Breaking News:

Net-Zero Ambitions Hit Major Roadblocks in Europe, UK, and US

Net-Zero transition targets touted so…

China's Rare Earths Strategy, Explained

China's recent discovery of new…

Major Crude Draw Offset By Jump In Gasoline Stocks

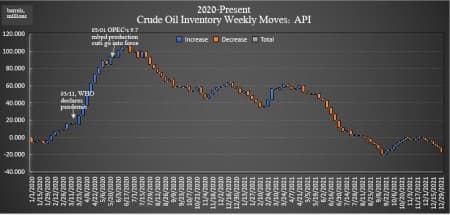

This week, the American Petroleum Institute (API) estimated the inventory draw for crude oil to be 6.432 million barrels, after analysts predicted a much smaller 3.40 million barrel draw.

U.S. crude inventories shed a total of some 75 million barrels over the course of 2021.

In the previous week, the API reported a draw in oil inventories of 3.09 million barrels after analysts had predicted a draw of 3.233 million barrels.

Oil prices were trading up on Tuesday in the run-up to the data release, after OPEC+ decided on Tuesday to increase its oil production quota by another 400,000 bpd—largely as expected. WTI was trading up 1.60% to $77.30 on the day at 10:45 a.m. EDT, but up $1.30 per barrel on the week. Brent was trading up by 1.58% at $80.23 on the day and up $1.20 on the week.

U.S. oil production has been on a slow but steady climb. For the week ending December 24—the last week for which the Energy Information Administration has provided data—crude oil production in the United States rose to 11.8 million bpd—an increase of 800,000 bpd since the start of the year.

The API reported a large build in gasoline inventories of 7.061 million barrels for the week ending December 31—after the previous week's 319,000 barrel draw.

Distillate stocks saw an increase in inventory of 4.340 million barrels for the week, after last week's 716,000-barrel decrease. Cushing saw a 2.268 million-barrel increase this week.

At 4:36 pm, EST, WTI was trading at $77.07, with Brent trading at $80.07.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Russia May Be Nearing Limit Of Oil Output Capacity

- The Lone Star State May Host The World’s Next Big Hydrogen Hub

- Fossil Fuel Financing Under Pressure As Wall Street Caves To ESG Demands

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

See what the EIA says tomorrow.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B