|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 7 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 14 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 14 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 14 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 14 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

Coal Share of China's Power Output Drops to Record Low

China reached a momentous milestone…

Harris Presidency Will Be Bad News for Oil

In the case of a…

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

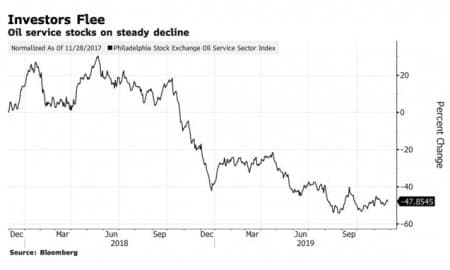

Investors Are Abandoning “Uninvestable” Oil Service Stocks

By ZeroHedge - Nov 27, 2019, 2:30 PM CSTThere have been few sectors dripping with apathy of late quite like the oil services sector.

On Tuesday, The Philadelphia Oil Service Sector Index fell 2% again, adding to a 15% drubbing it has taken this year so far, according to Bloomberg. Over the same period of time, the S&P 500 index has risen 25%.

Piper Jaffray sent analysts to New York recently to gauge investor interest in the industry, which remains tepid. The company's analysts wrote in a note: “Not surprisingly, interest in oil service stocks is at a career low, if one’s marketing schedule is an indication of interest."

They stated that marketing trips in the oil services sector consist of “a sparse two-day schedule featuring plenty of coffee time between meetings.” Years prior, such trips would often include back-to-back meetings along with group lunches and dinners, the analysts said.

Oilfield stocks remain a concern due to their leverage, profitability concerns and poor well returns.

Bank of America even commented in a recent note that Apple, on its own, is worth more than the S&P 500 Energy Index, which includes names like Conoco, Exxon and Chevron.

Many oil stocks now have dividend yields between 3% and 5%, but that hasn't been enough to convince investors to buy into the weakness. “Collectively, the consensus view is that the oil service sector remains un-investable,” Piper's analysts concluded.

But not everybody agrees. Recall, just last week we noted that Sam Zell and other billionaires were starting to circle the oil industry like vultures, scooping up assets from distressed companies on the cheap.

By Zerohedge.com

More Top Reads From Oilprice.com:

- The World Is Getting Windier And Renewables Will Benefit

- The Natural Gas Nation Every Exporter Is Targeting

- How Much Energy Do Americans Use On Thanksgiving?

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com