Breaking News:

The Price of Oil Expansion in Argentina

Argentina's energy landscape is evolving,…

What Would the Re-Election of Trump Mean for U.S. Energy?

A potential Trump re-election could…

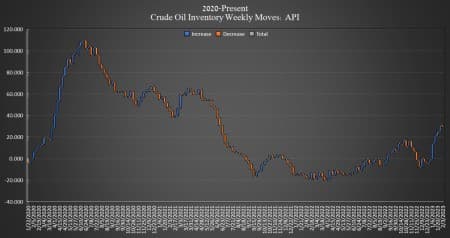

Large Gasoline Inventory Build Counters Crude Draw

Crude oil inventories fell by 2.184 million barrels last week, the American Petroleum Institute (API) data showed on Tuesday, countering in part several weeks of builds.

U.S. crude inventories increased 13 million barrels last year, according to API data, while crude stored in the nation’s Strategic Petroleum Reserves sunk by 221 million barrels. This week, SPR inventory held steady for the fourth week in a row at 371.6 million barrels as the emergency releases that the Biden Administration announced last spring are now complete. The SPR now contains the least amount of crude oil since early December 1983.

Oil prices were trading about 4% higher on Tuesday in the runup to the data release. At 3:49 p.m. EST, WTI was trading up $3.21 (+4.33%) on the day to $77.32 per barrel—a weekly decrease of roughly $1.50 per barrel. Brent crude was trading up $2.87 (+3.54%) on the day at $83.96—a weekly decrease of about $0.50 per barrel.

U.S. crude oil production stayed at 12.2 million bpd for the fourth week in a row for week ending January 27—it is the highest production rate since last August. U.S. production is still 900,000 bpd lower than the peak production seen in March 2020.

WTI was trading at $77.31 shortly after the data release.

Gasoline inventories rose by 5.261 million barrels after last week’s API data showed the fuel inventories rising by 2.73 million barrels. Distillates rose 1.109 million barrels after rising by 1.53 million bpd in the week prior.

Inventories at Cushing, Oklahoma, increased by 178,000 barrels on top of the 2.72-million barrel hike reported last week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Russian Urals Traded At $49.48 in January, But The Kremlin Isn’t Worried

- Germany’s Largest Gas Storage Facility Can’t Store Gas

- Germany’s $2 Trillion Economic Miracle at Risk

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B