Breaking News:

What Would the Re-Election of Trump Mean for U.S. Energy?

A potential Trump re-election could…

Oil Rig Count Jumps as Drilling Activity Picks Up

The total number of active…

Goldman Sachs: UK Inflation Could Break 22% If Gas Prices Remain High

Inflation could soar to the highest level since 1975 if global gas prices do not fall from their historic highs, a Wall Street investment bank warned today.

The cost of living would climb to a peak of 22.4 percent if the energy watchdog is forced to heap even more woe onto households by passing on elevated gas prices again in January, according to Goldman Sachs.

The fresh warning adds to the string of experts warning the UK is set to tumble into a tough slump over the winter that may last for more than a year.

Goldman also warned in a note over the weekend that Britain will tip into a recession in the final months of this year and stay there until the beginning of 2024. Citigroup earlier this month said inflation is set to peak at nearly 19 percent.

The Bank of England earlier this month also warned the country is headed for the longest downturn since the financial crisis.

“In a scenario where gas prices remain elevated at current levels, we would expect the price cap to increase by over 80 percent in January,” Goldman warned.

Under those circumstances, the British economy would shrink 3.4 percent “due to a larger hit to real disposable incomes,” the Wall Street titan added.

The energy regulator Ofgem last week said household bills will jump 80 percent in October to £3,549.

Brits are set to absorb the worst hit to their living standards on record over the next 18 months or so due to rising prices eroding wage growth.

Household consumption is expected to dip in response to this living standards shock, dealing a sharp blow to the health of the economy.

Elevated inflation will force Bank governor Andrew Bailey and the rest of the monetary policy committee to keep hike interest rates rapidly despite the economic slump.

“We continue to look for the BoE to hike by another 50 basis point in September and see upside risks to our expectation of 25 basis point hikes in November and December given continued upside inflation and wage growth surprises and the need to keep inflation expectations anchored,” Goldman said.

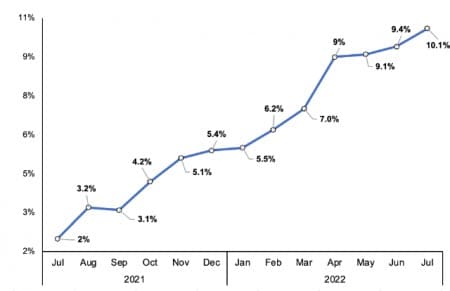

The Bank has lifted borrowing costs six times in a row to tame rising prices, sending them to 1.75 percent. Prices are up 10.1 percent over the last year, the quickest acceleration in 40 years.

Inflation has soared over the last year

Inflation has soared to a 40-year high (Source: ONS)

Central banks rarely raise interest rates during a recession to avoid piling more pressure on households’ and businesses’ finances.

By City AM

More Top Reads From Oilprice.com:

- Belgian Energy Minister: Europe Faces Tough Winter Without Gas Price Cuts

- The Global Gas Crisis Is Spilling Into The United States

- Gazprom Slashes Natural Gas Deliveries To French Utility Giant

City A.M

CityAM.com is the online presence of City A.M., London's first free daily business newspaper. Both platforms cover financial and business news as well as sport and…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B