Breaking News:

The Dramatic Fall of Mexico’s Oil Giant

Mexico's state-owned oil company, Pemex,…

Canada Set To Delay Trans Mountain Pipeline Sale After 2025 Election

Canada’s federal government plans to…

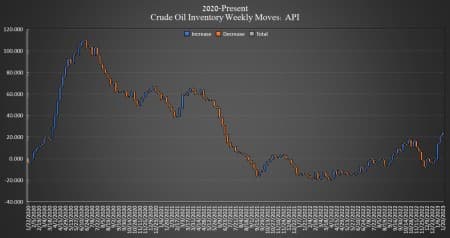

Rising Crude, Gasoline Inventories Weigh On Oil Prices

Crude oil inventories rose by 3.378 million barrels, American Petroleum Institute (API) data showed on Tuesday.

U.S. crude inventories increased 13 million barrels last year, according to API data, while crude stored in the nation’s Strategic Petroleum Reserves sunk by 221 million barrels. This week, SPR inventory held steady for the second week in a row at 371.6 million barrels as the emergency releases that the Biden Administration announced last spring are now complete. The SPR now contains the least amount of crude oil since early December 1983.

Oil prices were trading down on Tuesday in the runup to the data release. At 3:49 p.m. EST, WTI was trading down $1.48 (-1.81%) on the day to $80.14 per barrel—a weekly increase of roughly $1 per barrel. Brent crude was trading down $2 (-2.27%) on the day at $86.19—a weekly increase of about $1.50 per barrel.

U.S. crude oil production stayed at 2.2 million bpd for the second week in a row for week ending January 13—it is the highest production rate since last August. U.S. production is still 900,000 bpd lower than the peak production seen in March 2020.

WTI was trading at $80.12 shortly after the data release.

Gasoline inventories rose by 620,000 barrels after last week’s API data showed the fuel inventories rising by 2.8 million barrels last week. Distillates fell 1.929 million barrels after falling by 1.8 million bpd in the week prior.

Inventories at Cushing, Oklahoma, increased by 3.378 million barrels on top of the 3.7-million barrel hike reported last week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Sub-Zero Temperatures Set To Boost LNG Demand In Asia

- Netherlands To Shut Down Europe's Largest Gas Field

- Iran Claims Panama Oil Tanker Cancellations Were Politically Motivated

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

This practice has become too regular to be coincidental. In my view, it amounts to a kHmanipulation ploy to arrest the rise of oil prices.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert