Breaking News:

Oil Prices Under Pressure Despite Bullish Catalysts

Oil prices are under pressure…

China Begins Work on Massive Afghan Copper Mine

China and the Taliban initiate…

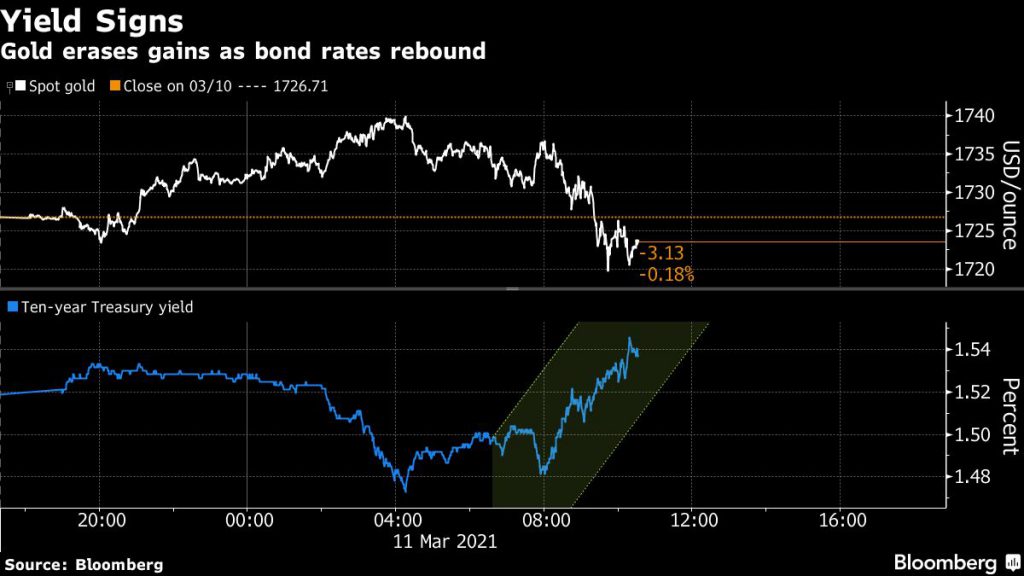

Gold Erases Gains On Rebounding Treasury Yields

Gold is heading for its first decline in three days, erasing its gains from that period, as US Treasury yields rebounded following congressional approval of a massive stimulus package.

Spot gold edged 0.2% lower to $1,724.28 per ounce by noon EST, while US gold futures held steady at $1,721.60 per ounce.

Yields are on the rise again Thursday, as President Joe Biden plans to sign his $1.9 trillion covid-19 relief bill later this week after clearing the final congressional hurdle.

Rising yields have played havoc with the price of gold, which touched an all-time high in August. Rates have climbed as increased economic aid stokes inflation concerns, hampering demand for the non-yielding bullion.

Even so, money managers at BlackRock feel that gold has become a less effective hedge against moves in other assets, such as equities, as well as inflation.

Prospects for faster economic growth are also denting demand for the precious metal as a safe haven asset, sending prices down by more than 9% this year.

Related: How Oil Could Go To $100 Per Barrel

Data showed that applications for US jobless benefits fell below forecast to the lowest since early November, with covid vaccinations accelerating across the nation and states easing business restrictions.

“Bond vigilantes continue to view the massive Biden $1.9 trillion stimulus bill with deep dread, concern, both with massive supply in the pipeline as well as inflation pressures,” Tai Wong, head of metals derivatives trading at BMO Capital Markets, told Bloomberg.

“Selling in bonds is keeping yields elevated and has taken gold rather smartly off overnight highs,” Wong said.

However, while the roll-out of vaccines has seen diminishing investor interest for the traditional haven, Biden’s economic package may give a huge “tailwind” to gold in the long term, according to Commerzbank AG analyst Carsten Fritsch.

“The inflation risks are growing at the same time, as handing out $1,400 to nearly every American and topping up and extending unemployment benefits are likely to massively fuel consumption,” Fritsch said.

By Mining.com

More Top Reads From Oilprice.com:

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B