Breaking News:

Why China’s Commodity Imports Rise amid Struggling Economy

Chinese purchases of LNG, coal,…

How the U.S. Presidential Election Could Influence Precious Metals Prices

Precious metals prices are expected…

Strong Gasoline Draw Supports Oil Prices

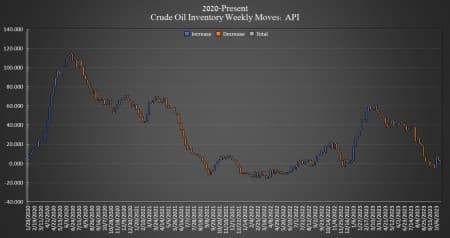

Crude oil inventories in the United States fell by 2.668 million barrels for week ending October 20, according to The American Petroleum Institute (API), after a 4.383-million-barrel dip in crude inventories in the week prior, API data showed.

Analysts were expecting a build of 1.550 million barrels for the week. API data shows a net draw in crude oil inventories in the United States of 2.679 million barrels so far this year.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) stayed the same for the third week in a row, with the SPR inventory still sitting at a near 40-year low of 351.3 million barrels, with total purchases for the SPR coming in at less than 4 million barrels since the Biden Administration began its buyback program.

Oil prices were trading down ahead of API data release, with Brent trading down 1.97% at $88.06 at 3:46 p.m. ET—a roughly $2.50 decrease week over week. The U.S. benchmark WTI was trading down on the day at 2.04%, at $83.75. WTI is down nearly $3.50 per barrel from this same time last week.

Gasoline inventories fell this week by 4.169 million barrels, on top of the 1.578 million barrel decrease in the week prior. Gasoline inventories are just above the five-year average for this time of year, last week’s EIA data shows. Distillate inventories also fell this week, by 2.313 million barrels, on top of the 612,000-barrel draw in the week prior, and are now about 12% below the five-year average for this time of year.

Cushing inventories saw the only build this week, of 513,000 barrels, after falling by 1.005 million barrels last week, leaving an estimated 21.5 million barrels in stock.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- IEA: OPEC+ Production Cuts To Send Oil Prices And Volatility Surging

- Guyana's Oil Boom Challenges OPEC+ Dominance

- Most Canadians Oppose Federal Plan To Write Down Trans Mountain Debt

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

Amazing to watch how everyone is being told War with Iran is the way to go to what ...solve the problems of the entire Middle East? Solve the problem of oil prices that might plunge again? Hard to imagine but there was a time when there was no US military presence upon all of the Middle East...but now at least we know why that military presence is there if there was ever any doubt....none of it having to do with US national security and all of it having to do with the exact opposite of that. Very impressive Putin Russia attack upon all of Ukraine as well! "Feeling the moment" truly and totally of that there can be no doubt now as well.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B