Breaking News:

NIMBY: The Battle for Britain’s Clean Energy Future

The UK government faces growing…

Unaffordable Prices and Elevated Interest Rates Impact New Car Demand

Amid rising inventories and lackluster…

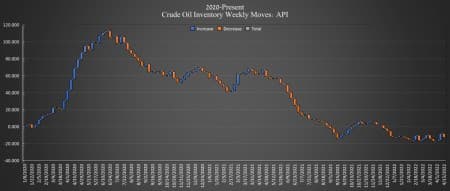

Oil Prices Fall On Larger Than Expected Crude Inventory Build

The American Petroleum Institute (API) reported a surprise build this week for crude oil of 4.784 million barrels, compared to analyst predictions of a much smaller 600.000 barrel build.

U.S. crude inventories have shed some 71 million barrels since the start of 2021 and about 14 million barrels since the start of 2020.

In the week prior, the API reported a surprise draw in crude oil inventories of 4.49 million barrels after analysts had predicted a build of 2.533 million barrels.

Oil prices were trading up on Tuesday after Monday's brief selloff, as China's central bank promised to provide monetary policy support to its economy after the lockdown. The price moves remain a testament to the hyper volatility that exists in the market post covid and post-Russian invasion.

WTI was trading up 4.11% at $102.60 per barrel on the day at 1:45 p.m. ET—but up roughly $.20 per barrel on the week. Brent crude was trading up 3.63% on the day at $106.10 per barrel on the day—but down $1 per barrel on the week.

U.S. crude oil production rose to 11.9 million bpd for the week ending April 15. Crude production in the United States is still down 1.2 million barrels per day from pre-pandemic times.

This week, the API reported a draw in gasoline inventories at 3.91 million barrels for the week ending April 22—after the previous week's 2.933-million-barrel build.

Distillate stocks saw a build in inventory of 431,000 barrels for the week compared to last week's 1.652-million-barrel decrease.

Cushing saw a 1.143-million-barrel build this week. Cushing inventories fell to 26.152 million barrels as of April 15, according to EIA data—down from 59.2 million barrels at the start of 2021, and down from 37.3 million barrels at the end of 2021.

At 4:50 pm, ET, WTI was trading at $101.50 (+3.05%), with Brent trading at $104.90 (+2.56%).

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- EU In Talks With Alternative Suppliers As It Considers A Russian Oil Ban

- Libya May Reach Full Oil Production Within Days

- Can Lebanon Repair Its Failing Energy Sector?

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B