|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 12 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 19 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 19 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 19 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 19 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

The West Aims to Rebuild Influence in Middle East Energy Hub with LNG Deals

The last few days have…

How the U.S. Presidential Election Could Influence Precious Metals Prices

Precious metals prices are expected…

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

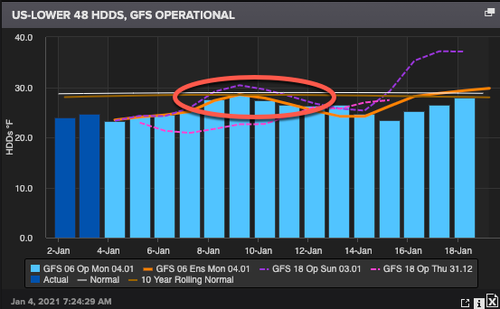

Natural Gas Prices Jump On Cold Weather Forecast

By ZeroHedge - Jan 04, 2021, 3:30 PM CSTNatgas February Nymex contracts jumped 3.5% Monday morning due to colder weather trends and increased heating demand forecasted for the next ten days.

Bespoke Weather Services said since last week, weather models have shifted "materially colder" for parts of the US through mid-January.

"While the 15-day period as a whole remains solidly warmer than normal, we have chipped away at a good deal of the warmth, and it is important, in our view, to note that the colder changes are focused over the next eight to 10 days," Bespoke said. "This signals risk that models toward mid-month and beyond could again be too warm."

US Temapture deviations through mid-month show large swaths of the country, at times, will record colder than average temperatures.

Colder temperatures will increase energy demand to heat a structure, shown in the chart below:

With colder weather ahead, Refinitiv data estimates natgas demand, including exports, would rise from 121.1 billion cubic feet per day this week to 126.1 billion cubic feet per day next week.

By Zerohedge.com

More Top Reads From Oilprice.com:

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com