Breaking News:

Rystad: OPEC's Oil Reserves are Much Lower Than Officially Reported

Rystad Energy’s latest research shows…

The Dramatic Fall of Mexico’s Oil Giant

Mexico's state-owned oil company, Pemex,…

Oil Prices Rise As API Confirms Crude Inventory Draw

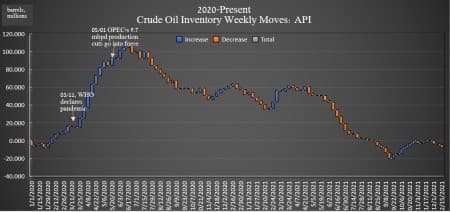

This week, the American Petroleum Institute (API) estimated the inventory draw for crude oil to be 3.670 million barrels.

U.S. crude inventories have shed some 65 million barrels since the beginning of the year.

Analyst expectations for the week were for a smaller draw of 2.633 million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 815,000 barrels, compared to the 2.60-million-barrel draw that analysts had predicted.

At the start of the day at 7:30 a.m. EST WTI had risen by more than 1% to $69.73, but was still $1 per barrel week on week. Brent was also trading up by more than 1% at $72.56—also $1 under last week's levels.

Oil prices were trading up by more than 3% on Tuesday in the run-up to the data release, after a brutal Monday that saw prices dip as much as 5% on fresh Omicron fears.

U.S. oil production has been on a slow but steady climb. For the week ending December 10—the last week for which the Energy Information Administration has provided data—crude oil production in the United States came in at 11.7 million bpd for the second week in a row—an increase of 700,000 bpd since the start of the year.

The API reported a build in gasoline inventories of 3.701 million barrels for the week ending December 17—after the previous week's 426,000-barrel build.

Distillate stocks saw a decrease in inventory of 849,000 barrels for the week, after last week's 1.016-million-barrel decrease. Cushing saw a 1.272 million-barrel increase this week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Cities Around The World Are Trying To Cut Out Natural Gas

- Tight U.S. Oil Inventories Prop Up Oil Prices

- Are Oil Markets Already Oversupplied?

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

Your article did not list the size of the crude oil draw even though your headline spoke of a draw. You gave the expected numbers but not the actual number. Why did you leave the size of the draw out?

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B