Breaking News:

Net-Zero Targets Could Double Yearly Copper Demand by 2035

Copper shortage fears return as…

U.S. Refiners Q2 Results Expected to Dull on Dampening Demand

U.S. oil refiners are expected…

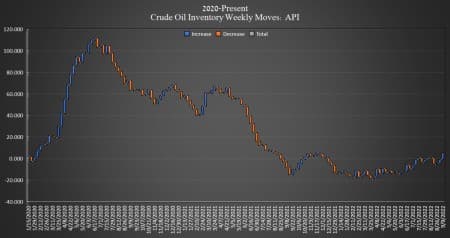

Oil Prices Unmoved By Large Crude Inventory Build

The American Petroleum Institute (API) reported a build this week for crude oil of 6.035 million barrels, while analysts predicted a draw of 200,000 barrels.

The build comes as the Department of Energy released a record-setting 8.4 million barrels from the Strategic Petroleum Reserves in the week ending September 9, leaving the SPR with just 434.1 million barrels.

In the week prior, the API reported a surprise build in crude oil inventories of 3.645 million barrels after analysts had predicted a draw of 733,000 barrels.

WTI fell on Wednesday prior to the data release, with inflation figures in the United States coming in higher than expected, serving as a threat to oil demand. At 12:50 p.m. ET, WTI was trading down $1.34 (-1.53%) on the day at $86.44 per barrel—a roughly $4 per barrel increase on the week. Brent crude was trading down $1.69 (-1.80%) on the day at $92.31—a $4 increase on the week.

U.S. crude oil production data for the week ending September 2 stayed the same at 12.1 million bpd, according to the latest weekly EIA data.

The API reported a draw in gasoline inventories this week of 3.23 million barrels for the week ending September 9, on top of the previous week's 836,000-barrel draw.

Distillate stocks saw a build of 1.75 million barrels for the week, on top of last week's 1.833-million-barrel increase.

Cushing inventories were up by 101,000 barrels this week. Last week, the API saw a Cushing decrease of 772,000 barrels. Official EIA Cushing inventory for the week ending September 2 was 24.783 million barrels, down from 25.284 million barrels in the prior week.

Oil prices were still down after the release, with WTI trading at $87.61 (-0.19%) and Brent trading at $93.42 (-0.62%).

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Nigeria’s Oil Exports Plunge To Record Low

- Permian Oil Production Is Set To Hit A Record High

- This Large U.S. Driller Just Made A Big Move Into LNG

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

Amazingly enough coal is still a critical component to both the energy and industrial mix as well which is hardly good news for oil bulls would be an understatement.

Having said that refined product supplies remain not disrupted throughout the entirety of the USA going on forever now and this now particularly so be the height of Hurricane Season.

Anyhow all seems like great news for the oil *BUSINESS* but not so much oil as a commodity per se. Might see some big time for sale signs going up upon oil drilling Companies as it is truly a capital intensive and very high risk but high reward Enterprise. Nothing like building a Super Tall in the current situation tho would be an understatement!