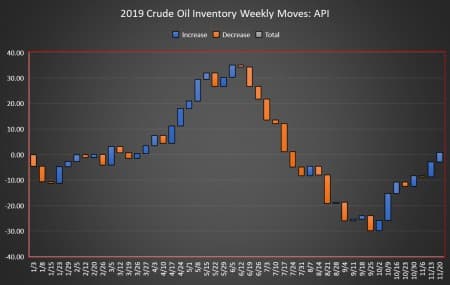

The American Petroleum Institute (API) has estimated a crude oil inventory build of 3.639 million barrels for the week ending November 21, compared to analyst expectations of a 418,000-barrel draw in inventory.

Last week saw a build in crude oil inventories of 5.954 million barrels, according to API data. The EIA’s estimates, however, reported a build of 1.4-million barrels for that week.

After today’s inventory move, the net draw has swung into build territory for the year, standing at 830,000 barrels for the 48-week reporting period so far, using API data.

Oil prices were trading up on Tuesday prior to the data release on trade talk hopes for China and the United States surfaced again on Tuesday, with negotiators for both sides conversing today by phone. Still, no tangible progress has been made.

At 2:48pm EST, WTI was trading up $0.24 (+0.41%) at $58.28—roughly $2.50 per barrel above last week’s prices. Brent was trading up $0.36 (+0.57%) at $62.98, up almost $2 a barrel from last week.

The API this week reported a build of 4.378 million barrels of gasoline for week ending November 21, compared to analyst expectations of a smaller build in gasoline inventories of 1.222-million barrels for the week.

Distillate inventories saw a draw of 665,000 barrels for the week, while Cushing inventories fell by 516,000 barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending November 15 stayed at the most recent high of 12.8 million bpd for a second week in a row.

At 4:42pm EDT, WTI was trading at $58.36, while Brent was trading at $63.14.

By Julianne Geiger for Oilprice.com

More Top Reads from Oilprice.com:

- Musk: Tesla Truck Will Crush The Competition

- 99 Oil Rigs Gone And Counting: Rig Count Falls Again

- Putin Calls U.S. Shale “Barbaric”

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B