Breaking News:

Canada Set To Delay Trans Mountain Pipeline Sale After 2025 Election

Canada’s federal government plans to…

Goldman Sachs Sees Downside For Copper in The Short Term

China's unwrought copper and copper…

Oil Prices Get Another Boost As U.S. Crude Oil, Product Inventories Fall

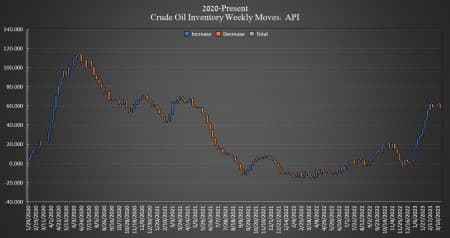

Crude oil inventories in the United States fell this week by 6.076 million barrels, the American Petroleum Institute (API) data showed on Tuesday, in a major divergence from the 187,000 barrel build that was expected.

The total number of barrels of crude oil gained so far this year is still more than 53 million barrels.

This week, SPR inventory held steady for the eleventh week in a row at 371.6 million barrels—the lowest amount of crude oil in the SPR since December 1983.

U.S. crude oil production rose to 12.3 million bpd for week ending March 17. U.S. production is now 800,000 bpd lower than the peak production seen in March 2020, but 700,000 bpd higher than this time last year.

Oil prices traded up on Tuesday in the run-up to the data release as banking collapse fears eased and 400,000 bpd of crude exports from Kurdistan were shut in.

By 4:17 p.m. EST, WTI was trading up $0.62 (+0.85%) on the day to $73.43 per barrel, a gain of about $4 per barrel on the week. Brent crude was trading up $0.68 (+0.87%) on the day at $78.80—up roughly $3.50 per barrel from this same time last week.

WTI was trading at $73.41 shortly after the data release.

With the large draw in crude oil inventories came product draws as well.

Gasoline inventories fell by 5.891 million barrels, on top of last week's draw of 1.09 million barrels. Distillate inventories rose 548,000 barrels after decreasing by 1.84 million bpd in the week prior.

Inventories at Cushing, Oklahoma, decreased by 2.388 million barrels—after falling 760,000 barrels last week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- M&A Action Continues In The Canadian Oil Patch With $1.2 Billion Deal

- Latin America’s Bid To Challenge China’s Dominance In The Lithium Market

- Kurdistan’s 400,000-Bpd Oil Exports Still Shut-In As Talks With Iraq Fail

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B