Breaking News:

Chinese Mining Operations in Tajikistan Spark Environmental Backlash

Chinese mining and agricultural companies…

Canada Set To Delay Trans Mountain Pipeline Sale After 2025 Election

Canada’s federal government plans to…

Oil Rises As API Reports Major Draw In Crude Inventories

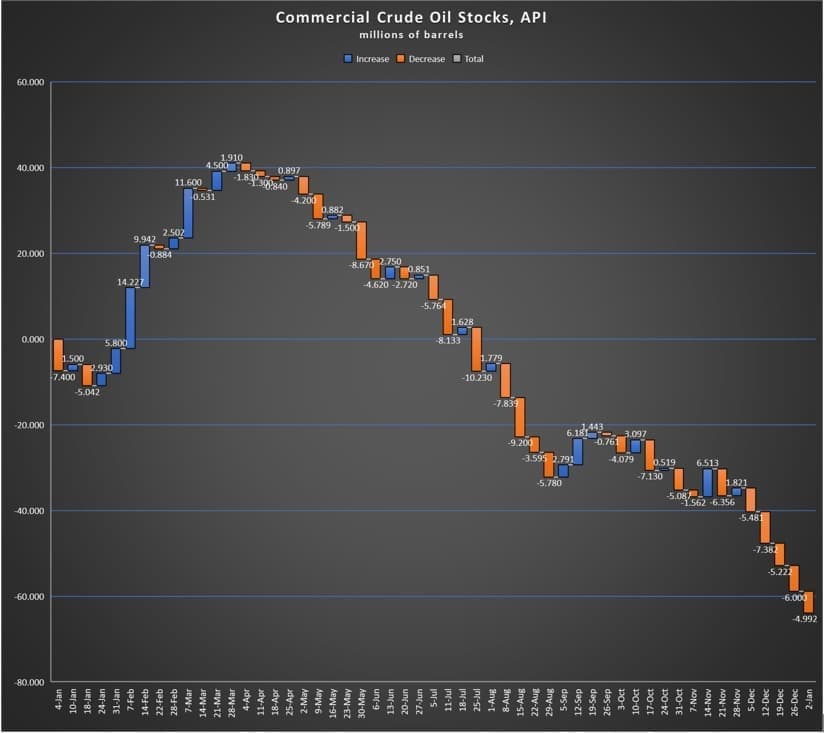

The American Petroleum Institute (API) reported a draw of 4.992 million barrels of United States crude oil inventories for the week ending December 29, marking five large draws in as many weeks. This marks the final inventory count for 2017 from the API.

This week brings the total crude oil drawdown for 2017 to over 63 million barrels according to the API.

(Click to enlarge)

Analysts had expected a smaller drawdown of 5.26 million barrels in crude oil.

Last week, the American Petroleum Institute (API) reported a large draw of 6.0 million barrels of crude oil, along with an increase in gasoline inventories of 3.1 million barrels.

This week, the API is reporting another build in gasoline inventories at 1.87 million barrels for the week ending December 29. The results came in close to forecasts for a 1.864-million-barrel build.

WTI and Brent were soaring at multi-year highs on Wednesday as supply threats loom over violent protests in Iran, which some fear could spill over to Saudi Arabia. Supply disruptions in Libya have also surfaced, with a pipeline explosion last week and concerns that IS may attack the Oil Crescent.

WTI was trading up 1.57% (+$0.95) at $61.32 at 11:28am EST. The Brent benchmark was trading up 1.28% (+$0.85) at $67.42. While the price spikes of recent weeks are undeniable, analysts are cautious of its long-term prospects as US shale is expected to continue to eat away at OPEC’s production cut efforts as prices rise.

Distillate inventories saw a build this week of 4.272 million barrels, against a forecast of a 1.030-million-barrel build.

Inventories at the Cushing, Oklahoma, site decreased by 2.11 million barrels this week.

Related: What Is Tesla Hiding From Wall Street?

The dip in US crude oil inventories comes after multiple weeks of increasing oil production in the United States, growing from an average of 8.946 million bpd in the first week of January 2017 and reaching an average of 9.754 million bpd for week ending December 22—a slight decrease from the previous week’s 9.789 million bpd.

The U.S. Energy Information Administration report on oil inventories is due to be released on Thursday at 11:00 a.m. EDT due to the New Year holiday.

By 4:35pm EST, the WTI benchmark was trading up 2.35% on the day to $61.79 while Brent was trading up 2.00% on the day at $67.90.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Why Germans Are Being Paid To Use Power

- Iranian Crisis Could Send Oil To $100

- Is ISIS About To Attack Libyan Oil?

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B