Breaking News:

Solar Surplus: California's Renewable Energy Dilemma

California's excess solar power production,…

Solar Companies Forced To Borrow To Finance Growth

Solar companies raised $12.2 billion…

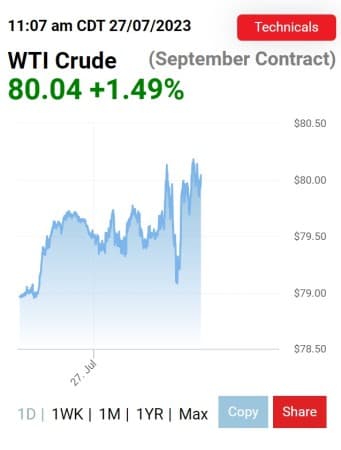

Oil Ignores Fed Hike As WTI Hits $80

Oil prices had already forgotten about Wednesday’s rate hike by Thursday morning, with WTI hitting $80 per barrel just before noon ET.

WTI was trading at $80 per barrel on Thursday morning at 11:52 a.m. ET, up $1.22 per barrel, or 1.54% on the day. Prices haven’t been this high since mid-April.

Analysts had long warned speculators that the oil markets had already priced in a fed rate hike—a move that typically sends crude oil prices lower on propects of economic slowdown and decreased oil demand. But since the fed rate hike didn’t exactly come out of the blue and was combined with low gasoline inventories and outlooks for tight fundamentals now that we’ve entered the second half of the year, oil prices refused to march to the beat of the federal government’s drum.

Retail gasoline prices were also up on Thursday, with the current gallon of gas in the United States averaging $3.714 at the pump-a nearly 3-cent hike on the day and above the week-ago and month-ago averages, according to AAA data. Gasoline inventories in the United States are 7% below the five-year average for this time of year, according to data from the Energy Information Administration (EIA).

Oil prices sagged slightly yesterday after the EIA recorded a small draw from inventory of 600,000 barrels for the week ending July 21. Gasoline inventories and distillates also drew down.

But ultimately, the oil markets are concerned that there will be a significant tightening this half of the year, with demand signals continuing to be strong while production is still artificially restrained in OPEC+ members and U.S. production fails to gain traction.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Clean Energy Investor: OPEC+ Breakup Could Send Oil Down To $35

- Saudi Arabia’s Oil Revenues Slump To The Lowest Level Since 2021

- Bullish Sentiment Slowly Builds In Oil Markets

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B