Breaking News:

The Rise of the Middle Corridor Trade Route

The Ukraine war has catalyzed…

How to Prepare Your Portfolio for a Harris Victory

From an historical perspective, it’s…

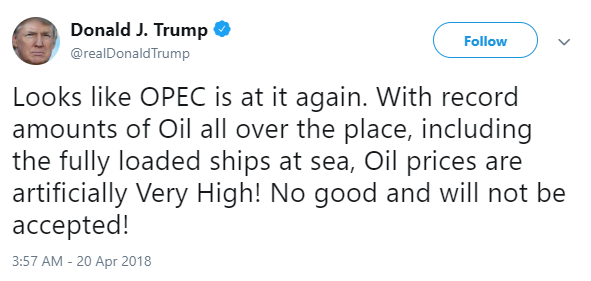

President Trump Throws Hail Mary Tweet On Eve Of OPEC Meet

US President Donald Trump fired another shot across OPEC’s bow on Wednesday, a day before the oil cartel is set to meet in Vienna to discuss possible production cuts.

“The World does not want to see, or need, higher oil prices!” the Tweet read, in part.

President Trump has issued a long string of Tweets directed at OPEC this year, lashing out at OPEC in the past for restricting production, which raises prices as supply tightens.

Oil prices were down on Wednesday, as OPEC has failed to give the market a clear signal that it will cut production, and that Russia would be on board with a production cut as well, should one be implemented.

WTI was trading down 0.08% at 2:24pm EST at $53.21, with Brent crude falling 0.16% to $61.98.

The fate of the OPEC meeting scheduled for December 6 and 7 is murky at best, with OPEC reportedly urging both Libya and Nigeria—two members exempt from the previous round of production cuts—to join in the production cut for this round. Without their buy-in, other members may feel less inclined to pick up their slack this time around. Iran, too, is a wildcard in the production cut talks, with its oil minister staunchly refusing to negotiate any production cuts for as long as the country remains under U.S. Sanctions.

The two major players in the production cut talks, Saudi Arabia and Russia, seem to be on board with a production cut, but the volume of cuts has yet to be determined, and it is also uncertain if they will go it alone should others refuse. Qatar’s withdrawal from the cartel after its decades-long history with the organization is but another worrying signal to OPEC that it may find additional resistance tomorrow.

President Trump’s Tweet could be seen as a warning to the cartel to measure any production cuts carefully, but OPEC has long been the target of Trump’s tweets, even prior to his presidency, chastising the organization for restricting oil during the near-$100/barrel days.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- The Most Likely Outcome Of The OPEC Meeting

- Is This The Next Disaster For Canadian Drillers?

- The Biggest Threat To Australia’s LNG Sector

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

President Trump should stop pestering OPEC by calling on it not to make production cuts. He wants ow oil prices because he thinks that is good for the US economy though I very much doubt that low oil prices are good for the US economy or the US shale oil industry. In so doing he is following his policy of “America First”. Still he begrudges OPEC members defending their interests and getting a better price for their finite assets. This in my view the ultimate selfishness. If President Trump doesn’t want better prices for OPEC, then he should buy oil somewhere else.

He should encourage US shale oil industry to meet most of the US demand for oil. However, he might not be aware that to achieve this goal, US shale oil producers need an oil price above $80 a barrel since their breakeven price is $60-$70 a barrel.

It is very probable that a cut of production will be agreed upon in the OPEC meeting tomorrow in Vienna. But who will be doing the cutting?

The overwhelming majority of OPEC members are not in favour of new cuts. Instead, they will demand that Saudi Arabia and Russia withdraw the 650,000 barrels a day (b/d) they jointly added to the market in June against OPEC members’ wishes and return them to the original 1.8 million barrels a day (mbd) cut under the OPEC/non-OPEC agreement.

Saudi Arabia will end up doing most of the cutting with some symbolic reduction from Russia estimated between 100,000-150,000 b/d as a show of solidarity with the Saudis.

Were the Saudis to succumb to pressure from President Trump and decide not to cut production, oil prices could decline further and they will be in a worse mess than the one they faced after their decision to flood the global oil market in the aftermath of the 2014 oil price crash. Their decision then failed miserably and inflicted huge damage on the Saudi economy and the economies of OPEC members. So this is not an option for Saudi Arabia since Saudi foreign exchange reserves have fallen from $750 bn in 2014 to an estimated $500 now. These will be needed to defend the Saudi currency against devaluation.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London